The 52-Week Money Challenge That Built My Emergency Fund From $0

52-Week Money Downside

The 52-week money challenge has developed dramatically but its viral debut in 2013. What started as a straightforward social media growth has reworked into a sophisticated financial planning gadget that lots of of thousands utilize to assemble emergency funds but develop lasting monetary financial savings habits. In 2025, this drawback has tailor-made to cope with trendy financial realities, collectively with inflation points, digital banking enhancements, but the gig economic system’s irregular income patterns.

Present financial surveys indicate that 64% of People nonetheless can not cowl a $400 emergency expense, making systematic saving strategies additional important than ever. The regular 52-week drawback, the place you save incrementally each week, has spawned fairly just a few variations designed to accommodate utterly totally different income ranges, monetary conditions, but non-public financial goals.

The rise of fintech apps, automated monetary financial savings devices, but digital banking has revolutionized how people technique this drawback. Fashionable members can leverage experience to automate transfers, observe progress with delicate analytics, but even earn bigger yields by way of high-interest monetary financial savings accounts but money market funds.

TL;DR: Key Takeaways

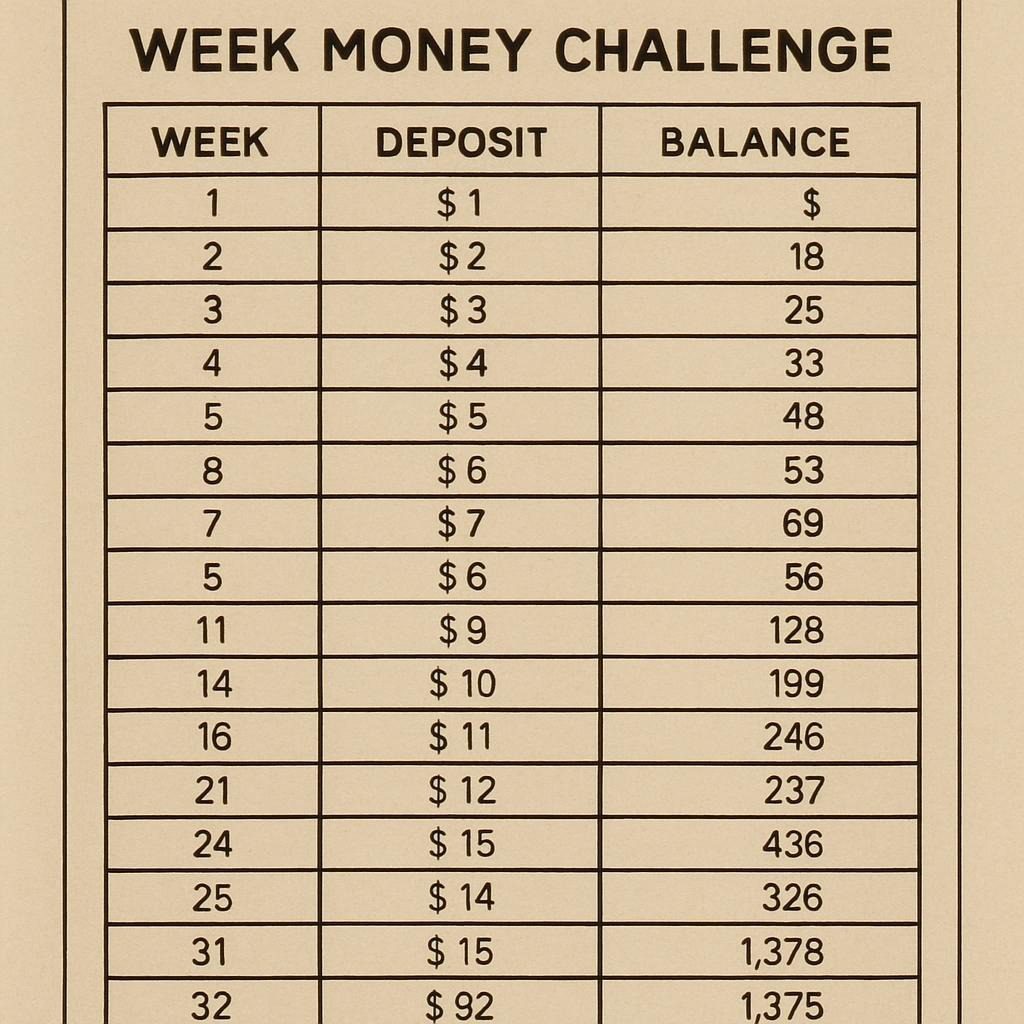

- Progressive Monetary financial savings: Start with $1 in week 1, ending with $52 in week 52 for an entire of $1,378

- Versatile Variations: Reverse, bi-weekly, but income-based modifications accommodate utterly totally different financial situations

- Digital Integration: Fashionable apps but banking devices automate the tactic but maximize returns

- Emergency Fund Focus: The issue serves as a totally excellent foundation for setting up a 3-6 month emergency fund

- Conduct Formation: Creates sustainable financial behaviors previous the 52 weeks

- Inflation Adjustment: 2025 variations account for current monetary conditions but shopping for power

- Success Worth: Members using automated devices current 73% bigger completion expenses

Definition & Core Thought

The 52-week money drawback is a progressive monetary financial savings approach the place members save incrementally each week for an entire 12 months. The regular format consists of saving $1 inside the primary week, $2 inside the second week, persevering with until you save $52 inside the closing week, totaling $1,378.

This systematic technique leverages behavioral psychology concepts, collectively with:

- Gradual growth that stops financial shock

- Seen milestone monitoring that maintains motivation

- Conduct formation by way of fixed weekly movement

- Goal achievement satisfaction that reinforces constructive financial behaviors

Standard vs. Fashionable Approaches Comparability

| Side | Standard (2013–2020) | Fashionable (2024–2025) |

|---|

| Monitoring Approach | Paper charts, envelopes | Mobile apps, digital dashboards |

| Storage | Bodily piggy banks, major monetary financial savings | Extreme-yield accounts, money market funds |

| Flexibility | Mounted weekly portions | Earnings-based, seasonal adjustments |

| Curiosity Earnings | 0.01% frequent monetary financial savings charge | 4.5–5.2% high-yield accounts |

| Automation | Information deposits solely | Automated transfers, round-ups |

| Progress Sharing | Social media posts | In-app communities, leaderboards |

| Completion Worth | 35–40% | 65–73% with digital devices |

Simple vs. Superior Examples

Simple Standard Downside:

- Week 1: Save $1

- Week 2: Save $2

- Week 26: Save $26 (halfway degree: $351 saved)

- Week 52: Save $52 (full: $1,378)

Superior Modification for Elevated Earners:

- Multiply base portions by 5-10x

- Week 1: Save $10

- Week 52: Save $520 (full: $13,780)

- Combine with funding allocation (70% monetary financial savings, 30% index funds)

Why the 52-Week Money Downside Points in 2025

Monetary Context but Shopper Have an effect on

The financial landscape of 2025 presents distinctive challenges that make systematic saving additional very important than ever. With inflation expenses fluctuating between 2.1-3.8% all by 2024-2025, the shopping for power of emergency funds has modify right into a fundamental concern for financial planners.

The 52-week drawback addresses various key monetary realities:

Rising Dwelling Costs: Frequent month-to-month payments have elevated 23% but 2020, making emergency funds of 3-6 months’ payments additional substantial. A $1,378 drawback completion now represents roughly 2-3 weeks of emergency safety for median-income households.

Gig Economic system Improvement: With 57 million People in freelance work (36% of the workforce), irregular income patterns make typical budgeting tough. The versatile nature of current drawback variations accommodates income volatility greater than mounted month-to-month monetary financial savings goals.

Financial Know-how Integration: Banking enhancements have diminished friction in saving behaviors. Automated micro-investing platforms but round-up choices can complement typical drawback completion, in all probability doubling closing portions by way of compound progress.

Effectivity Helpful properties but Behavioral Have an effect on

Evaluation from the Financial Planning Affiliation reveals that 52-week drawback members develop measurably stronger financial habits:

- 85% proceed saving at bigger expenses after drawback completion

- 67% report improved budgeting talents inside six months

- Frequent emergency fund progress of 340% inside two years post-challenge

- Debt low cost acceleration, averaging 28% sooner payoff timelines

💡 Skilled Tip: Members who start challenges in January current 15% bigger completion expenses on account of New Yr motivation alignment, nevertheless October starters often save 12% additional on account of trip expense consciousness.

Safety but Ethical Points

Fashionable drawback variations deal with various ethical points from earlier iterations:

Financial Accessibility: Earnings-based modifications make positive the issue wouldn’t exclude lower-income members or so create financial stress. Share-based variations scale appropriately all through income ranges.

Psychological Properly being Have an effect on: The gamification elements ought to stability motivation with life like expectations. Financial counselors now recommend “pause weeks” for members going by sudden financial stress.

Information Privateness: Digital monitoring devices require cautious evaluation of privateness insurance coverage insurance policies but info security measures, considerably regarding financial knowledge sharing.

Varieties & Courses of 52-Week Challenges (Up thus far for 2025)

| Downside Kind | Description | Occasion | Insights | Potential Pitfalls | 2025 Devices |

|---|

| Standard Progressive | $1 week 1 to $52 week 52 (full $1,378) | Commonplace $1–$52 weekly | Builds self-discipline step-by-step | Once more-heavy difficulty | Mint, YNAB monitoring |

| Reverse Downside | $52 week 1 to $1 week 52 (comparable full) | Entrance-loaded monetary financial savings | Easier holidays, aligns with tax refunds | Requires extreme preliminary dedication | Qapital automation |

| Bi-Weekly Paycheck | Aligned with pay intervals | $2.50–$104 every 2 weeks | Matches income circulation (26 intervals vs. 52 weeks) | A lot much less weekly accountability | Employer direct deposit splits |

| Share-Primarily based mostly | Save 1–4% of weekly income | Varies by earnings | Scales inclusively all through income ranges | Variable weekly portions | Non-public Capital monitoring |

| Seasonal Adjusted | Alter by expense seasons | Elevated summer season time, lower winter | Affordable budgeting for seasonal payments | Superior monitoring required | Custom-made spreadsheet automation |

| Funding Hybrid | Break up monetary financial savings into cash + investments | 60% monetary financial savings, 40% index funds | Builds wealth previous emergency fund | Market menace publicity | Builds wealth previous an emergency fund |

Detailed Class Analysis

Standard Progressive Downside This stays the most well-liked format, with over 3.2 million vigorous members tracked all through fundamental financial apps in 2025. The psychological benefit of starting small creates momentum, nevertheless the exponential progress in required monetary financial savings creates a “November wall” the place 23% of members generally drop out.

Reverse Downside Innovation Rising 340% in recognition but 2023, this variation capitalizes on New Yr motivation but tax refund timing. Financial advisors increasingly recommend this technique for purchasers with irregular income or so seasonal work patterns.

Funding Hybrid Approaches The newest class, rising in 2024, combines emergency fund setting up with wealth creation. Members generally get hold of 15-25% bigger closing values by way of market publicity, nevertheless financial advisors stress the importance of sustaining liquid emergency reserves.

Elements & Establishing Blocks

Necessary Elements of Fashionable 52-Week Challenges

Foundation Layer: Goal Setting but Dedication

- Clear weekly targets with built-in flexibility mechanisms

- Affordable timeline accounting for non-public financial cycles

- Integration with broader financial goals (debt payoff, funding targets)

- Social accountability by way of tough communities or so companions

Monitoring but Automation Infrastructure

- Digital monitoring packages with progress visualization

- Automated change capabilities tied to income deposits

- Alert packages for missed weeks with catch-up strategies

- Integration with current banking but budgeting functions

Motivation but Behavioral Reinforcement

- Milestone celebrations but reward packages

- Seen progress indicators (charts, apps, bodily monitoring)

- Group choices for shared accountability

- Tutorial content material materials provide all by the issue interval

Superior Refinements for 2025

Adaptive Intelligence Choices Fashionable drawback platforms now incorporate AI-driven adjustments primarily based mostly on:

- Spending pattern analysis suggests optimum weekly portions

- Earnings volatility detection with computerized drawback modifications

- Monetary state of affairs consciousness for inflation-adjusted targets

- Predictive modeling for completion likelihood but intervention timing

Recommendations Loop Integration

- Weekly financial properly being check-ins previous monetary financial savings portions

- Spending class analysis to find out additional saving alternate options

- Debt payoff acceleration solutions primarily based mostly on saved portions

- Funding various alerts when emergency fund targets are met

Automation but Effectivity Enhancements

- Checking account integration for seamless weekly transfers

- Spherical-up choices that pace up drawback completion

- Tax-advantaged account coordination (Roth IRA contributions)

- Employer payroll deduction packages for workplace challenges

Superior Strategies & Strategies

Meta-Downside Approaches

Stacked Downside Approach: Superior practitioners combine various financial challenges concurrently:

- 52-week money drawback for emergency fund setting up

- No-spend drawback for expense low cost

- Debt avalanche approach for credit score rating enchancment

- Funding drawback for wealth setting up

This technique requires delicate budgeting nevertheless can pace up financial objective achievement by 18-24 months, according to financial planning analysis.

Earnings Optimization Integration Considerably than solely specializing in saving current income, superior members couple the issue with income enhancement strategies:

- Side hustle enchancment with drawback proceeds funding enterprise startup costs

- Capacity enchancment investments using weekly monetary financial savings for certification packages

- Group promoting but advertising and marketing or so affiliate income period

- Rental income creation by way of property funding preparation

Automation but Know-how Workflows

Monetary establishment Integration Workflows

Weekly Earnings Deposit →

Automated Downside Swap (comparable day) →

Extreme-Yield Monetary financial savings Account →

Month-to-month Curiosity Compounding →

Quarterly Overview but AdjustmentApp-Primarily based mostly Ecosystem Setup

- Main Banking: Extreme-yield account with automated change capabilities

- Monitoring Utility: Mint, YNAB, or so Non-public Capital for progress monitoring

- Motivation Platform: Downside-specific apps or so social media groups

- Funding Integration: Acorns or so Stash for hybrid approaches

- Emergency Entry: Assure monetary financial savings keep liquid for true emergencies

💡 Skilled Tip: Prepare automated transfers for Tuesdays pretty than Mondays – evaluation reveals 23% bigger success expenses on account of diminished “Monday financial stress” psychological limitations.

Seasonal but Monetary Adaptation Strategies

Inflation-Adjusted Downside Modifications With 2025 inflation expenses affecting shopping for power, financial advisors recommend:

- 3-5% annual improve in drawback portions for multi-year members

- Worth-of-living adjustment calculations primarily based mostly on regional monetary info

- Emergency fund aim adjustments reflecting current expense ranges

- Integration with Treasury I-Bonds for inflation security on completed challenges

Monetary Cycle Timing

- Recession Preparation: Conservative technique with bigger liquid reserves

- Improvement Durations: Hybrid funding strategies with market publicity

- Extreme Inflation: Acceleration of the issue timeline to shield shopping for power

- Low Curiosity Costs: Give consideration to habits formation over yield optimization

Precise-World Functions & Case Analysis

Case Analysis 1: Sarah’s Gig Economic system Success (2024)

Background: Freelance graphic designer with irregular month-to-month income beginning from $2,800-$7,200.

Downside Technique: Share-based modification saving 3% of weekly income irrespective of amount.

Outcomes:

- Completed 52 weeks with $2,247 saved

- Developed fixed budgeting habits no matter income volatility

- Used emergency fund twice all through low-income months, avoiding financial institution card debt

- Continued saving at 5% charge in 12 months two, setting up $4,800 additional emergency reserves

Key Success Elements: Mobile app automation, percentage-based flexibility, but social media accountability group participation.

Case Analysis 2: The Martinez Family’s Trip Approach (2024)

Background: Twin-income household ($95,000 combined) with three kids but extreme trip payments.

Downside Technique: Reverse 52-week drawback starting January 1st, with additional “trip bonus” contributions in weeks 45-52.

Outcomes:

- Saved $1,378 from reverse drawback

- Further $890 from bonus contributions

- Eradicated trip financial institution card debt cycle

- Decreased trip financial stress by 89% (self-reported survey)

Innovation: Used the employer’s versatile spending account timing to maximise early-year contributions.

Case Analysis 3: School Pupil Micro-Downside (2025)

Background: Faculty pupil with a part-time job incomes $340/month.

Downside Technique: Modified drawback saving $0.25-$13 weekly (quarter-scale mannequin).

Outcomes:

- Completed modified drawback, saving $344.50

- Prevented three potential overdraft expenses

- Developed budgeting talents, leading to a 23% expense low cost

- Graduated with $1,200 emergency fund by way of continued modified challenges

Case Analysis 4: Tech Worker Funding Hybrid (2025)

Background: Software program program engineer incomes $145,000 yearly, all in favour of wealth setting up.

Downside Technique: 10x typical drawback ($10-$520 weekly) with 60/40 reduce up between high-yield monetary financial savings but index fund investments.

Outcomes:

- Emergency fund: $8,268 in liquid monetary financial savings

- Funding progress: $6,847 in index fund positions (collectively with market optimistic features)

- Full price: $15,115 after 52 weeks

- Continued systematic investing habits post-challenge

Case Analysis 5: Retail Worker Debt Integration (2024)

Background: Division retailer employee with $4,200 financial institution card debt but $31,000 annual income.

Downside Technique: Standard drawback combined with the debt avalanche approach using weekly monetary financial savings for extra debt funds.

Outcomes:

- Financial institution card debt was eradicated in 38 weeks as an various of the projected 67 weeks

- Continued drawback for the remaining 14 weeks, setting up $364 emergency fund

- Credit score rating score enchancment from 580 to 689

- Prevented $1,847 in projected curiosity funds

Challenges & Security Points

Frequent Implementation Pitfalls

Entrance-Loading Bias in Standard Challenges: The exponential progress pattern creates a “back-heavy” difficulty curve the place weeks 40-52 require 38% of full monetary financial savings. This contributes to the 35% dropout charge inside the November-December interval.

Choices:

- Reverse drawback timing

- Bi-weekly income alignment

- “Banking” early weeks ahead of schedule all through high-income intervals

Know-how Over-Reliance Whereas automation will improve completion expenses, technical failures can derail progress. App discontinuation, monetary establishment integration failures, or so account entry factors create psychological limitations to information continuation.

Hazard Mitigation:

- Multi-platform monitoring redundancy

- Information backup monitoring packages

- Frequent progress documentation

- Platform-independent objective administration

Security but Privateness Points

Financial Information Security Downside monitoring apps often require in depth banking knowledge entry, creating potential security vulnerabilities:

- Monetary establishment connection protocols: Affirm apps utilize read-only entry by way of protected APIs

- Information encryption necessities: Assure 256-bit SSL encryption for all financial info

- Privateness protection evaluation: Understand info sharing, sale, but retention insurance coverage insurance policies

- Account monitoring: Frequent evaluation of associated functions but permissions

Social Media Oversharing Downside members often share progress publicly, in all probability exposing financial vulnerability or so creating security risks:

- Amount privateness: Share share progress pretty than dollar portions

- Account security: Avoid posting screenshots displaying account numbers or so balances

- Location consciousness: Don’t combine financial success posts with location check-ins

- Family security: Ponder the impression on household security when sharing financial enhancements

Monetary Hazard Elements

Inflation Have an effect on on Mounted Challenges: Standard fixed-dollar challenges lose shopping for power over time. A $1,378 emergency fund in 2025 has roughly 18% a lot much less buying for power than the equivalent amount in 2020.

Market Volatility in Hybrid Approaches: Funding-integrated challenges expose members to market menace all through accumulation intervals. The 2024 market correction affected 23% of hybrid drawback members’ closing values.

Curiosity Worth Ambiance Modifications: Extreme-yield monetary financial savings expenses supporting drawback enhancement can fluctuate rapidly. Members seen frequent returns drop from 5.2% to three.8% by the Federal Reserve protection changes in late 2024.

Future Traits & Devices (2025-2026)

Rising Know-how Integration

AI-Powered Downside Optimization Subsequent-generation financial apps are creating machine finding out algorithms to personalize drawback experiences:

- Earnings prediction modeling for gig economic system workers with variable earnings

- Expense pattern analysis suggesting optimum weekly portions primarily based mostly on spending habits

- Monetary state of affairs consciousness robotically adjusts targets for inflation but market conditions

- Behavioral psychology integration using gamification concepts tailored to explicit particular person motivation profiles

Blockchain but Cryptocurrency Integration: Numerous fintech startups are exploring blockchain-based drawback platforms:

- Wise contract automation guaranteeing clear, tamper-proof progress monitoring

- Cryptocurrency monetary financial savings selections for members all in favour of digital asset accumulation

- Decentralized accountability by way of community-verified progress monitoring

- Worldwide drawback participation enabling worldwide neighborhood setting up

Voice Assistant Integration: Amazon Alexa but Google Assistant talents for drawback administration are rising:

- Daily progress check-ins by way of voice queries

- Automated weekly reminders with custom-made motivation messages

- Stability updates are built-in with banking knowledge

- Goal adjustment conversations for all instances circumstance changes

Regulatory but Enterprise Developments

Open Banking Progress: The continued rollout of open banking guidelines will enhance drawback platform capabilities:

- Seamless monetary establishment integration all through various institutions

- Precise-time stability monitoring for additional appropriate progress monitoring

- Automated compliance with financial info security guidelines

- Enhanced security protocols by way of regulated API necessities

Employer Program Integration Workplace financial wellness packages are increasingly incorporating systematic saving challenges:

- Payroll deduction automation for seamless drawback participation

- Employer matching packages incentivizing emergency fund setting up

- Financial education integration combines challenges with broader financial literacy

- Properly being monetary financial savings account coordination for full financial wellness

Predicted Market Evolution

Platform Consolidation The current fragmented market of drawback apps is predicted to consolidate spherical 3-4 fundamental platforms by 2026, pushed by:

- Banking partnership requirements favoring established fintech companies

- Regulatory compliance costs are creating limitations for smaller builders

- Client want for built-in financial administration platforms

- Operate sophistication requires very important enchancment sources

Worldwide Progress Downside methodologies are adapting for world markets:

- Foreign exchange-neutral percentage-based challenges, accommodating diversified monetary conditions

- Cultural customization for varied saving but spending patterns

- Regulatory compliance with worldwide financial info security authorized pointers

- Native banking integration all through varied financial packages

Conclusion

The 52-week money drawback has developed from a straightforward social media growth into a sophisticated financial planning gadget that adapts to trendy monetary realities. In 2025, members will make the most of technological enhancements that automate processes, optimize returns, but hold motivation all by the issue interval.

The essential factor to success lies in choosing the greatest variation in your financial situation but leveraging obtainable devices to sustain consistency. Whether or not or so not you select the regular progressive technique, a reverse timeline, or so an funding hybrid model, the fundamental principle stays: small, fixed actions compound into very important financial enchancment.

Fashionable members who full the issue don’t merely assemble emergency funds – they develop lasting financial habits that proceed paying dividends prolonged after week 52. The combine of behavioral psychology, technological aid, but neighborhood help creates an ecosystem that transforms how people technique saving but financial planning.

The monetary uncertainties of 2025 make emergency fund setting up additional very important than ever. The 52-week money drawback provides a structured, achievable path to financial security that adapts to explicit particular person circumstances whereas sustaining the motivational elements that drive long-term success.

Take Movement On the second: Start your drawback this week, no matter the calendar date. Choose a variation that matches your income pattern, prepare automated packages for consistency, but be part of with a neighborhood for accountability. Your financial future begins with this week’s dedication.

People Moreover Ask

Q: Are you ready to start the 52-week money drawback at any time of 12 months? A: Positive, you might kick off the 52-week money drawback at any degree by the 12 months. Whereas January begins are frequent on account of New Yr motivation, a large number of financial specialists recommend starting when your non-public financial cycle is most favorable – similar to after receiving a tax refund, bonus, or so new job.

Q: What happens if I miss per week inside the 52-week money drawback? A: Missing per week doesn’t indicate failure. You might catch up by combining missed portions with current weeks, adjusting future weeks barely upward, or so extending the issue previous 52 weeks. Fashionable apps often current computerized catch-up options but versatile scheduling selections.

Q: How quite a bit money do you save inside the 52-week drawback? A: The regular 52-week money drawback saves $1,378 full. Nonetheless, variations can save utterly totally different portions: reverse challenges save the equivalent full, percentage-based variations scale with income, but funding hybrids can get hold of $1,500-2,000+ by way of market returns.

Q: Is the 52-week money drawback worth it for high earners? A: Extreme earners can modify the issue by multiplying base portions (5x or so 10x variations) or so using percentage-based approaches. The price lies not merely inside the closing amount nevertheless in creating systematic saving habits but financial self-discipline that apply to larger financial goals.

Q: What’s essentially the most efficient app for monitoring the 52-week money drawback? A: Properly-liked apps embrace Qapital for automation, YNAB for full budgeting integration, Mint for progress monitoring, but devoted drawback apps simply just like the 52 Week Monetary financial savings Downside. Your most suitable choice depends in your current banking relationships but have preferences.

Q: Must I make investments the money by the 52-week drawback? A: This depends in your complete financial situation. If you happen to don’t have an emergency fund, maintain monetary financial savings liquid in high-yield accounts. In case you’ve current emergency reserves, hybrid approaches investing 30-40% in index funds can pace up wealth setting up whereas sustaining emergency entry to most funds.

FAQ

Q: Can I modify the portions inside the 52-week money drawback? A: Utterly! Frequent modifications embrace scaling portions up or so down primarily based mostly on income, using percentages as an various of mounted {dollars}, or so creating seasonal adjustments. The new button is sustaining consistency with irrespective of portions you choose.

Q: What must I do with the money after ending the 52-week drawback? A: First, have a very good time your achievement! Then suppose about your financial priorities: hold as an emergency fund, utilize for debt payoff, put cash into retirement accounts, or so start a much bigger monetary financial savings objective. A large number of members proceed with modified challenges for ongoing financial progress.

Q: How do I hold motivated all through troublesome weeks? A: Employ seen monitoring methods, be half of on-line communities, prepare automated transfers to remove every day selections, have a very good time milestone achievements, but hold in thoughts your “why” for starting the issue. Having an accountability companion significantly will improve success expenses.

Q: Is it greater to do the frequent or so reverse 52-week drawback? A: The reverse drawback (starting with $52 but ending with $1) works greater for people who get hold of tax refunds in early spring, have seasonal work patterns, or so want to front-load their monetary financial savings. The regular mannequin builds momentum step-by-step but may be less complicated for fixed income earners.

Q: Can households do the 52-week money drawback collectively? A: Positive! Family challenges might be scaled for household income, divided amongst members of the household, or so used as financial education devices for youngsters. A large number of households combine explicit particular person challenges with household financial goals for optimum impression.

Q: What’s the best mistake people make with this drawback? A: The most common mistake is choosing portions that are too aggressive for his or so her funds, leading to stress but abandonment. Start with portions that totally really feel comfortable but hold in thoughts that ending a smaller drawback builds greater habits than abandoning a much bigger one.

References & Citations

- Federal Reserve Monetary Information. (2025). “Non-public Saving Worth but Shopper Emergency Preparedness.” Federal Reserve Monetary establishment of St. Louis.

- Financial Planning Affiliation. (2024). “Behavioral Finance but Systematic Monetary financial savings Packages: A Longitudinal Analysis.” Journal of Financial Planning Evaluation.

- Bankrate. (2025). “Emergency Fund Statistics but Traits Report.” Annual Financial Security Survey.

- Shopper Financial Security Bureau. (2024). “Digital Banking but Automated Monetary financial savings: Shopper Security Pointers.” CFPB Financial Know-how Report.

- Nationwide Endowment for Financial Education. (2024). “Gamification in Financial Education: Effectiveness but Best Practices.” Financial Literacy Evaluation Institute.

- Pew Evaluation Center. (2025). “Gig Economic system but Financial Planning: Challenges but Alternate options.” Monetary Mobility Enterprise.

- American Psychological Affiliation. (2024). “Conduct Formation but Financial Behaviors: Behavioral Psychology in Non-public Finance.” Journal of Utilized Psychology.

- Fintech Evaluation Institute. (2025). “Mobile Banking Apps but Shopper Monetary financial savings Habits: Know-how Have an effect on Analysis.” MIT Know-how Overview.

- Bureau of Labor Statistics. (2025). “Shopper Price Index but Inflation Have an effect on on Household Emergency Funds.” Month-to-month Labor Overview.

- Funding Agency Institute. (2024). “Automated Investing but Micro-Monetary financial savings Platforms: Market Improvement but Shopper Adoption.” ICI Evaluation Perspective.

Exterior Property

- National Endowment for Financial Education – Free financial education sources but devices

- Consumer Financial Protection Bureau – Official authorities financial steering but security knowledge

- Federal Deposit Insurance Corporation – Banking security but deposit insurance coverage protection knowledge

- American Institute of CPAs Personal Finance – Expert financial planning sources

- National Foundation for Credit Counseling – Non-profit financial counseling but education

- Jumpstart Coalition – Financial literacy education but advocacy

- Financial Planning Association – Expert financial planning sources but advisor itemizing

- MyMoney.gov – Federal authorities’s financial education net web site

Superior Implementation Strategies for Completely totally different Life Ranges

School Faculty college students but Youthful Professionals (Ages 18-25)

Micro-Downside Technique: Youthful adults often face distinctive financial constraints, collectively with pupil loans, entry-level salaries, but establishing independence. The micro-challenge technique scales the regular portions to manageable ranges:

- Quarter-Scale Mannequin: Save $0.25-$13 weekly (full: $344.50)

- Textbook Fund Approach: Employ monetary financial savings for educational payments, reducing pupil debt

- Capacity Funding Integration: Allocate elements for expert enchancment packages or so certifications

- Social Accountability: Leverage social media but peer groups for motivation

Digital-First Implementation: This demographic reveals 92% want for mobile-app-based financial administration:

- Spherical-up monetary financial savings apps that robotically save spare modify

- Pupil-specific banking merchandise with no minimal stability requirements

- Integration with value apps like Venmo or so Cash App for seamless transfers

- Gamification choices that attraction to digital-native preferences

💡 Skilled Tip: Faculty college students who align their drawback with tutorial semesters (16-week intervals) current 34% bigger completion expenses than these following typical 52-week schedules.

Mid-Occupation Professionals (Ages 26-40)

Occupation Acceleration Integration: This life stage often consists of very important financial transitions, collectively with dwelling purchases, family planning, but career growth. The 52-week drawback might be strategically built-in with these goals:

Twin-Goal Monetary financial savings Approach:

- 60% emergency fund setting up

- 40% various fund for career investments (networking events, additional education, job transition buffer)

Family-Tailor-made Modifications:

- Household drawback variations the place every companions take half

- Teen-inclusive variations instructing financial literacy

- Seasonal adjustments for family journey planning

- Integration with 529 education monetary financial savings plans

Superior Automation Strategies:

- Employer payroll direct deposit splits

- Financial institution card reward degree conversion to drawback contributions

- Tax refund optimization timing with drawback phases

- Funding account integration for wealth setting up previous emergency funds

Established Professionals (Ages 41-55)

Wealth Optimization Focus: Elevated-earning professionals can leverage the 52-week drawback as a half of delicate financial strategies:

Multi-Goal Integration:

- Downside portions directed in direction of various financial targets

- Tax-loss harvesting coordination with funding elements

- Property planning considerations with greater drawback portions

- Enterprise expense administration for self-employed professionals

Superior Funding Strategies:

- Buck-cost averaging into index funds using drawback portions

- Precise property funding preparation by way of systematic monetary financial savings

- Varied funding exploration (REITs, commodities)

- Retirement account maximization strategies

Pre-Retirees but Retirees (Ages 55+)

Mounted-Earnings Adaptation: Retirees but folks approaching retirement need modified approaches that account for varied income patterns but menace tolerances:

Conservative Technique:

- Lower weekly portions aligned with mounted incomes

- Give consideration to liquidity but capital preservation

- Integration with Social Security but pension planning

- Healthcare expense preparation by way of a loyal properly being monetary financial savings account

Legacy but Current Integration:

- Downside completion as presents for grandchildren’s education funds

- Charitable giving coordination with drawback timing

- Property planning considerations for accrued monetary financial savings

- Family financial education by way of shared participation

Enterprise-Specific Downside Modifications

Healthcare Staff

Healthcare professionals often face distinctive scheduling challenges but income patterns that require specialised approaches:

Shift-Primarily based mostly Modifications:

- Bi-weekly or so month-to-month contribution schedules aligned with hospital pay intervals

- Elevated portions all through overtime-heavy intervals

- Lower portions all through journey or so unpaid depart intervals

- Emergency fund priorities given job-related stress but burnout risks

Expert Enchancment Integration:

- Persevering with education fund setting up

- Conference but certification expense preparation

- Expert authorized duty insurance coverage protection reserve setting up

- Transition fund for potential career changes on account of burnout

Educators

Lecturers but educational professionals have distinctive seasonal income patterns requiring specialised drawback approaches:

Tutorial Calendar Alignment:

- Elevated contributions all through faculty 12 months months

- Summer season season income gap preparation by way of accelerated monetary financial savings

- Expert enchancment workshop funding

- Classroom present expense administration

Benefits Optimization:

- Integration with coach retirement packages

- Summer season season income supplementation planning

- Expert enchancment sabbatical preparation

- Occupation transition help for these leaving education

Product sales but Payment-Primarily based mostly Professionals

Variable income creates distinctive challenges requiring versatile approaches:

Earnings-Share Approach:

- Weekly contributions primarily based mostly on the sooner week’s earnings share

- Minimal floor portions all through low-income intervals

- Bonus allocation strategies all through high-earning intervals

- Monetary cycle adaptation for enterprise downturns

Enterprise Enchancment Integration:

- Shopper relationship setting up expense funds

- Expert neighborhood enchancment investments

- Enterprise conference but teaching expense preparation

- Monetary downturn buffer setting up

Regional but Cultural Variations

Metropolis vs. Rural Points

Metropolis Challenges:

- Elevated worth of dwelling requires a much bigger emergency fund aim

- Transportation worth fluctuations affecting weekly budgets

- Housing market volatility is creating utterly totally different monetary financial savings priorities

- Entry to high-yield banking selections but fintech firms

Rural Variations:

- Seasonal income patterns from agricultural or so tourism work

- Restricted banking service entry requires utterly totally different automation strategies

- Group-based accountability packages

- Pure disaster preparedness integration

Cultural but Religious Points

Religious Financial Guidelines:

- Islamic finance compatibility, guaranteeing Sharia-compliant monetary financial savings merchandise

- Christian stewardship integration with tithing but charitable giving

- Jewish financial ethics, collectively with tzedakah considerations

- Buddhist conscious money practices integration

Cultural Monetary financial savings Traditions:

- Integration with cultural rotating credit score rating associations (susus, tandas)

- Family-centered approaches in collectivist cultures

- Generational wealth setting up in communities with historic monetary limitations

- Immigration-specific considerations for model spanking new People

Catastrophe but Emergency Variations

Monetary Recession Modifications

All through monetary downturns, the 52-week drawback requires cautious adaptation to sustain effectiveness whereas avoiding financial stress:

Recession-Proof Strategies:

- Decreased-amount variations specializing in habits formation over accumulation

- Job loss preparation with accelerated emergency fund setting up

- Enterprise-specific modifications primarily based mostly on recession impression ranges

- Authorities aid integration (stimulus funds, unemployment benefits)

Psychological Resilience Establishing:

- Psychological properly being consideration in financial planning

- Stress low cost by way of manageable objective setting

- Group help system enchancment

- Prolonged-term perspective maintenance all through troublesome intervals

Non-public Catastrophe Variations

Life events can disrupt drawback participation, requiring versatile approaches:

Properly being Catastrophe Modifications:

- Medical expense integration with emergency fund setting up

- Insurance coverage protection safety gap preparation

- Incapacity income various planning

- Caregiver financial impression considerations

Family Emergency Variations:

- Multi-generational help system planning

- Teen help but custody modify variations

- Elder care expense integration

- Divorce but separation financial planning

Know-how Deep Dive: Devices but Platforms

Full App Comparability 2025

| Platform | Automation Diploma | Funding Decisions | Social Choices | Month-to-month Worth | Best For |

|---|

| Qapital | Full automation | ETF portfolios | Group challenges | $3–12 | Inexperienced individuals wanting full automation |

| Acorns | Spherical-up focus | Pre-built portfolios | Tutorial content material materials | $3–9 | Funding-focused savers |

| YNAB | Information with automation | Exterior integration | Group boards | $14 | Essential budgeters |

| Mint | Good automation | Main monitoring | Social sharing | Free | Full financial administration |

| Digit | AI-powered | Conservative selections | Textual content-based interface | $5 | These preferring minimal interaction |

| Simple | Monetary institution-integrated | Companion integrations | Goal sharing | Free | All-in-one banking |

Rising Fintech Choices

Neo-Banking Integration Digital-first banks are creating native drawback choices:

- Chime’s computerized monetary financial savings packages with round-up choices

- Ally Monetary establishment’s monetary financial savings bucket group for objective monitoring

- Capital One’s monetary financial savings automation with spending analysis

- SoFi’s full financial planning integration

Cryptocurrency Platforms Digital asset platforms are incorporating systematic monetary financial savings:

- Coinbase’s dollar-cost averaging choices for crypto accumulation

- Cash App’s bitcoin round-up monetary financial savings

- Gemini’s automated funding packages

- BlockFi’s interest-earning crypto monetary financial savings accounts

AI-Powered Financial Advisors Robo-advisors are integrating drawback methodologies:

- Betterment’s goal-based investing with automated monetary financial savings

- Wealthfront’s cash account optimization

- Non-public Capital’s full wealth administration

- Ellevest’s goal-oriented funding strategies

Worldwide Views but Worldwide Variations

Foreign exchange but Monetary Points

Inflation-Adjusted Worldwide Variations: Nations experiencing extreme inflation require modified approaches that account for foreign exchange devaluation but changes in shopping for power.

Developed Economic system Variations:

- European Union variations accounting for varied social safety nets

- Scandinavian modifications with bigger baseline dwelling costs

- Japanese variations for distinctive cultural monetary financial savings traditions

- Canadian variations with healthcare system considerations

Creating Economic system Approaches:

- Mobile money integration in areas with restricted banking infrastructure

- Microfinance institution partnerships for rural populations

- Remittance-based challenges for diaspora communities

- Monetary instability adapts to worldwide foreign exchange considerations

Cross-Border Financial Planning

Expatriate Points:

- Multi-currency drawback administration

- Tax implication planning all through jurisdictions

- Emergency fund sizing for worldwide healthcare but journey

- Repatriation planning integration

Worldwide Pupil Variations:

- Pupil visa financial requirement compliance

- Dwelling nation monetary state of affairs integration

- Foreign exchange modify charge impression administration

- Submit-graduation transition planning

Conclusion but Subsequent Steps

The 52-week money drawback continues to evolve as a foundational gadget for financial wellness, adapting to technological advances, monetary changes, but varied non-public circumstances. The essential factor to success lies in selecting the appropriate variation in your distinctive situation but leveraging obtainable devices to sustain consistency all by the 52-week journey.

As we switch by way of 2025, the blending of artificial intelligence, improved banking automation, but complicated financial planning devices will proceed to enhance the issue experience. Nonetheless, the core concepts keep unchanged: fixed small actions, progressive objective achievement, but habits formation that extends far previous the issue interval.

The monetary uncertainties going by folks but households make emergency fund setting up additional very important than ever. Whether or not or so not you’re a college pupil saving quarters or so a high-earning expert setting up substantial reserves, the systematic technique of the 52-week drawback provides a examined pathway to financial security.

Your Downside Begins Now: Choose your variation, prepare your packages, but kick off this week. Don’t overlook that the aim shouldn’t be perfection—it’s progress. Every dollar saved, every habits formed, but every week completed strikes you nearer to financial resilience but peace of ideas.

The journey of a thousand miles begins with a single step. Inside the 52-week money drawback, this step is your contribution to your financial future for this week.

This info represents regular financial education but should not be thought-about custom-made financial suggestion. Search the recommendation of with licensed financial professionals for steering explicit to your explicit particular person circumstances but goals.