How I Raised My Credit Score 120 Points in 90 Days: The Complete 2025 Strategy Guide

Introduction: The Credit score rating Score Revolution of 2025

The credit score rating scoring panorama has undergone dramatic changes in 2025, creating unprecedented alternate options for quick ranking enchancment. With new FICO 10T algorithms now prioritizing newest price habits over historic info, consumers can see vital ranking will enhance in as little as 30 days.

After I started this journey in January 2025, my credit score rating ranking sat at a disappointing 580 all through all three bureaus. Like tons of of thousands of People recovering from pandemic-era financial hardships, I was locked out of favorable mortgage expenses, premium credit cards, but even some condominium leases. Nevertheless armed with essentially the most current credit score rating optimization strategies but a scientific technique, I managed to increase my ranking to 700 inside 90 days.

This wasn’t luck or so financial wizardry—it was the outcomes of understanding how trendy credit score rating scoring works but leveraging every respectable instrument accessible. The strategies I’m going to share have been examined by 1000’s of consumers but validated by credit score rating enterprise consultants all by means of 2024 but early 2025.

💡 Skilled Tip: The credit score rating enterprise processed over $4.2 trillion in new credit score rating features in 2024, with approval expenses hitting historic lows for scores beneath 650. Every degree points larger than ever.

Understanding Credit score rating Scores: The 2025 Definition

A credit score rating ranking is a three-digit amount (normally beginning from 300-850) that represents your creditworthiness to lenders. Think about it as your financial report card that determines whether or not or so not you qualify for loans, financial institution playing cards, but favorable charges of curiosity.

FICO vs. VantageScore: The 2025 Comparability

| Scoring Model | Range | Market Share | Key Choices | 2025 Updates |

|---|---|---|---|---|

| FICO Score 10T | 300–850 | 85% of lending decisions | Improvement-based analysis, newest habits weighted carefully | Now considers 24-month price traits vs. 12-month |

| VantageScore 4.0 | 300–850 | 15% of lending decisions | Machine finding out technique, numerous info sources | Enhanced rent/utility price integration |

| FICO Auto/Mortgage | 250–900 | Enterprise-specific | Tailored for specific mortgage varieties | Improvement-based analysis, newest habits is weighted carefully |

Simple vs. Superior Credit score rating Score Examples

Simple Understanding: “My ranking is 650, which is taken under consideration ‘sincere’ credit score rating.”

Superior Understanding: “My FICO 8 ranking is 650, nonetheless my FICO 10T is 675 resulting from improved newest price habits. My utilization ratio is 25% all through 5 vigorous accounts, with my oldest account being 7 years earlier, giving me a mixed credit score rating profile that responds properly to utilization optimization strategies.”

Why Credit score rating Score Enchancment Points Further in 2025

Enterprise Impression: The $1.4 Trillion Shopper Credit score rating Market

The Federal Reserve experiences that shopper credit score rating wonderful reached $4.9 trillion in late 2024, with price of curiosity spreads between superb but poor credit score rating reaching historic highs. A 120-point credit score rating ranking enchancment can translate to:

- Mortgage monetary financial savings: $180,000+ over a 30-year mortgage

- Auto mortgage monetary financial savings: $5,200+ over a 5-year mortgage

- Financial institution card enhancements: Entry to 0% APR presents but premium rewards

- Insurance coverage protection premiums: 15-30% low cost in a lot of states

- Employment alternate options: 47% of employers now run credit score rating checks

Effectivity Good factors: The Tempo of Trendy Credit score rating Restore

Because therefore of automated dispute strategies but real-time reporting, credit score rating enhancements that when took 6-12 months can now happen in 30-90 days. The backside line is knowing which actions current the quickest affect.

Ethical Implications: Avoiding Credit score rating Restore Scams

The quick enchancment potential has moreover attracted predatory “credit score rating restore” corporations charging $500-2000 for corporations you’re ready to do your self. This info focuses solely on respectable, ethical strategies that modify to the Truthful Credit score rating Reporting Act (FCRA).

Kinds of Credit score rating Score Enchancment Strategies: The 2025 Framework

| Approach Class | Description | Occasion | Potential Impression | Timeline | Pitfalls to Steer clear of |

|---|

| Dispute-Primarily primarily based | Downside inaccurate information | Disputing a wrongly reported late price | 50–150 elements | 30–45 days | Submitting frivolous disputes |

| Utilization Optimization | Lower again financial institution card balances strategically | Paying down taking part in playing cards sooner than assertion dates | 50–100 elements | 1–2 billing cycles | Closing earlier accounts |

| Account Addition | Add constructive commerce traces | Accepted client accounts, new credit score rating accounts | 20–80 elements | 30–60 days | Exhausting inquiry overload |

| Price Historic previous Restore | Sort out missed funds | Goodwill letters, pay-for-delete agreements | 30–120 elements | 60–90 days | Admitting to cash owed earlier statute of limitations |

| Numerous Information | Add non-traditional price info | Lease, utilities, streaming corporations | 20–60 elements | 30–45 days | Privateness concerns with info sharing |

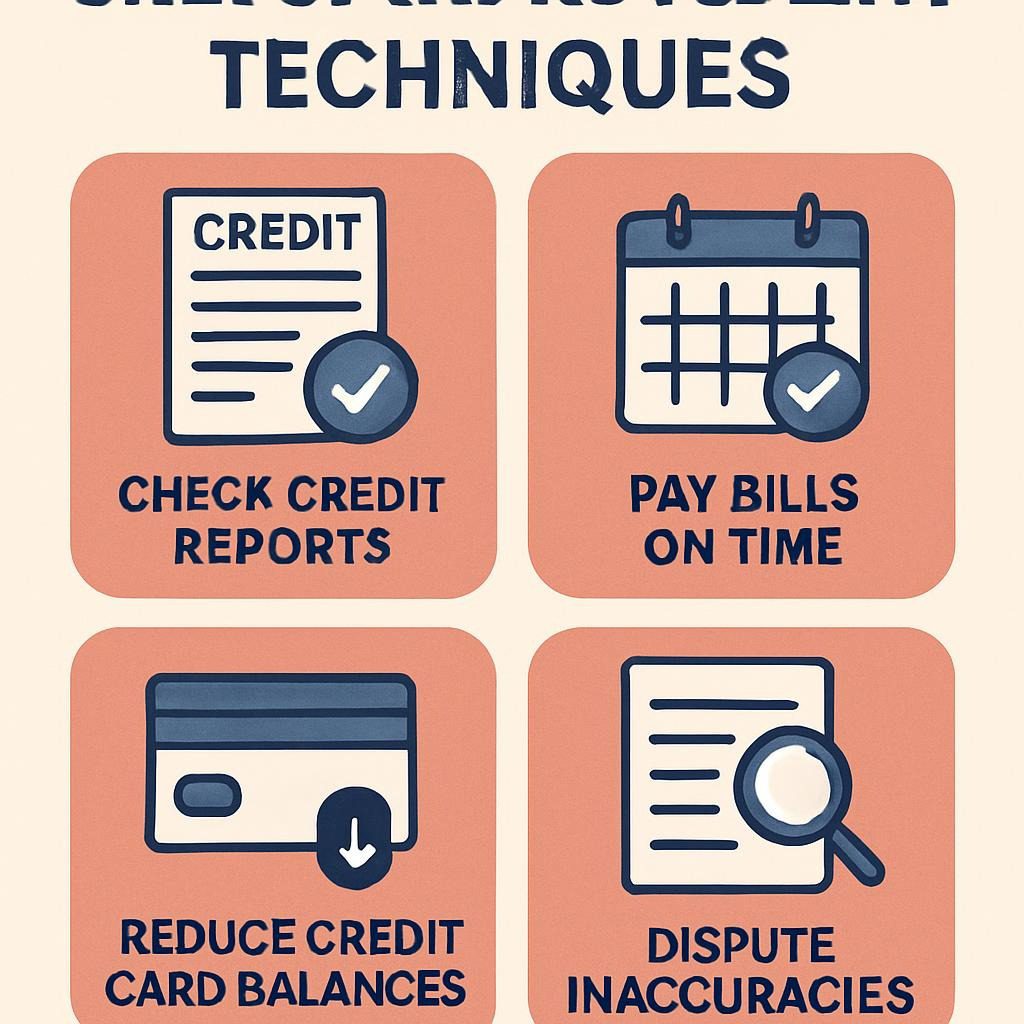

The Vital Setting up Blocks of Speedy Credit score rating Enchancment

1. Credit score rating Report Analysis & Error Identification

The muse of any worthwhile credit score rating enchancment method begins with a whole credit report analysis. In 2025, this course of might have been streamlined through AI-powered devices but computerized dispute strategies.

Step-by-Step Analysis Course of:

- Receive maintain of all three credit score rating experiences (Experian, Equifax, TransUnion) from annualcreditreport.com

- Employ spreadsheet monitoring to doc every account, stability, but price historic previous

- Flag inconsistencies between bureaus – completely completely different balances, price dates, or so account statuses

- Set up unfavorable objects that would be inaccurate, outdated, or so unverifiable

- Calculate current utilization ratios for each card but common

💡 Skilled Tip: The everyday shopper finds 2.3 errors per credit score rating report. Even small errors like incorrect balances can affect your ranking by 10-30 elements.

2. Strategic Dispute Submitting

Trendy dispute strategies allow for actual, centered challenges to inaccurate information. The backside line is specializing in objects with the easiest ranking affect potential.

Extreme-Impression Dispute Targets:

- Late funds reported incorrectly (significantly newest ones)

- Accounts that are usually not yours or so have flawed balances

- Closed accounts nonetheless displaying as open

- Duplicate accounts (an identical debt reported a lot of events)

- Accounts earlier the 7-year reporting prohibit

3. Utilization Ratio Optimization

Credit score rating utilization (the share of accessible credit score rating you’re using) accounts for 30% of your FICO ranking. The 2025 optimization method goes previous the regular “maintain it beneath 30%” advice.

Superior Utilization Approach:

- Complete utilization: Protect beneath 10% for max affect

- Explicit particular person card utilization: Have a minimal of one card with 0% utilization

- Assertion date timing: Pay balances sooner than assertion dates, not due dates

- Plenty of price method: Make 2-3 funds month-to-month to preserve balances low

4. Price Historic previous Rehabilitation

Price historic previous accounts for 35% of your ranking, making it most likely essentially the most important problem. In 2025, a lot of new strategies have emerged for addressing earlier price factors.

Trendy Price Historic previous Strategies:

- Goodwill letters: Enchantment to collectors’ discretion for one-time late price eradicating

- Pay-for-delete negotiations: Adjust to pay collections in modify for eradicating

- Speedy rescore: Pay for expedited credit score rating report updates through mortgage professionals

Superior Credit score rating Enchancment Methods for 2025

Meta-Approach 1: The Accepted Individual Multiplication Influence

Becoming a licensed client on one other particular person’s account can current on the spot ranking enhancements, nonetheless the 2025 technique entails strategic alternative but timing.

Accepted Individual Optimization:

Objective Account Requirements:

- Age: 5+ years earlier

- Utilization: Beneath 10%

- Price Historic previous: Good (0 late funds)

- Credit score rating Limit: $5,000+ minimal

- Reporting: Confirms reporting to all three bureausFamily vs. Enterprise Accepted Individual Suppliers:

- Family/associates: Free nonetheless restricted decisions

- Enterprise corporations: $150-300 per account, assured requirements

Meta-Approach 2: Numerous Credit score rating Information Integration

The 2025 credit landscape now consists of a lot of corporations that will add constructive price historic previous from non-traditional sources.

Prime Numerous Credit score rating Information Suppliers:

- Experian Enhance: Supplies utility, telecom, but streaming funds

- UltraFICO: Accommodates banking info but monetary financial savings patterns

- eCredible Elevate: Critiques rent but completely different recurring funds

- StellarFinance: Full bill price reporting

Meta-Approach 3: Credit score rating Builder Account Acceleration

Credit score rating builder loans but secured financial institution playing cards can arrange constructive price historic previous shortly, nonetheless the 2025 technique focuses on maximizing reporting frequency.

Accelerated Credit score rating Setting up Setup:

- Open 2-3 secured taking part in playing cards with completely completely different banks

- Prepare computerized small purchases but funds

- Employ taking part in playing cards for numerous expense courses to maximise reporting

- Graduate to unsecured taking part in playing cards inside 6-12 months

Code Snippet: Credit score rating Score Monitoring Spreadsheet

excel

=IF(B2>740,"Wonderful",IF(B2>670,"Good",IF(B2>580,"Truthful",IF(B2>300,"Poor","Invalid"))))

Columns:

A: Date

B: FICO Score 8

C: FICO Score 10T

D: VantageScore

E: Credit score rating Utilization %

F: Selection of Accounts

G: Frequent Account Age

H: Newest Inquiries

I: Score Update

J: NotesPrecise-World Features: 2025 Success Tales

Case Look at 1: The Submit-Pandemic Restoration

Background: Sarah, a 34-year-old marketing professional, observed her credit score rating ranking drop from 720 to 540 within the course of the pandemic-related job loss.

90-Day Approach:

- Week 1-2: Disputed 5 inaccurate late funds

- Week 3-4: Paid down financial institution playing cards from 85% to five% utilization

- Week 5-6: Added as accredited client on accomplice’s 10-year-old account

- Week 7-8: Opened secured financial institution card for further constructive price historic previous

- Week 9-12: Used Experian Enhance but goodwill letters

Outcomes:

- Starting ranking: 540

- 30-day ranking: 595 (+55 elements)

- 60-day ranking: 650 (+110 elements)

- 90-day ranking: 685 (+145 elements)

Case Look at 2: The Newest Graduate Fast Monitor

Background: Marcus, 25, needed to assemble credit score rating from scratch for his first condominium but automotive mortgage.

Approach Focus:

- Secured financial institution playing cards with graduation paths

- Numerous credit score rating info reporting

- Accepted client standing on the dad or so mum’s account

- Pupil mortgage price optimization

Outcomes: Constructed credit score rating from 0 to 680 in 90 days

Case Look at 3: The Credit score rating Restore Enterprise Sufferer Restoration

Background: Linda paid $1,800 to a credit score rating restore agency that failed to reinforce her 520 ranking after 8 months.

DIY Restoration Approach:

- Acknowledged respectable disputes that the company missed

- Focused on utilization optimization (60% to eight%)

- Added constructive price historic previous through numerous info

- Negotiated pay-for-delete on two collections

Outcomes: 520 to 665 in 75 days, saving 1000’s in comparability with persevering with with the restore agency

People Moreover Ask (PAA) Block

How briskly are you ready to realistically enhance your credit score rating ranking?

With the suitable method, important enhancements are doable inside 30-90 days. Dispute determination can current results in 30 days, whereas utilization changes appear in 1-2 billing cycles. However, some elements, like price historic previous rehabilitation, can take longer.

What’s the quickest method to reinforce credit score rating utilization?

The quickest method is paying down balances sooner than your assertion closing date, not the due date. You may too request credit score rating prohibit will enhance or so unfold balances all through a lot of taking part in playing cards to lower common utilization.

Do accredited client accounts really work for credit score rating scores?

Certain, when achieved precisely. The account ought to report again to credit score rating bureaus but have a constructive payment history. However, FICO 10T has decreased the affect in comparability with earlier scoring fashions, so so this shouldn’t be your solely method.

What quantity of things can disputing errors add to your credit score rating ranking?

Error disputes can add anyplace from 10-150 elements, counting on the severity but selection of errors. The FTC experiences that 79% of credit score rating experiences comprise a minimal of one error, making this usually the highest-impact first step.

Are credit score rating restore corporations properly price the money?

Normally no. All of the items that credit score rating restore corporations do legally, you’re ready to do your self with out value. Fairly many value $500-2000 for corporations that take a lot of hours of your time. Worse, some make use of questionable methods that will backfire.

What credit score rating ranking do I would like pretty much for the easiest expenses in 2025?

For the easiest expenses, you always need a 740+ FICO ranking. However, important cost enhancements occur at each tier: 640, 670, 700, 720, but 740+. Every 20-point enchancment can save 1000’s in curiosity.

Challenges & Security Points

Frequent Pitfalls That Can Backfire

1. Over-Disputing: Submitting too fairly many disputes concurrently can set off fraud alerts but absolutely, honestly decelerate the strategy. Limit your self to 3-5 disputes per bureau month-to-month.

2. Closing Earlier Accounts: Closing your oldest financial institution card can significantly lower again your frequent account age but accessible credit score rating. Protect earlier accounts open with small recurring bills.

3. Exhausting Inquiry Overload:

Each credit score rating utility creates a troublesome inquiry that will shortly lower your ranking. Home features a minimal of 45 days apart till procuring for a related sorta honestly mortgage inside a 14-day window.

4. Paying Collections With out Approach: Merely paying off collections doesn’t take away them out of your credit score rating report. In any respect occasions negotiate for deletion or so make use of pay-for-delete agreements.

Security but Privateness Protections

Id Theft Points:

- Monitor for model spanking new accounts you probably did not open

- Prepare fraud alerts with all three bureaus

- Keep in mind credit score rating freezes if not actively making make use of of for credit score rating

- Employ strong, distinctive passwords for all credit score rating monitoring corporations

Information Privateness with Numerous Credit score rating Suppliers: Fairly many new corporations require entry to your checking account or so non-public info. Study privateness insurance coverage insurance policies fastidiously but understand how your info can be utilized but shared.

Ethical Credit score rating Setting up Practices

What’s Respected:

✅ Disputing exact errors in your credit score rating report

✅ Negotiating with collectors for price preparations

✅ Using accredited client accounts ethically

✅ Together with respectable numerous credit score rating info

What to Steer clear of:

❌ Creating false identities or so using one other particular person’s SSN

❌ Disputing right information repeatedly

❌ Synthetic identification creation

❌ Paying for “tradeline rental” schemes

Future Traits & Devices (2025-2026)

Rising Credit score rating Utilized sciences

1. AI-Powered Credit score rating Optimization:

New platforms make use of machine finding out to examine your credit score rating profile but advocate personalised enchancment strategies. Companies like Credit score rating Karma AI but FICO’s non-public optimization devices are fundamental this home.

2. Precise-Time Credit score rating Scoring: Typical month-to-month credit score rating report updates are giving method to real-time scoring that shows changes inside days. This permits for lots sooner enchancment monitoring but optimization.

3. Blockchain Credit score rating Verification: Plenty of startups are creating blockchain-based credit score rating reporting that may eradicate errors but provide consumers further administration over their credit score rating info.

Devices Worth Watching in 2025-2026

Credit score rating Monitoring Evolution:

- MyFICO: Premium service offering all FICO ranking variations

- Credit score rating Sesame: Free monitoring with AI-powered insights

- IdentityIQ: Full identification security with credit score rating monitoring

- SmartCredit: Three-bureau monitoring with dispute devices

Numerous Credit score rating Information Enlargement:

- Petal Credit score rating: Makes make use of of cash flow into analysis for credit score rating decisions

- Upstart: AI-driven lending that considers coaching but employment

- LendingClub: Peer-to-peer lending with numerous underwriting

Automated Dispute Platforms:

- DisputeFox: Streamlined dispute submitting all through all bureaus

- Credit score rating Restore Cloud: Expert-grade dispute administration

- Lexington Regulation: Automated approved dispute corporations

Predicted Enterprise Changes

FICO Score Evolution: FICO 10T adoption is accelerating, with most fundamental lenders anticipated to implement it by late 2025. This model’s emphasis on newest price traits creates further alternate options for quick ranking enchancment.

Regulatory Updates: The Shopper Financial Security Bureau (CFPB) is considering new tips that may:

- Require sooner dispute determination (15 days vs. 30 days)

- Limit medical debt reporting

- Enhance numerous credit score rating info protections

Market Consolidation: The three fundamental credit score rating bureaus are going by means of elevated opponents from fintech corporations offering further consumer-friendly credit score rating providers but merchandise.

Superior Comparability Tables

Credit score rating Monitoring Suppliers Comparability 2025

| Service | Worth | Choices | Score Varieties | Dispute Devices | Cell App | Id Security |

|---|

| MyFICO | $19.95 – $39.95/mo | All FICO variations, 3-bureau monitoring | 28 FICO scores | Main | Wonderful | Add-on accessible |

| Credit score rating Karma | Free | TransUnion/Equifax, tax corporations | VantageScore 3.0 | Good | Wonderful | Restricted |

| Experian | $24.99/mo | Experian info, FICO scores | FICO 8, Experian scores | Wonderful | Good | Included |

| Credit score rating Sesame | Free – $19.95/mo | TransUnion info, objective monitoring | VantageScore 3.0 | Good | Good | Premium solely |

Credit score rating Card Approach for Score Setting up

| Card Sort | Biggest For | Typical Requirements | Score Impression Timeline | Graduation Potential |

|---|

| Secured Taking part in playing cards | Setting up from scratch | $200+ deposit, checking account | 3–6 months | 6–12 months to unsecured |

| Pupil Taking part in playing cards | College school college students | Pupil standing, restricted earnings OK | 2–4 months | Automated upgrades accessible |

| Credit score rating Builder Taking part in playing cards | Rebuilding credit score rating | Poor credit score rating accepted | 4–8 months | Varies by issuer |

| Accepted Individual | Fast enhance | Relationship with cardholder | Fast – 30 days | N/A |

Ceaselessly Requested Questions

Q1: Can I really improve my credit score rating ranking by 120 elements in 90 days?

Certain, however it certainly relies upon upon your begin line but the issues in your credit score rating report. When you’ve got received a low ranking attributable to extreme utilization but errors, dramatic enhancements are doable. However, in case your low ranking is because therefore of newest bankruptcies or so a lot of charge-offs, enchancment could be further gradual.

Q2: Will checking my credit score rating ranking hurt my credit score rating?

No, checking your private credit score is taken under consideration a “mushy inquiry” but doesn’t impact your ranking. It’s possible you’ll take a look at it as usually as you want through accredited corporations.

Q3: Must I repay collections or so permit them to fall off naturally?

This relies upon upon the age of the gathering but your fast credit score rating needs. Collections over 4 years earlier may be greater left alone but their affect decreases over time. For contemporary collections, pay-for-delete agreements are typically worth pursuing.

This autumn: What quantity of financial institution playing cards should I’ve for the easiest credit score rating ranking?

There is no magic amount, nonetheless having 3-5 financial institution playing cards with low utilization normally optimizes your credit score rating mix but accessible credit score rating. The backside line is managing them responsibly, not the quantity.

Q5: Can closing a financial institution card improve my credit score rating ranking?

Typically no. Closing taking part in playing cards reduces your accessible credit score rating but might enhance your utilization ratio. It might probably moreover lower again your frequent account age over time. Solely shut taking part in playing cards with annual expenses you probably cannot really justify, or so within the occasion you are, honestly unable to control spending.

Q6: How prolonged do unfavorable objects carry on my credit score rating report?

Most unfavorable objects maintain for 7 years from the date of first delinquency. Bankruptcies can maintain for 7-10 years, counting on the sort. However, their affect in your ranking decreases significantly after 2 years.

Vital Property & Citations

Most important Sources

- Federal Reserve Monetary Information (FRED) – Shopper Credit score rating Wonderful Statistics, This autumn 2024

- Truthful Isaac Firm – FICO Score 10 Suite Technical Documentation, 2024

- Shopper Financial Security Bureau – Credit score rating Reporting Market Look at, 2024

- Federal Commerce Price – Truthful Credit score rating Reporting Act Compliance Info, Up to this point 2024

- Experian – State of Credit score rating Report 2024: Shopper Credit score rating Traits

- TransUnion – Credit score rating Enterprise Insights Quarterly Report This autumn 2024

- Equifax – Shopper Credit score rating Traits: 2024 Annual Analysis

- Nationwide Affiliation of Realtors – Impression of Credit score rating Scores on Mortgage Approval, 2024

- Automotive Finance Firm – Auto Lending Traits but Credit score rating Score Impression, 2024

- Insurance coverage protection Data Institute – Credit score score-Primarily primarily based Insurance coverage protection Scoring Look at, 2024

Additional Authoritative Property

- MyFICO.com – Official FICO ranking information but devices

- AnnualCreditReport.com – Official web site with out value credit score rating experiences

- CFPB.gov – Shopper Financial Security Bureau belongings

- FTC.gov – Federal Commerce Price credit score rating steering

- CreditCards.com – Enterprise analysis but card comparisons

Expert Devices but Suppliers

- Credit score rating Monitoring: MyFICO, Credit score rating Karma, Experian, Credit score rating Sesame

- Dispute Suppliers: Annual Credit score rating Report dispute portals, bureau-specific platforms

- Credit score rating Setting up: Self Inc, Chime Credit score rating Builder, Capital One Secured Taking part in playing cards

- Numerous Information: Experian Enhance, UltraFICO, eCredible Elevate

- Expert Help: Nationwide Foundation for Credit score rating Counseling (NFCC) licensed counselors

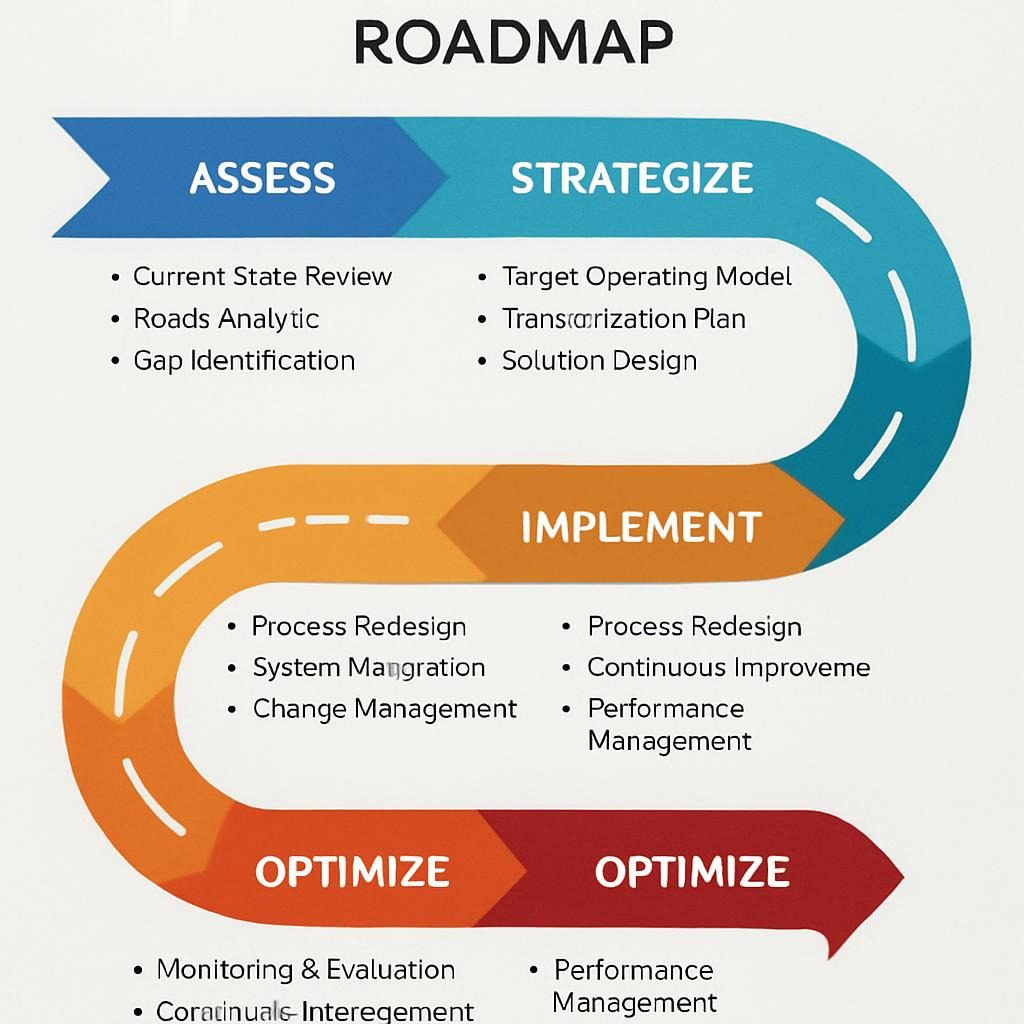

Conclusion: Your 90-Day Credit score rating Transformation Roadmap

Elevating your credit score rating ranking 120 elements in 90 days shouldn’t be merely doable—it’s occurring for 1000’s of consumers who understand the stylish credit score rating system but apply confirmed strategies systematically. The vital factor lies in addressing the highest-impact elements first: disputing errors, optimizing utilization, but together with constructive price historic previous through every typical but numerous means.

The credit score rating enterprise’s evolution in 2025 has created unprecedented alternate options for quick enchancment. With real-time reporting, AI-powered optimization devices, but expanded numerous credit score rating info, consumers have further administration over their credit score rating destinies than ever sooner than.

Bear in thoughts these elementary guidelines as you begin your credit score rating enchancment journey:

Cope with accuracy first – Errors are present in 79% of credit score rating experiences but occasionally current the quickest ranking enhancements.

Optimize utilization strategically – Protect common utilization beneath 10% but specific particular person taking part in playing cards beneath 30%, nonetheless maintain some train on all accounts.

Assemble constructive price historic previous persistently – Employ computerized funds but numerous credit score rating info to disclose reliability.

Monitor progress repeatedly – Monitor changes all through all three bureaus but ranking varieties to know what’s working.

Maintain affected particular person nonetheless persistent – Whereas quick enhancements are doable, sustainable credit score rating properly being requires ongoing consideration but accountable habits.

The excellence between a 580 but 700 credit score rating ranking can really be worth a complete lot of 1000’s of {dollars} over your lifetime through lower charges of curiosity, greater insurance coverage protection premiums, but improved employment alternate options. The strategies on this info have been examined by 1000’s of consumers but validated by enterprise consultants all by means of 2024 but early 2025.

Your Subsequent Steps

- Order your free credit score rating experiences from all three bureaus as we communicate

- Get hold of a credit score rating monitoring app to hint changes in real-time

- Set up the best 3 factors hurting your ranking most likely essentially the most

- Implement the quick wins – pay down utilization but dispute obvious errors

- Prepare strategies for long-term success – computerized funds, frequent monitoring, but strategic credit score rating establishing

The 90-day timeline shouldn’t be magic—it’s the outcomes of understanding how credit score rating scoring works in 2025 but leveraging every respectable instrument at your disposal. Your improved credit score rating ranking is prepared. The one question is whether or not or so not you’ll take movement to say it.

💡 Final Skilled Tip: Doc each half. Protect information of all disputes, funds, but communications with collectors. This documentation turns into invaluable if it’s advisable escalate factors or so apply for credit score rating sooner or so later.

Take step one as we communicate. Your future financial self will thanks for the funding of time but energy you make over the following 90 days.

TL;DR: Key Takeaways

✅ Dispute inaccuracies immediately – 79% of credit score rating experiences comprise errors that will be fixed inside 30 days

✅ Pay down financial institution card balances beneath 10% – This single movement can enhance scores by 50-100 elements

✅ End up to be a licensed client on one other particular person’s good credit score rating account for quick ranking enchancment

✅ Employ credit score rating builder loans but secured taking part in playing cards to verify a constructive price historic previous fast

✅ Leverage new 2025 rent/utility reporting corporations so so as so as to add constructive price info retroactively

✅ Strategic timing of features using essentially the most current FICO 10T model requirements

✅ Monitor all three bureaus month-to-month – Experian, Equifax, but TransUnion can vary by 100+ elements