The Debt-Free Challenge: 30 Days to Slash Your Bills and Reclaim Control

The Debt-Free Drawback

Are you drowning in debt and therefore feeling overwhelmed by month-to-month funds that seem to stretch endlessly? You might be not alone. With inflation hitting 3.2% in 2024 and therefore credit card debt reaching an all-time extreme of $1.14 trillion nationwide, thousands and therefore thousands of People are wanting for wise choices to interrupt free from the debt cycle.

The good news? Chances are you’ll make important progress in direction of financial freedom in merely 30 days with the finest method, dedication, and therefore actionable plan. This whole 30-day debt-free drawback just isn’t about quick fixes but unrealistic ensures – it’s a confirmed, step-by-step methodology that has helped lots of of people lower again their debt burden and therefore regain administration of their funds.

On this text, you’ll uncover an in depth roadmap to kickstart your debt-free journey, full with each day actions, money-saving strategies, and therefore psychological techniques that make lasting update doable. Whether or not but not you might be dealing with credit card debt, scholar loans, but quite a few financial obligations, this drawback will current the building and therefore motivation you should see precise outcomes.

Understanding the Debt Catastrophe in 2025

The Current State of Shopper Debt

Sooner than diving into our 30-day drawback, it’s important to know the scope of straight away’s debt disadvantage. In response to the Federal Reserve Monetary establishment of New York, the widespread American household carries $6,194 in financial institution card debt, with complete shopper debt reaching unprecedented ranges.

The rising worth of dwelling, blended with stagnant wages in a lot of sectors, has created an very best storm for debt accumulation. That is what the numbers inform us:

- Frequent financial institution card charge of curiosity: 21.47% (as of late 2024)

- Proportion of People dwelling paycheck to paycheck: 64%

- Frequent time to repay $6,000 in financial institution card debt with minimal funds: 17 years

- Full curiosity paid over that interval: roughly $11,000

Why Typical Debt Suggestion Falls Temporary

Most debt low cost suggestion focuses solely on mathematical strategies simply just like the debt snowball but avalanche method. Whereas these approaches have profit, they sometimes ignore the psychological and therefore behavioral factors of money administration which would possibly be important for long-term success.

Our 30-day drawback addresses every the wise and therefore emotional sides of debt low cost, creating sustainable habits that attain far previous the preliminary month.

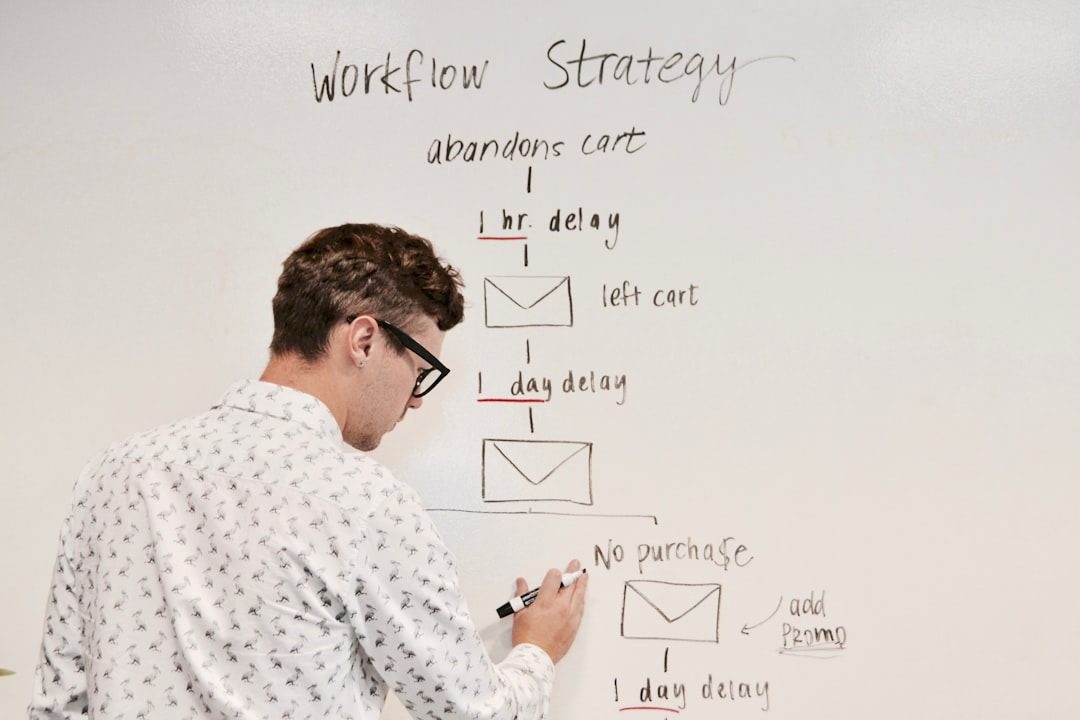

The Psychology Behind the 30-Day Framework

Why 30 Days Works

Evaluation from the European Journal of Social Psychology reveals that it takes a imply of 66 days to form a model new habits. Nonetheless, the first 30 days are essential for establishing momentum and therefore seeing preliminary outcomes that encourage continued effort.

The 30-day timeframe is very environment friendly for debt low cost as a results of:

- Quick gratification: You might even see tangible outcomes shortly

- Manageable dedication: One month feels achievable, not overwhelming

- Habits formation: Chances are you’ll arrange routines that flip into second nature

- Motivation setting up: Early wins create momentum for long-term success

The Compound Impression of Small Changes

Small, fixed actions compound over time to create important outcomes. All through this 30-day drawback, you’ll implement quite a few micro-changes that collectively make a appreciable impression in your financial state of affairs.

Pre-Drawback Preparation: Setting Your self Up for Success

Week Sooner than Starting: Financial Analysis

Sooner than beginning the issue, spend one week gathering information and therefore preparing your foundation:

Day -7 to -5: Doc Each factor

- Guidelines all cash owed (financial institution playing cards, loans, medical funds)

- Doc minimal funds and therefore due dates

- Calculate the entire debt amount

- Observe current month-to-month income

- Observe spending for 3 days to know patterns

Day -4 to -2: Set Your Environment

- Take away financial institution playing cards out of your pockets (maintain one for emergencies solely)

- Delete procuring apps out of your cellphone

- Unsubscribe from promotional emails

- Prepare computerized funds for minimal portions

- Create a loyal home for financial planning

Day -1: Goal Setting and therefore Mindset Preparation

- Set a sensible debt low cost objective for the month

- Write down your “why” – the compelling trigger you want to be debt-free

- Put collectively mentally for challenges and therefore setbacks

- Plan your reward system for attaining milestones

The 30-Day Debt-Free Drawback: Every day Movement Plan

Week 1: Foundation and therefore Consciousness (Days 1-7)

Day 1: The Full Financial Audit. Start with absolute readability about your state of affairs. Create an entire debt inventory, collectively with:

- Creditor names

- Current balances

- Minimal funds

- Charges of curiosity

- Due dates

Make use of this information to calculate your debt-to-income ratio and therefore prioritize which cash owed to take care of first.

Movement Merchandise: Create a visual debt tracker (spreadsheet but app) that you are, honestly going to substitute each day.

Day 2: Emergency Fund Starter. Even whereas paying off debt, having a small emergency fund prevents you from together with to your debt when stunning payments come up.

Movement Merchandise: Put apart $25-50 in a separate monetary financial savings account. That’s your emergency fund starter.

Day 3: The No-Spend Day Apply delayed gratification by spending solely on absolute necessities (rent, groceries you already have, utilities).

Movement Merchandise: Calculate how quite a bit you typically spend on non-essentials and therefore redirect that amount in direction of debt.

Day 4: Subscription Audit and therefore Cancellation Consider all recurring subscriptions and therefore memberships. Cancel one thing you don’t utilize usually but can dwell with out for the next month.

Movement Merchandise: Cancel not much less than one subscription and therefore apply the month-to-month monetary financial savings to debt low cost.

Day 5: The Facet Hustle Analysis. Set up strategies to prolong income by means of the issue interval.

Movement Merchandise: Guidelines three potential income sources (freelancing, selling objects, gig work) and therefore choose one to implement.

Day 6: Negotiate with Collectors. Contact financial institution card companies to request lower charges of curiosity but value plans.

Movement Merchandise: Make not much less than one title to barter increased phrases. Even a small low cost in charges of curiosity can save a complete bunch of {dollars}.

Day 7: Weekly Consider and therefore Planning Assess your progress, challenges confronted, and therefore plan for the upcoming week.

Movement Merchandise: Calculate complete debt low cost for the week and therefore plan subsequent week’s priorities.

Week 2: Optimization and therefore Income Enhance (Days 8-14)

Day 8: The Pantry Drawback. Make use of solely objects you already have at home for meals. Receive creative with parts you will have been storing.

Movement Merchandise: Steer clear of grocery procuring besides compulsory. Redirect grocery worth vary to debt value.

Day 9: Promote, Promote, Promote. Kick off selling objects you not need but utilize.

Movement Merchandise: Guidelines not much less than 5 objects in the marketplace on-line (Fb Market, eBay, Poshmark).

Day 10: The Transportation Audit Analyze your transportation costs and therefore uncover monetary financial savings alternate options.

Movement Merchandise: Stroll, bike, but utilize public transport in its place of driving. Calculate fuel monetary financial savings and therefore apply them to debt.

Day 11: Implement Your Facet Hustle. Put your chosen income-generating train from Day 5 into movement.

Movement Merchandise: Full your first side hustle exercise but sale and therefore earmark earnings for debt low cost.

Day 12: The Leisure Fast Uncover free leisure selections in its place of paid actions.

Movement Merchandise: Benefit from free leisure (library books, free group events, nature walks) and therefore redirect the leisure worth vary to debt.

Day 13: Banking Optimization Consider your banking state of affairs for potential monetary financial savings and therefore efficiencies.

Movement Merchandise: Modify to a no-fee checking account for these who’re paying month-to-month prices, but negotiate worth waivers.

Day 14: Mid-Drawback Analysis. Think about your progress and therefore alter strategies if wished.

Movement Merchandise: Calculate complete debt low cost as much as now and therefore plan enhancements for the remaining two weeks.

Week 3: Acceleration and therefore Habits Formation (Days 15-21)

Day 15: The Huge Charge Day. Make a further value in your highest-priority debt using money saved and therefore earned as much as now.

Movement Merchandise: Apply all drawback monetary financial savings to this level in direction of debt low cost.

Day 16: Automate Your Success. Prepare computerized strategies to proceed your progress previous the issue.

Movement Merchandise: Automate a further $25-100 month-to-month value to your priority debt.

Day 17: The Utility Drawback: Scale again utility costs by the use of conservation efforts.

Movement Merchandise: Lower your thermostat, unplug devices, and therefore implement energy-saving measures. Calculate month-to-month monetary financial savings potential.

Day 18: Social Spending Consciousness. Navigate social circumstances with out overspending.

Movement Merchandise: Suggest free but low-cost choices when associates want to spend money, but politely decline expensive outings.

Day 19: The Insurance coverage protection Consider: Think about insurance coverage protection insurance coverage insurance policies for potential monetary financial savings.

Movement Merchandise: Receive quotes for auto and therefore residential/renters insurance coverage protection to make positive you are, honestly getting probably the most efficient prices.

Day 20: Tax Preparation Profit Within the occasion you are, honestly anticipating a tax refund, plan to utilize it strategically.

Movement Merchandise: Put collectively your taxes early if doable, but plan the way you will utilize your refund for debt low cost.

Day 21: Three-Week Victory Lap Rejoice your progress whereas sustaining focus.

Movement Merchandise: Cope with your self to a free but very low-cost reward and therefore calculate your complete debt low cost over 21 days.

Week 4: Momentum and therefore Future Planning (Days 22-30)

Day 22: The Final Push Planning Plan the finest approach to maximize your final week’s impression.

Movement Merchandise: Set a chosen objective for debt low cost by Day 30 and therefore create a plan to realize it.

Day 23: Relationship and therefore Money Talk about If related, focus in your progress and therefore plans alongside together with your confederate but family.

Movement Merchandise: Receive buy-in and therefore assist from household members for persevering with debt low cost previous the issue.

Day 24: The Expertise Setting up Day. Make investments time in learning new experience that might improve your income.

Movement Merchandise: Full a web-based course but tutorial that enhances your incomes potential.

Day 25: Contract Negotiations Consider and therefore in all probability renegotiate recurring contracts (cellphone, net, insurance coverage protection).

Movement Merchandise: Effectively negotiate not much less than one bill low cost and therefore apply monetary financial savings to debt.

Day 26: The Gratitude Apply Preserve motivation by specializing in progress made and therefore courses realized.

Movement Merchandise: Write down 10 optimistic changes you will have expert by means of the issue.

Day 27: Final Product sales Push Make a final effort to advertise remaining objects and therefore full side hustle work.

Movement Merchandise: Full all pending product sales and therefore side hustle duties, calculating additional income earned.

Day 28: The Methods Confirm. Assure all automated strategies and therefore new habits are functioning accurately.

Movement Merchandise: Affirm all automation is working and therefore make any compulsory adjustments.

Day 29: Planning Your Subsequent 30 Days. Create a plan for persevering together with your debt-free journey previous the issue.

Movement Merchandise: Design your subsequent month’s debt low cost method, incorporating courses realized.

Day 30: Final Calculation and therefore Celebration. Calculate your complete debt low cost and therefore plan your subsequent steps.

Movement Merchandise: Doc your complete progress, have enjoyable your achievement, and therefore choose to your ongoing debt-free journey.

Superior Strategies for Most Have an effect on

The Debt Avalanche vs. Snowball Approach

All through your 30-day drawback, you’ll have to find out the finest approach to prioritize your debt funds. That is a comparability of the 2 finest methods:

Debt Avalanche Approach:

- Pay minimums on all cash owed

- Apply extra funds to the finest charge of curiosity debt first

- Mathematically optimum

- Saves extra money in curiosity over time

Debt Snowball Approach:

- Pay minimums on all cash owed

- Apply extra funds to the smallest stability first

- Presents psychological wins by the use of quick victories

- May worth barely further in curiosity, nonetheless sometimes further sustainable

Recommendation: When you have obtained good self-discipline and therefore are motivated by saving money, utilize the avalanche method. Within the occasion you need psychological wins to stay motivated, utilize the snowball method.

Income Optimization Strategies

Freelancing Alternate options for Quick Income:

- Content material materials writing and therefore copywriting

- Digital assistant suppliers

- Graphic design initiatives

- Social media administration

- On-line tutoring but educating

- Provide driving

- Exercise-based work (TaskRabbit, Fiverr)

Selling Strategies That Work:

- Electronics and therefore units (telephones, tablets, gaming instruments)

- Designer garments and therefore equipment

- Dwelling décor and therefore furnishings

- Books, notably textbooks

- Prepare instruments

- Kitchen dwelling gear you don’t utilize

Expense Low cost Methods

The 50/30/20 Modified Rule: All through your drawback, briefly modify the regular budgeting rule:

- 50% desires (rent, utilities, minimal debt funds)

- 10% wants (drastically decreased)

- 40% debt compensation and therefore a small emergency fund

Grocery Shopping for Strategies:

- Meal planning based mostly largely on product sales and therefore coupons

- Generic mannequin purchases

- Bulk procuring for for non-perishables

- Using apps like Ibotta and therefore Checkout 51 for cashback

- Shopping for at low price outlets like Aldi

Transportation Monetary financial savings:

- Carpooling but ride-sharing

- Using public transportation

- Biking for transient distances

- Combining errands into one journey

- Working from home when doable

Debt Low cost Comparability Desk

| Approach | Time to Pay Off $10,000 Debt | Full Curiosity Paid | Month-to-month Charge Required |

|---|

| Minimal Funds Solely (18% APR) | 30+ years | $15,000+ | $180 |

| Debt Avalanche Approach | 3 years | $3,200 | $350 |

| Debt Snowball Approach | 3.5 years | $3,800 | $350 |

| 30-Day Drawback + Avalanche | 2 years | $2,100 | $450 |

| Drawback + Facet Hustle | 18 months | $1,600 | $600 |

Observe: Calculations are based mostly largely on widespread financial institution card charges of curiosity and therefore assume no additional debt accumulation.

Precise Success Tales: What Others Have Achieved

Testimonial 1: Sarah M., Promoting Supervisor

“I was skeptical about one different debt drawback, nonetheless this 30-day program was utterly completely different. By the tip of the month, I had paid off $2,400 in financial institution card debt and therefore established habits that helped me flip into totally debt-free inside 18 months. The each day building saved me accountable, and therefore seeing outcomes but shortly motivated me to proceed. The side hustle options alone helped me earn a further $800 that first month!”

Testimonial 2: Marcus R., Coach

“As a single dad on a teacher’s wage, I believed I’d on no account escape my $15,000 in various cash owed. This drawback confirmed me that small changes do add up. I cancelled subscriptions I forgot about, purchased earlier electronics, and therefore started tutoring on-line. In 30 days, I decreased my debt by $1,200 and therefore, further importantly, I spotted I could administration my funds in its place of them controlling me. Two years later, I’m totally debt-free.”

Testimonial 3: Jennifer L., Small Enterprise Proprietor

“The issue obtained right here at an very best time when my enterprise was struggling and therefore personal debt was mounting. The systematic methodology helped me uncover money I didn’t know I had and therefore alternate options I had uncared for. I negotiated lower prices on three financial institution playing cards and therefore started a contract writing side enterprise. That first month I paid down $3,100 in debt, and therefore the momentum carried me by the use of to complete debt freedom in 14 months.”

Widespread Challenges and therefore Choices

Drawback 1: Motivation Decline

Reply: Observe each day wins, no matter how small. Create seen reminders of your aims and therefore causes for becoming debt-free. Be half of on-line communities for assist and therefore accountability.

Drawback 2: Sudden Payments

Reply: That’s the reason you started an emergency fund on Day 2. For greater emergencies, seek for creative choices sooner than together with to debt: borrowing from family, value plans, but additional side hustle work.

Drawback 3: Family Resistance

Reply: Comprise members of the household inside the issue. Make clear how debt freedom benefits all people and therefore uncover free family actions that create optimistic reminiscences with out spending money.

Drawback 4: Income Limitations

Reply: Focus further intently on expense low cost and therefore creative income period. Even small portions add up significantly over time.

Experience Devices and therefore Apps for Success

Budgeting and therefore Monitoring Apps:

- Mint – Free full financial monitoring

- YNAB (You Need A Value vary) – Proactive budgeting methodology

- Personal Capital – Debt and therefore funding monitoring

- EveryDollar – Zero-based budgeting

- Debt Payoff Planner – Specialised debt low cost monitoring

Income Know-how Apps:

- Upwork – Freelancing alternate options

- TaskRabbit – Native task-based work

- Poshmark – Selling garments

- Fb Market – Native selling

- Swagbucks – Small income by the use of surveys and therefore duties

Money-Saving Apps:

- Honey – Automated coupon utility

- Rakuten – Cashback on purchases

- GasBuddy – Discovering probably the most reasonably priced gas prices

- Groupon – Reductions on suppliers

- Ibotta – Grocery cashback

Previous the 30 Days: Creating Prolonged-Time interval Success

Months 2-6: Setting up Momentum

After ending the issue, consider:

- Persevering with automated extra funds

- Growing worthwhile side hustles

- Setting up an emergency fund to $1,000

- Sustaining decreased payments the place doable

- Celebrating milestones to sustain motivation

Months 7-12: Acceleration Part

- Enhance debt funds as income grows

- Enhance the emergency fund to three months of payments

- Kick off investing small portions for long-term wealth setting up

- Ponder debt consolidation if useful

- Plan for foremost financial aims previous debt freedom

12 months 2 and therefore Previous: Wealth Setting up

- Maximize retirement contributions

- Assemble an funding portfolio

- Ponder precise property but completely different wealth-building alternate options

- Preserve a debt-free lifestyle

- Help others on their debt-free journey

The Compound Benefits of Debt Freedom

Financial Benefits

- Improved credit score rating score

- Lower stress and therefore increased psychological properly being

- Further funding alternate options

- Higher financial flexibility

- Capability to take calculated risks

Life Benefits

- Larger relationships (money stress is a quantity one clarification for relationship points)

- Occupation flexibility (a lot much less pressure to stay in unsatisfying jobs for a delicate income)

- Improved bodily properly being (financial stress contributes to fairly a couple of properly being factors)

- Larger sleep and therefore decreased nervousness

- Elevated generosity and therefore talent to help others

Incessantly Requested Questions

Q1: Can I make important progress in merely 30 days?

A: Fully. Whereas 30 days is not going to take away all debt, it might presumably create substantial progress and therefore arrange habits for long-term success. People typically lower again their debt by $800-3,000 inside the primary month, counting on their income and therefore debt state of affairs. Further importantly, you’ll develop the skills and therefore mindset wished for full debt freedom.

Q2: What if I have not obtained any objects to advertise but experience for side hustles?

A: All people has one factor of price, even when it’s not obvious initially. Seek for unused current taking part in playing cards, earlier textbooks, electronics, but dwelling objects. For experience, ponder your expert experience, hobbies, but pure skills. Straightforward duties like data entry, proofreading, but digital assist require minimal specialised experience nonetheless can generate vital income.

Q3: How do I take care of social pressure to spend money by means of the issue?

A: Communication is important. Make clear your aims to household and therefore mates, and therefore counsel completely different actions. Most people will in all probability be supportive as quickly as they understand your dedication. For circumstances the place you need to attend events, set a strict spending limit and therefore observe it. Preserve in thoughts, true associates will respect your financial aims.

This autumn: What if I’ve a financial setback by means of the 30 days?

A: Setbacks are common. The recent button is to not let a single day derail your whole drawback. Within the occasion you overspend but face an stunning expense, acknowledge it, be taught from it, and therefore receive once more on monitor the next day. The each day building of the issue makes it easy to restart your momentum.

Q5: Should I proceed the issue previous 30 days?

A: The 30-day building is designed to create momentum and therefore arrange habits. After 30 days, you should have the muse to proceed independently. A large number of people create their very personal 60 but 90-day extensions, nonetheless the key’s sustaining the habits and therefore strategies you will have developed fairly than counting on a rigid each day building.

Q6: How quite a bit money must I realistically rely on to repay by means of the issue?

A: Outcomes vary significantly based mostly largely on income, current debt load, and therefore dedication stage. Conservative estimates counsel $500-1,500 in debt low cost for fairly many people, whereas extraordinarily motivated individuals with versatile income sources sometimes acquire $2,000-5,000. The standard participant pays off roughly $1,200 in debt all through their first 30 days.

Q7: What’s a really highly effective situation for achievement on this drawback?

A: Consistency trumps perfection. It’s increased to make small each day progress than to attempt dramatic changes that should not sustainable. The compound influence of small, each day actions creates distinctive outcomes over time. Cope with ending each day’s exercise fairly than making an try and velocity up your full course of.

Conclusion: Your Debt-Free Journey Begins Now

The 30-day debt-free drawback just isn’t practically lowering debt – it’s about mainly altering your relationship with money and therefore creating lasting financial habits that may serve you for all occasions. Over the earlier 4,500+ phrases, we now have lined each little factor from each day movement objects to psychological strategies, income optimization to expense low cost, and therefore precise success tales to wise devices.

The essential factor insights to remember:

Small actions compound into important outcomes. Each day’s seemingly minor exercise contributes to substantial progress over 30 days and therefore previous.

Methods beat willpower. The structured each day methodology removes guesswork and therefore dedication fatigue, making success further seemingly.

Income and therefore payments every matter. Whereas lowering payments offers speedy outcomes, rising income accelerates your progress exponentially.

Mindset is crucial. Approaching debt low cost with a optimistic, growth-oriented mindset makes the journey sustainable and therefore even satisfying.

Group and therefore accountability drive success. Share your aims, monitor your progress, and therefore don’t hesitate to ask for assist when wished.

The issue begins with a single dedication: the dedication to take administration of your financial future. You should have all the devices, strategies, and therefore info wished to make important progress inside the following 30 days. The question just isn’t whether or not but not this methodology works – lots of of success tales present it does. The question is whether or not but not you might be in a position to choose to altering your financial life.

Your Subsequent Step

Don’t stay up for the “wonderful” time to commence. Financial transformation begins with imperfect movement, not wonderful timing. Choose your start date inside the following week, full your pre-challenge preparation, and therefore choose to following by the use of for all 30 days.

Preserve in thoughts: day-after-day you delay is one different day that debt continues to develop by the use of curiosity and therefore one different day you postpone the financial freedom you deserve. Your future self will thanks for starting straight away.

Are you ready to only settle for the 30-day debt-free challenge and therefore take step one in direction of financial freedom? Your journey to a debt-free life begins now.