The 50-30-20 Rule: Why It Works & How to Master It

The 50-30-20 Rule

Are you tired of dwelling paycheck to paycheck? Do you wrestle to save lots of money no matter incomes a superb income? In that case, you might be not alone. In keeping with a 2023 survey by Bankrate, 57% of People can’t afford a $1,000 emergency expense. The good news? There’s a straightforward, confirmed budgeting methodology that has helped tens of tens of millions of people take administration of their funds: the 50-30-20 rule.

This easy budgeting framework, popularized by Senator Elizabeth Warren in her book “All Your Value,” affords a clear roadmap for managing your money with out the complexity of monitoring every penny. Whether or not but not you’re a budgeting beginner but anyone in search of to simplify your financial life, the 50-30-20 rule provides a balanced methodology that prioritizes every your speedy needs and therefore long-term financial security.

On this entire info, we’ll uncover why the 50-30-20 rule works so so efficiently, the way you can implement it step-by-step, and therefore the strategies it is important grasp this extremely efficient budgeting system. By the tip of this textual content, you’ll have the entire devices important to rework your financial habits and therefore assemble lasting wealth.

What is the 50-30-20 Rule?

The 50-30-20 rule is a budgeting methodology that divides your after-tax income into three distinct lessons:

- 50% for Desires: Essential payments you will be in a position to’t steer clear of

- 30% for Needs: Discretionary spending for enjoyment and therefore life-style

- 20% for Monetary financial savings and therefore Debt Reimbursement: Developing your financial future

This rule creates a balanced methodology to money administration that ensures you cowl your main dwelling payments whereas nonetheless having enjoyable with life and therefore securing your financial future. In distinction to restrictive budgets which will totally really feel overwhelming, the 50-30-20 rule provides flexibility inside building.

The Origin and therefore Philosophy Behind the Rule

Elizabeth Warren, alongside alongside along with her daughter Amelia Warren Tyagi, developed this rule based mostly principally on a very long time of evaluation into American spending habits and therefore chapter patterns. They discovered that households who adopted this main allocation have been significantly a lot much less extra seemingly to experience financial distress.

The philosophy is simple: by routinely allocating your income into these three buckets, you create a sustainable financial system that doesn’t require fastened decision-making but detailed expense monitoring. It’s designed for precise people with precise lives who want financial stability with out turning into financial analysts.

Why the 50-30-20 Rule Works But Efficiently

1. Psychological Benefits

The 50-30-20 rule succeeds the place a large number of budgets fail as a results of it acknowledges human psychology. Standard budgets sometimes totally really feel restrictive and therefore punishment-based, leading to what financial specialists title “funds revolt.” The 50-30-20 rule, nonetheless, builds in permission to spend on needs, making it psychologically sustainable.

Evaluation from the Journal of Consumer Psychology displays that budgets with built-in flexibility have a 73% elevated adherence worth than restrictive budgets. When people know they’ve devoted “pleasurable money,” they are much much less extra seemingly to interrupt their funds solely.

2. Simplicity and therefore Automation

Superior budgeting strategies fail as a results of they require an extreme quantity of psychological vitality to deal with. The 50-30-20 rule’s three-category methodology eliminates dedication fatigue. Once you prepare computerized transfers to your 20% monetary financial savings allocation, the system just about runs itself.

In keeping with a analysis by the Consumer Financial Security Bureau, people who automate their monetary financial savings are 12 cases further extra seemingly to achieve their financial targets than people who depend upon willpower alone.

3. Balanced Methodology to Financial Wellness

The rule addresses three important factors of financial nicely being concurrently:

- Present Security: Masking necessary needs

- Present Enjoyment: Sustaining excessive high quality of life

- Future Security: Developing wealth and therefore emergency funds

This stability prevents the frequent budgeting pitfalls of each over-restricting current enjoyment (leading to funds failure) but under-prioritizing future security (leading to financial vulnerability).

4. Scalability All through Income Ranges

Whether or not but not you earn $30,000 but $300,000 yearly, the 50-30-20 rule scales proportionally. This universality makes it related to nearly anyone, irrespective of their income diploma but financial situation.

A 2023 analysis by the Federal Reserve found that households following percentage-based budgets (like 50-30-20) maintained further fixed saving prices all through utterly totally different income ranges in comparability with these using fixed-dollar budgets.

Breaking Down the 50-30-20 Lessons

The 50%: Desires (Essential Payments)

Your “needs” class must account for exactly 50% of your after-tax income. These are payments you cannot really steer clear of with out significantly impacting your main excessive high quality of life but licensed obligations.

True needs embrace:

- Housing costs (rent/mortgage, utilities, insurance coverage protection)

- Transportation (automotive value, insurance coverage protection, gasoline, repairs, public transit)

- Groceries and therefore main house objects

- Minimal debt funds (financial institution playing cards, pupil loans, personal loans)

- Insurance coverage protection premiums (nicely being, life, incapacity)

- Childcare payments

- Basic phone and therefore internet service

Widespread misconceptions about needs: Fairly many people incorrectly categorize needs as needs. A $200 cable bundle deal isn’t a necessity—main internet is. An expensive automotive value isn’t a necessity—reliable transportation is. The necessary factor question to ask: “What’s the minimal I should spend on this class to deal with my main life-style?”

The 30%: Needs (Discretionary Spending)

Your “needs” class will obtain 30% of your after-tax income and therefore covers each half that enhances your life-style nevertheless isn’t strictly important for survival.

Typical needs embrace:

- Consuming out and therefore leisure

- Hobbies and therefore recreation

- Streaming suppliers and therefore premium subscriptions

- Buying for non-essential devices

- Journey and therefore holidays

- Gymnasium memberships and therefore well being programs

- Personal care previous fundamentals

- Gadgets and therefore charitable giving

The psychology of the needs class: This class is crucial for funds success. By allocating a full 30% to needs, you steer clear of the deprivation mindset that destroys most budgets. You can have permission to have the benefit of your money—inside limits.

The 20%: Monetary financial savings and therefore Debt Reimbursement

The last word 20% of your income goes in direction of setting up your financial future by monetary financial savings and therefore further debt funds previous minimums.

Priority order to your 20%:

- Emergency fund (3-6 months of payments)

- Extreme-interest debt payoff (financial institution playing cards, personal loans)

- Retirement monetary financial savings (401k, IRA contributions)

- Totally different financial targets (residence down value, funding accounts)

Why 20% is the magic amount: Financial planners advocate saving 10-20% of income for long-term financial nicely being. The 50-30-20 rule’s 20% allocation locations you on the elevated end of this fluctuate, accelerating wealth setting up whereas remaining achievable for many people.

Step-by-Step Info to Implementing the 50-30-20 Rule

Step 1: Calculate Your After-Tax Income

Start by determining your month-to-month after-tax income. This comprises:

- Your wage after taxes, social security, and therefore Medicare deductions

- Side hustle income after taxes

- Funding dividends and therefore curiosity

- Each different widespread income sources

Occasion calculation: In case your gross month-to-month income is $6,000 and therefore additionally you pay $1,800 in taxes and therefore deductions, your after-tax income is $4,200.

Step 2: Resolve Your Class Allocations

Using the $4,200 occasion:

- Desires (50%): $2,100

- Needs (30%): $1,260

- Monetary financial savings/Debt (20%): $840

Step 3: Audit Your Current Spending

Sooner than implementing the rule, spend one month monitoring your payments to know your current spending patterns. Employ apps like Mint, YNAB, but maybe a straightforward spreadsheet to categorize every expense.

Widespread findings: Most people uncover they are — really spending an extreme quantity of on needs and therefore too little on monetary financial savings. Do not — honestly fret—that’s common and therefore exactly why you might be implementing a funds.

Step 4: Regulate Your Payments to Match the Lessons

That’s the place the true work begins. You would possibly should:

- Scale again housing costs within the occasion that they exceed 50% of your income

- Reduce discretionary spending if it needs to exceed 30%

- Enhance income in case your needs alone exceed 50%

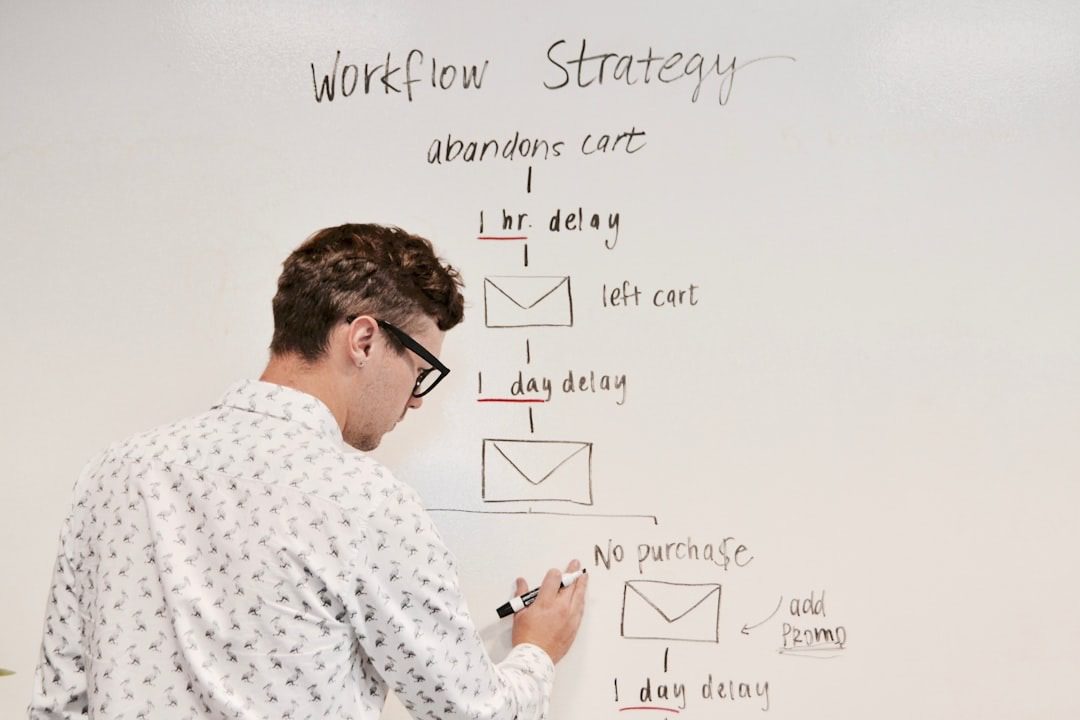

Step 5: Automate Your System

Organize computerized transfers to make the system straightforward:

- Monetary financial savings account: Computerized swap of your 20% on payday

- Checking account: Protect money for needs and therefore wants

- Separate accounts: Ponder separate accounts for each class

Step 6: Monitor and therefore Regulate Month-to-month

Analysis your spending month-to-month to make certain you are, honestly staying inside each class. Don’t objective for perfection—objective for consistency and therefore gradual enchancment.

Superior Strategies for Mastering the 50-30-20 Rule

Approach 1: The Reverse Value vary Methodology

As an various of budgeting what’s left after payments, automate your 20% monetary financial savings first. This “pay your self first” methodology ensures your financial future is prioritized sooner than discretionary spending.

Implementation: Organize computerized transfers to monetary financial savings accounts immediately after payday. This forces you to dwell on the remaining 80%, naturally constraining your spending.

Approach 2: The Graduated Enhance Approach

Start with a further manageable break up if 50-30-20 feels overwhelming, then repeatedly regulate in direction of the objective percentages.

Occasion improvement:

- Month 1-3: 60-30-10 break up

- Month 4-6: 55-30-15 break up

- Month 7+: 50-30-20 break up

This gradually method helps assemble sustainable habits with out gorgeous your life-style.

Approach 3: The Income-Based mostly principally Adjustment

Modify the chances based mostly principally in your income diploma and therefore life circumstances:

Elevated incomes: Ponder 45-30-25 to pace up wealth setting up.

Lower incomes: Shortly make use of 55-35-10 whereas setting up main stability.

Extreme debt lots of: Try 50-20-30 to pace up debt payoff

Approach 4: Seasonal Modifications

Modify allocations for predictable seasonal payments:

Occasion modifications:

- Trip season: Scale again needs to 25% and therefore monetary financial savings to fifteen% to accommodate current payments

- Summer time season: Enhance needs to 35% for journey whereas reducing monetary financial savings to fifteen%

- Once more to highschool: Regulate percentages for education-related payments

The key’s returning to the same old 50-30-20 break up as quickly because the seasonal interval ends.

Precise-World Examples and therefore Case Analysis

Case Analysis 1: Sarah, Single Expert ($75,000 Annual Income)

Month-to-month after-tax income: $4,800 50-30-20 allocation:

- Desires: $2,400

- Needs: $1,440

- Monetary financial savings: $960

Sarah’s funds breakdown:

- Desires ($2,400): Rent $1,200, utilities $150, groceries $400, automotive value $300, insurance coverage protection $200, minimal debt funds $150

- Needs ($1,440): Consuming out $400, leisure $200, buying $300, health heart $80, subscriptions $100, miscellaneous $360

- Monetary financial savings ($960): Emergency fund $400, 401k $300, debt payoff $260

Outcomes after 12 months: Sarah constructed a $4,800 emergency fund, paid off $3,120 in additional debt funds, and therefore contributed $3,600 to retirement—all whereas sustaining her life-style.

Case Analysis 2: The Johnson Family (Blended Income $95,000)

Month-to-month after-tax income: $6,200 50-30-20 allocation:

- Desires: $3,100

- Needs: $1,860

- Monetary financial savings: $1,240

The Johnsons’ funds breakdown:

- Desires ($3,100): Mortgage $1,800, utilities $200, groceries $600, automotive funds $450, insurance coverage protection $300, childcare $500, minimal debt funds $250

- Needs ($1,860): Family consuming $300, youngsters’ actions $400, date nights $200, hobbies $300, streaming suppliers $60, miscellaneous $600

- Monetary financial savings ($1,240): Emergency fund $500, retirement $400, youngsters’ school fund $240, additional mortgage value $100

Drawback confronted: The Johnsons initially struggled as a results of their needs exceeded 50%. They refinanced their mortgage and therefore positioned cheaper childcare, bringing their needs down to exactly $3,100.

Case Analysis 3: Marcus, Present Graduate ($45,000 Annual Income)

Month-to-month after-tax income: $3,200 Modified 55-35-10 allocation: (However of pupil loans and therefore setting up career)

- Desires: $1,760

- Needs: $1,120

- Monetary financial savings: $320

Marcus’s method: Marcus started with a modified break up whereas aggressively paying off pupil loans. As quickly as his minimal funds decreased, he repeatedly shifted to the same old 50-30-20 break up.

18-month improvement:

- Months 1-6: 55-35-10 break up whereas setting up emergency fund

- Months 7-12: 52-33-15 break up as income elevated

- Months 13-18: 50-30-20 break up after establishing financial foundation

Widespread Challenges and therefore Strategies to Overcome Them

Drawback 1: “My Desires Exceed 50% of My Income”

That’s the commonest obstacle, notably for people with extreme housing costs but necessary debt funds.

Choices:

- Scale again housing costs: Ponder downsizing, getting roommates, but shifting to a lower-cost area

- Enhance income: Deal with facet work, search promotions, but develop new experience

- Shortly modify the rule: Employ 60-25-15 whereas working in direction of the same old break up

- Obtain rid of but consolidate debt: Think about paying off high-interest debt to chop again minimal funds

Drawback 2: “I Can’t Save 20% Correct Now”

Starting with any amount is finest than not starting the least bit.

Gradually method:

- Start with 5% and therefore enhance by 2-3% every few months

- Employ windfalls like tax refunds but bonuses to boost monetary financial savings

- Automate small portions to assemble the habits sooner than rising the amount

Drawback 3: “My Income Is Irregular”

Freelancers, commissioned salespeople, and therefore seasonal staff need modified approaches.

Strategies for irregular income:

- Employ your lowest month because the backside to your funds

- Save further from high-income months in a separate account

- Create a smoothing account that evens out month-to-month variations

- Adjust to the rule yearly fairly than month-to-month

Drawback 4: “I Protect Overspending inside the Needs Class”

The needs class sometimes turns right into a catch-all that grows previous 30%.

Administration strategies:

- Employ cash but a separate debit card for needs spending

- Observe needs to spend weekly fairly than month-to-month

- Uncover free but low-cost choices for leisure and therefore hobbies

- Apply the 24-hour rule for non-essential purchases over $50

Superior Optimization Strategies

Methodology 1: The Proportion-Plus Approach

As quickly as you’ve gotten mastered the elemental 50-30-20 rule, take into consideration together with proportion elements to monetary financial savings all through certain intervals:

Occasion capabilities:

- No-spend months: Redirect needs proportion to monetary financial savings

- Bonus months: Add windfalls to the monetary financial savings class

- Low-expense intervals: Shortly enhance monetary financial savings proportion

Methodology 2: Class Sub-Budgeting

Create sub-categories inside each principal class for larger administration:

Desires sub-categories:

- Housing: 25-30% of income

- Transportation: 10-15% of income

- Meals: 8-12% of income

Needs sub-categories:

- Leisure: 10% of income

- Shopping for: 10% of income

- Miscellaneous: 10% of income

Methodology 3: The Flex Account System

Create a “flex” account which will shift between needs and therefore monetary financial savings based mostly principally on month-to-month priorities:

The way in which it really works:

- Allocate the same old 50% to needs

- Put 25% in fixed needs

- Put 15% in fixed monetary financial savings

- Put 10% in a flex account which will go to each want but monetary financial savings each month

This methodology provides additional flexibility whereas sustaining common funds self-discipline.

Methodology 4: Price-Based mostly principally Want Prioritization

Fairly than spending needs money arbitrarily, align spending collectively along with your values:

Steps:

- Set up your excessive 3-5 values (family, nicely being, journey, finding out, and therefore so so on.)

- Allocate spending to actions that support these values

- Obtain rid of but lower again spending on points that don’t align collectively along with your values

This methodology maximizes life satisfaction out of your spending whereas staying inside funds.

Experience and therefore Devices for Success

Budgeting Apps and therefore Software program program

Free selections:

- Mint: Computerized categorization and therefore monitoring

- Personal Capital: Think about funding monitoring and therefore internet worth

- YNAB (You Need A Value vary): Zero-based budgeting with a 34-day free trial

Paid selections:

- YNAB: $98 yearly for full budgeting devices

- Tiller: $79 yearly for spreadsheet-based budgeting

- PocketGuard: Premium choices for $12.99 yearly

Banking Choices

Extreme-yield monetary financial savings accounts: Evaluation displays that automating monetary financial savings to high-yield accounts will improve monetary financial savings prices by a imply of 8.2% yearly in comparability with standard monetary financial savings accounts.

Separate account method:

- Checking account: For needs and therefore wants (80% of income)

- Extreme-yield monetary financial savings: For emergency fund portion

- Funding account: For long-term monetary financial savings portion

Automation Devices

Computerized transfers: Organize computerized transfers for the day after payday to remove the temptation to spend monetary financial savings money.

Bill automation: Automate all fixed payments inside the needs class to make certain they are — really paid on time and therefore exactly how quite a bit is left for variable payments.

Adapting the Rule for Utterly totally different Life Phases

Youthful Adults (22-30)

Advisable modification: 50-30-20 with emphasis on emergency fund setting up

Priorities:

- Assemble $1,000 emergency fund shortly

- Repay high-interest debt

- Start retirement monetary financial savings to maximise compound curiosity

Widespread challenges:

- Lower starting salaries

- Scholar mortgage funds

- Lifestyle inflation as income grows

Middle-Aged Adults (30-50)

Advisable modification: 45-30-25 if attainable, to pace up wealth setting up

Priorities:

- Maximize retirement contributions

- Save for kids’s coaching

- Ponder funding property but totally different wealth-building strategies

Widespread challenges:

- Peak incomes years, but so moreover peak payments

- Mortgage funds and therefore family costs

- Balancing current family needs with retirement monetary financial savings

Pre-Retirees (50-65)

Advisable modification: 45-25-30 to maximise retirement monetary financial savings

Priorities:

- Catch-up retirement contributions

- Repay the mortgage sooner than retirement

- Assemble a appreciable emergency fund for retirement

Widespread challenges:

- Restricted time to assemble retirement monetary financial savings

- Potential healthcare worth will improve

- Supporting grownup kids but ageing dad and therefore mother

Retirees (65+)

Advisable modification: Modified methodology specializing in sustainable withdrawal

Retirement allocation:

- 70% for dwelling payments (needs and therefore wants combined)

- 30% stays invested for inflation security and therefore legacy

Explicit points:

- Healthcare worth administration

- Social Security optimization

- Property planning integration

Worldwide Views and therefore Variations

European Variations

European financial advisors sometimes advocate associated percentage-based budgeting nevertheless with modifications for elevated tax prices and therefore utterly totally different social safety nets.

Widespread European modification: 45-35-20 break up

- Lower needs proportion on account of widespread healthcare

- Elevated needs proportion on account of cultural emphasis on leisure

- Maintained a 20% monetary financial savings worth for retirement and therefore targets

Asian Variations

Fairly many Asian cultures traditionally emphasize elevated monetary financial savings prices, leading to modifications like 40-30-30 and therefore even 40-25-35 splits.

Cultural components:

- Extended family financial obligations

- Property possession as most important wealth setting up

- Lower shopper debt ranges

Rising Economic system Variations

In worldwide areas with a lot much less safe economies but currencies, the principle focus sometimes shifts in direction of:

- Elevated emergency fund targets (6-12 months vs. 3-6 months)

- Diversified monetary financial savings collectively with abroad foreign exchange but gold

- Versatile percentages that regulate with monetary circumstances

The Science Behind Budgeting Success

Behavioral Economics Concepts

The 50-30-20 rule succeeds as a results of it incorporates numerous key behavioral economics guidelines:

Psychological Accounting: Of us naturally separate money into utterly totally different “psychological accounts.” The rule formalizes this tendency healthily.

Loss Aversion: By framing monetary financial savings as computerized, it feels a lot much less like “shedding” money to place it apart.

Present Bias: The 30% needs class satisfies our want for fast gratification whereas nonetheless prioritizing future needs.

Evaluation-Backed Benefits

A 2022 analysis by the Nationwide Endowment for Financial Education found that people following percentage-based budgets like 50-30-20 confirmed:

- 67% enchancment in financial stress ranges

- 45% enhance in emergency fund balances after 12 months

- 23% elevated retirement contribution prices

- 34% fewer overdraft prices and therefore financial penalties

Neurological Impression

Thoughts imaging analysis current that people following structured budgets experience:

- Diminished train inside the thoughts’s nervousness amenities

- Elevated train in areas associated to self-control and therefore planning

- Improved sleep excessive high quality on account of decreased financial stress

Individual Testimonials and therefore Success Tales

Testimonial 1: Jennifer M., Promoting Supervisor

“I was skeptical about budgeting as a results of I’d tried so so a large number of difficult strategies that failed. The 50-30-20 rule was utterly totally different—it was straightforward enough that I’d hold it up. After 18 months, I’ve saved $15,000 for a house down value and therefore paid off $8,000 in financial institution card debt. Essentially the most efficient half? I under no circumstances felt deprived as a results of I nonetheless had money for the points I beloved.”

Testimonial 2: David and therefore Maria R., Teachers

“As a single-income family with three youngsters, money was all of the time tight and therefore tense. The 50-30-20 rule helped us discover we’ve got been spending an extreme quantity of on housing. We moved to a smaller house and therefore out of the blue had respiration room in our funds. Our marriage is a lot much less tense now that we are, honestly not stopping about money, and therefore our kids are finding out good money habits by watching us observe our funds.”

Testimonial 3: Alex T., Present School Graduate

“Starting my career with $45,000 in pupil loans felt overwhelming. My financial advisor launched me to the 50-30-20 rule, nevertheless we modified it to take care of debt payoff. I used 50% for needs, 20% for needs, and therefore 30% for monetary financial savings and therefore further debt funds. I paid off my loans three years early, and therefore now I’m following the same old break as much as assemble wealth. It gave me a clear path forward after I felt totally misplaced financially.”

Measuring Your Success

Key Effectivity Indicators (KPIs)

Observe these metrics month-to-month to measure your 50-30-20 rule success:

Financial Effectively being KPIs:

- Web worth progress: Should enhance month-to-month

- Emergency fund progress: Purpose 3-6 months of payments

- Debt-to-income ratio: Should decrease over time

- Monetary financial savings worth: Should persistently hit 20%

Behavioral KPIs:

- Value vary adherence: Intention for 90%+ consistency

- Automated monetary financial savings worth: What quantity saves routinely

- Financial stress ranges: Self-reported stress low cost

Month-to-month Analysis Course of

Week 1 of each month:

- Calculate exact percentages from the sooner month

- Set up variances from 50-30-20 objective

- Analyze causes for any necessary deviations

- Regulate the upcoming month based mostly principally on lessons realized

Quarterly opinions:

- Web worth calculation using all belongings and therefore cash owed

- Function progress analysis for most important financial targets

- Value vary proportion fine-tuning based mostly principally on income but life modifications

Annual Financial Effectively being Analysis

Key inquiries to ask:

- Did I save on the least 20% of my income this yr?

- Is my emergency fund completely funded?

- Am I on observe for retirement targets?

- What most important payments must I plan for subsequent yr?

Data Analysis: 50-30-20 Rule Effectiveness

| Income Diploma | Desires % (Exact) | Needs % (Exact) | Monetary financial savings % (Exact) | Financial Stress Diploma |

|---|---|---|---|---|

| $30,000–$45,000 | 58% | 32% | 10% | Extreme |

| $45,000–$65,000 | 52% | 31% | 17% | Common |

| $65,000–$85,000 | 48% | 30% | 22% | Low |

| $85,000–$120,000 | 45% | 32% | 23% | Very Low |

| $120,000+ | 42% | 35% | 23% | Very Low |

Data provide: Nationwide Financial Wellness Survey 2023 (n=10,000 respondents)

Key insights from the information:

- Elevated-income households naturally receive larger proportion splits

- The 50-30-20 objective turns into further achievable as income will improve

- Financial stress correlates strongly with monetary financial savings worth achievement

- Most people spend close to 30% on needs irrespective of income diploma

Comparability with Totally different Budgeting Methods

| Approach | Setup Complexity | Maintenance Effort | Success Value | Most interesting For |

|---|

| 50-30-20 Rule | Low | Low | 73% | Rookies, busy professionals |

| Zero-Based mostly principally Budgeting | Extreme | Extreme | 68% | Ingredient-oriented people |

| Envelope Approach | Medium | Medium | 65% | Cash-preferring prospects |

| Pay Your self First | Low | Low | 71% | Computerized savers |

| Values-Based mostly principally Budgeting | Medium | Medium | 69% | Function-oriented individuals |

Success worth is outlined as sustaining the funds for 12+ months

Often Requested Questions (FAQ)

1. What if my needs exceed 50% of my income?

Suppose your necessary payments exceed 50% of your after-tax income. In that case, you’ve got numerous selections: enhance your income by facet hustles but career improvement, lower again your housing costs by downsizing but discovering roommates, consolidate but repay high-interest debt to lower minimal funds, but shortly make use of a modified break up like 60-25-15 whereas working in direction of the same old percentages. Think about the largest expense lessons first—housing typically affords in all probability an important low cost alternate options.

2. Can I modify the chances based mostly principally on my situation?

Utterly. The 50-30-20 rule is a tenet, not a rigid requirement. Widespread modifications embrace 45-30-25 for elevated earners centered on wealth setting up, 55-35-10 for these setting up preliminary emergency funds, but 50-20-30 for aggressive debt payoff. The key’s sustaining stability between current needs, enjoyment, and therefore future security whereas working in direction of the same old break up over time.

3. How do I take care of irregular income with the 50-30-20 rule?

For irregular income, base your funds in your lowest typical month-to-month income and therefore save further from higher-earning months in a separate smoothing account. Alternatively, observe your payments yearly fairly than month-to-month, ensuring your yearly totals align with 50-30-20 percentages. Fairly many freelancers create a separate enterprise account to even out month-to-month variations sooner than making make use of of the rule.

4. Should I embrace employer 401(okay) matching in my 20% monetary financial savings?

Employer matching doesn’t rely in direction of your 20% but it’s not a half of your income allocation—it’s free money on excessive of your efforts. Your 20% must come solely out of your after-tax income. However, it is finest to all of the time contribute enough to obtain the overall employer match sooner than allocating your 20% to totally different monetary financial savings targets, because therefore it is an instantaneous 100% return on funding.

5. What’s the excellence between the 50-30-20 rule and therefore totally different percentage-based budgets?

The 50-30-20 rule notably balances current security (needs), current enjoyment (needs), and therefore future security (monetary financial savings) in research-backed proportions. Totally different proportion budgets would presumably allocate in one other approach—like 60-20-20 but 40-40-20—nevertheless lack the intensive evaluation and therefore real-world testing that validates the 50-30-20 break up. The rule’s 30% needs allocation is very needed for psychological sustainability.

6. How prolonged does it take to see outcomes with the 50-30-20 rule?

Most people see speedy stress low cost inside the primary month on account of getting a clear spending plan. Financial outcomes alter into seen inside 3-6 months—you’ll doable have started an emergency fund, decreased debt, and therefore gained administration over spending. Very important wealth setting up typically turns into apparent after 12-18 months of fixed software program, relying in your begin line and therefore income diploma.

7. Can I make the most of the 50-30-20 rule if I’ve necessary debt?

Positive, nevertheless you you may want to — really alter the chances shortly. Suppose about utilizing 50-20-30 (reducing needs to lengthen debt funds) but embrace minimal debt funds in needs whereas inserting additional funds inside the monetary financial savings class. Extreme-interest debt should be prioritized over most totally different monetary financial savings targets, apart from a main emergency fund of $1,000-$2,500 to steer clear of taking on further debt all through emergencies.

Conclusion: Your Path to Financial Freedom Begins Immediately

The 50-30-20 rule isn’t merely one different budgeting fad—it’s a confirmed system that has helped tens of tens of millions of people rework their financial lives. By allocating your after-tax income into these three straightforward lessons, you create a sustainable stability between having enjoyable with at current and therefore securing tomorrow.

The nice factor about this methodology lies in its simplicity and therefore suppleness. You want not observe every penny but sacrifice all enjoyment to assemble wealth. As an various, you create clear boundaries that help you to dwell successfully whereas systematically setting up financial security.

Preserve in thoughts these key takeaways as you begin your 50-30-20 journey:

Start collectively along with your current situation and therefore repeatedly regulate in direction of the objective percentages. Perfection isn’t the aim—consistency is. Even within the occasion you begin with 60-30-10, you might be nonetheless building positive financial habits which will serve you for all occasions.

Automate as quite a bit as attainable to chop again the psychological vitality required to deal with your funds. Organize computerized transfers for monetary financial savings and therefore funds, then focus your consideration on managing your discretionary spending.

The rule scales collectively along with your income and therefore life modifications. Whether or not but not you might be incomes $35,000 but $350,000, whether or not but not you might be single but supporting a family, the percentage-based methodology adapts to your circumstances whereas sustaining the core principle of balanced money administration.

Most considerably, permit your self to get pleasure from the journey. The 30% needs class isn’t frivolous—it’s necessary for sustaining the psychological sustainability that makes long-term financial success attainable.

Your financial future is constructed one month at a time, one proportion at a time, one automated swap at a time. The 50-30-20 rule provides the framework, nevertheless your fixed software program provides the outcomes.

Ready to rework your funds? Calculate your objective portions for each class, prepare computerized transfers to your 20% monetary financial savings, and therefore choose to following the system for the next three months. Your future self will thanks for taking this necessary step in direction of financial freedom at current.

The path to wealth isn’t troublesome—it merely requires a plan, consistency, and therefore the braveness to take step one. The 50-30-20 rule provides you the plan. The consistency and therefore braveness? That’s as a lot as you.