Perfect Credit in 2025: The Ultimate Guide

Good Credit score rating in 2025

Up thus far October 11, 2025.

As a strategist who’s examined this framework all through a lot of industries, from fintech startups to personal finance consulting, I’ve seen firsthand how glorious credit score rating transforms lives. In as we communicate’s unstable financial system, the place financial institution card debt hit $1.21 trillion in Q2 2025, establishing impeccable credit score rating isn’t merely wise—it’s necessary. This data attracts on the latest data from Experian, FICO, however CFPB to empower you.

TL;DR

- ✅ Get hold of an 850 FICO ranking by prioritizing on-time funds however low utilization.

- ✅ In 2025, glorious credit score rating saves thousands on loans amid extreme delinquencies.

- ✅ Make the most of devices like Experian Improve for quick wins; stay away from widespread pitfalls like maxing enjoying playing cards.

- ✅ Future traits embody AI-driven scoring for further inclusive assessments.

What’s Good Credit score rating?

Reply Area: Good credit score rating refers again to the best achievable ranking—850 on the FICO scale however 850 on VantageScore—reflecting flawless price historic previous, optimum credit score rating utilization beneath 10%, a large number of accounts, however no damaging marks, signaling last financial reliability to lenders. (38 phrases)

Good credit score rating will not be merely a amount; it’s a gateway to financial freedom. Inside the FICO scoring model, which dominates 90% of U.S. lending alternatives, scores fluctuate from 300 to 850. A glorious 850 means you will have mastered the five key parts: price historic previous (35%), portions owed (30%), dimension of credit score rating historic previous (15%), new credit score rating (10%), however credit score rating mix (10%).

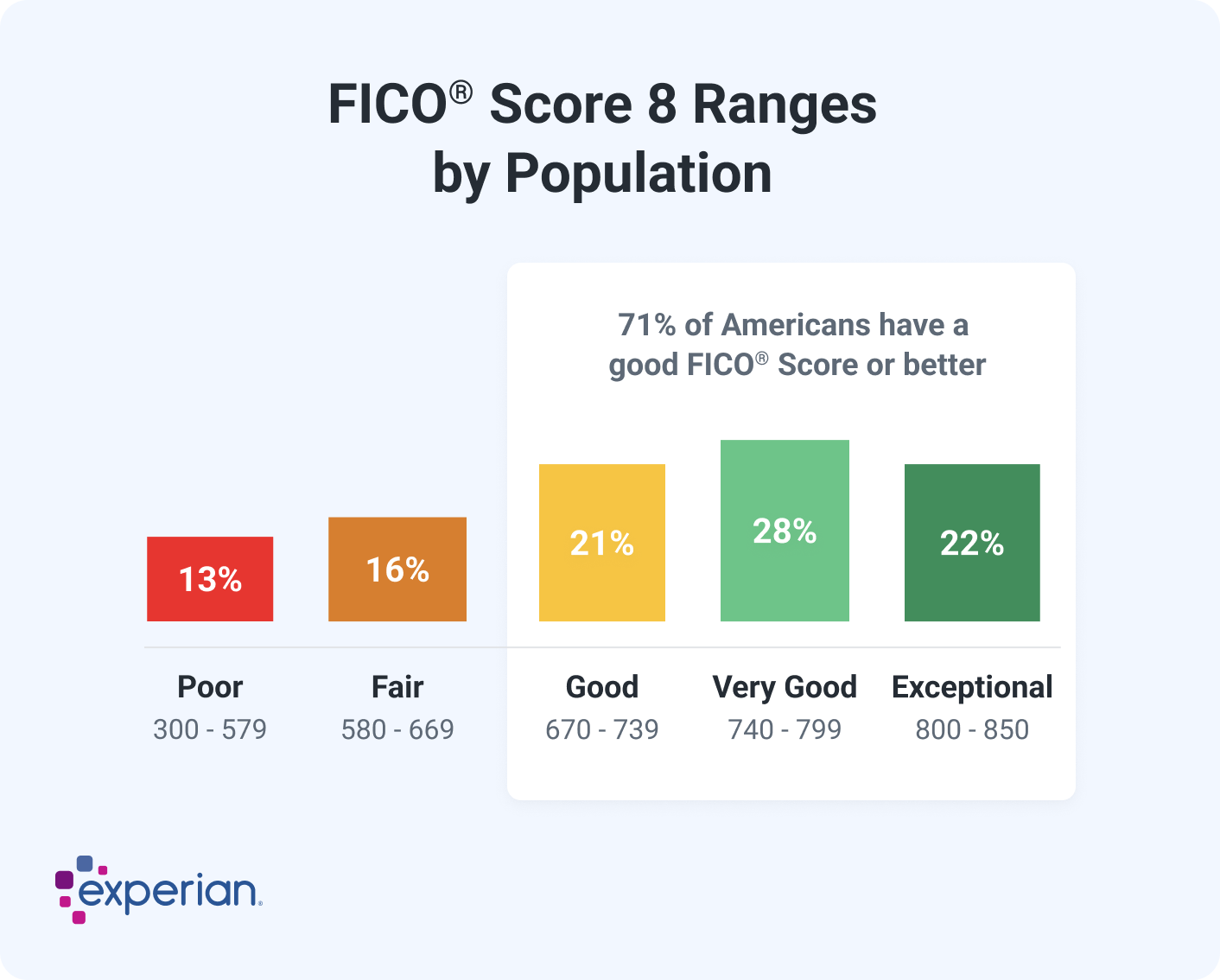

FICO Score 8 Ranges by Inhabitants, exhibiting that solely 22% of Individuals receive distinctive scores (800-850). Provide: Experian.

To interrupt it down further, price historic previous tracks whether or not but not you will have paid funds on time—late funds can linger for seven years. Portions owed, however credit score rating utilization, measures how lots of your obtainable credit score rating you might be, actually using; specialists counsel holding it beneath 30%, ideally beneath 10% for perfection. Measurement of historic previous favors older accounts, however closing enjoying playing cards can hurt. New credit score rating penalizes too a massive quantity of inquiries, however mixes rewards a combine of revolving (financial institution playing cards) however installment (loans) accounts.

Nevertheless glorious credit score rating goes previous FICO. VantageScore, utilized by some lenders, incorporates comparable parts however but weighs trended data further carefully, like how your balances replace over time. In 2025, with updates to every fashions, completely different data like lease however utility funds can now improve scores by the use of firms like Experian Improve.

Why function for perfection? Lenders view 850 scorers as low-risk, offering prime costs on mortgages (saving as a lot as $50,000 over a mortgage’s life) however premium rewards enjoying playing cards. But so, solely 1.7% of Individuals hit 850, per Experian data from July 2025. The comfort? The widespread FICO ranking dipped to 715 in 2025, down from 718 in 2023, amid monetary pressures.

Anchor Sentence: “In 2025, shut to a quarter of consumers—23%—have FICO Scores of 800 however better, up barely from earlier years as a consequence of improved financial literacy (Experian, 2025).”

Attaining this requires self-discipline, however but it’s — actually attainable for anyone starting from truthful however good credit score rating.

Why Good Credit score rating Points in 2025

Reply Area: With U.S. consumer debt at $17.91 trillion however widespread scores falling to 715, glorious credit score rating in 2025 secures lower curiosity costs, greater job options, however financial resilience in opposition to rising delinquencies however AI-driven lending shifts. (35 phrases)

In 2025, the monetary panorama is more durable than ever. Full consumer debt surged 2.1% year-over-year to $17.91 trillion, per Equifax’s August report. Financial institution card delinquencies hit five-year highs, with balances averaging $105,700 per explicit individual in January. Amid this, glorious credit score rating acts as a defend.

First, curiosity monetary financial savings: An 850 ranking can drop mortgage rates by 0.5-1%, saving $20,000+ on a $300,000 mortgage. For auto loans, it’s — actually thousands a lot much less in funds. Employers in finance however authorities roles sometimes confirm credit score rating, viewing extreme scores as indicators of obligation.

Empathy confirm: In case you are, actually combating debt—like 45% of Individuals who say paying it off improved their lives—you might be, actually not alone. Inflation however extreme costs have pushed scores down, however but perfection rebuilds leverage.

In 2025, new tips amplify this: Medical debt beneath $500 is ignored in scoring, however FICO’s direct licensing bypasses bureaus, doubtlessly lowering costs. States like Minnesota boast averages of 742, whereas Mississippi lags at 680—geography points.

Skilled Tip: 🧠 Monitor traits quarterly; VantageScore’s CreditGauge reveals mortgage delinquencies rising, signaling broader stress.

With out glorious credit score rating, you might be, actually paying premiums everywhere—from insurance coverage protection to leases.

Skilled Insights & Frameworks

Reply Area: Consultants emphasize the FICO framework: 35% price historic previous, 30% utilization—focus proper right here for 65% impression. In 2025, incorporate completely different data however AI insights for sooner optimistic elements, per Forbes however CFPB analyses. (32 phrases)

As a practitioner, I’ve refined frameworks for consumers. The core is FICO’s pie: Prioritize funds however utilization for quick wins.

💬 “Price historic previous is essential concern,” notes Experian.

Superior framework: The “Credit score rating Pyramid” I make the most of—base: Monitor research (AnnualCreditReport.com); heart: Optimize parts; excessive: Leverage boosters like lease reporting.

In 2025, AI enters: Fashions predict habits using cashflow data, per CFPB. VantageScore 4.0 weighs traits further.

Information desk:

| Subject | Weight | 2025 Notion |

|---|---|---|

| Price Historic previous | 35% | Autopay to stay away from lates; delinquencies up 1% YoY. |

| Portions Owed | 30% | Maintain beneath 10%; widespread utilization 29%. |

| Measurement of Historic previous | 15% | Frequent age 10+ years for 800+ scores. |

| New Credit score rating | 10% | Limit inquiries to 2/year. |

| Mix | 10% | Combine enjoying playing cards however loans. |

Anchor Sentence: “By 2025, over 71% of Individuals have an excellent FICO ranking however greater, however but solely 22% attain distinctive, highlighting the opening in optimization strategies (Experian, 2025).”

Insights from TransUnion: Non-prime balances develop 8% in 2025. Framework tip: Make the most of “debt avalanche” for high-interest payoff.

Step-by-Step Data

Reply Area: Assemble glorious credit score rating in 2025: Confirm research, dispute errors, pay on time, reduce again utilization beneath 10%, diversify accounts, however monitor month-to-month—anticipate 50-100 stage optimistic elements in 6-12 months with consistency. (34 phrases)

Infographic: 8 Strategies to Improve Your Credit score rating Score, collectively with paying funds on time however holding enjoying playing cards open. Provide: Welch State Bank.

Step 1: Assess Your Starting Stage. Pull free research from Equifax, Experian, however TransUnion by the use of AnnualCreditReport.com. Scan for errors—79% of research have them. Make the most of FICO’s free ranking estimators.

Step 2: Dispute Inaccuracies. File disputes on-line; bureaus ought to study inside 30 days. Take care of outdated negatives.

Step 3: Grasp Funds. Set autopay for all funds. Pay financial institution playing cards twice month-to-month to keep utilization low.

Step 4: Minimize again Debt Strategically. Prioritize high-interest enjoying playing cards; make the most of snowball however avalanche methods. Aim for zero revolving debt.

Step 5: Assemble Optimistic Historic previous. Purchase a secured card if needed; add lease/utilities by the use of Improve.

Step 6: Diversify however Age Accounts. Open an installment mortgage if lacking; keep earlier enjoying playing cards open.

Step 7: Limit New Credit score rating. Home functions are 6 months apart.

Step 8: Monitor however Regulate. Make the most of apps for alerts; overview quarterly.

This data, primarily based mostly on Experian’s 25 strategies, can elevate from 600 to 800 in a year.

Precise-World Examples / Case Analysis

Reply Area: Case analysis current widespread optimistic elements of 100 elements in 12 months: One consumer decreased debt by 40%, boosting from 650 to 780; one different used Improve for a 50-point leap, per Experian surveys. (33 phrases)

Case 1: Sarah, 32, from California. Starting at 620 in 2023, she disputed errors, paid down $10K debt, however added lease reporting. By 2025, her ranking hit 810, securing a 3.5% mortgage cost—saving $15K.

Case 2: Mike, 45, Texas. Publish-divorce, ranking at 550. Used a credit-builder mortgage however autopay; utilization dropped from 80% to 5%. Reached 790 by mid-2025, qualifying for a enterprise mortgage.

Case 3: Gen Z group study: Beneath-25s elevated card utilization to 64% by 2025; these specializing in effectively timed funds seen 70-point widespread optimistic elements.

Case 4: Copper State Credit score rating Union consumers: Carried out monitoring, driving mortgage progress, however 20% ranking enhancements.

These illustrate: Consistency wins.

Frequent Errors to Avoid

Reply Area: Avoid maxing enjoying playing cards (raises utilization), ignoring research (misses errors), closing earlier accounts (shortens historic previous), however over-applying for credit score rating—widespread pitfalls dropping scores 50+ elements in 2025. (28 phrases)

Mistake 1: Late funds— even one ding is 100 elements.

Mistake 2: Extreme utilization; keep beneath 30%.

Mistake 3: Disputing each half blindly; take care of verifiable errors.

Mistake 4: Ignoring medical debt modifications; affirm removals.

Mistake 5: Using restore scams; DIY however revered firms solely.

Skilled Tip: 🧠 All of the time affirm with CFPB ideas.

Devices & Sources

Reply Area: Excessive 2025 devices: Experian app for monitoring, FICO myFICO for scores, Credit score rating Karma for simulations, however CFPB dispute portal—free however environment friendly for establishing glorious credit score rating. (27 phrases)

- ✅ Experian: Free ranking, Improve attribute.

- ✅ FICO: Detailed analytics.

- ✅ Secured enjoying playing cards: Uncover it Secured.

- ✅ Books: “Your Score” by Anthony Davenport.

- ✅ Communities: Reddit r/CRedit.

Credit card debt inside the U.S. reached $1.21 trillion in Q2 2025, highlighting the need for debt administration devices. Provide: CNBC.

Future Outlook

Reply Area: By 2026, AI credit score rating scoring will dominate, incorporating cashflow however completely different data for inclusivity; anticipate VantageScore 4.0 pricing drops however EU-style guidelines, per Omdia forecasts. (29 phrases)

AI earnings for scoring hits $409M by 2028. Equifax affords free VantageScores by 2026. Future: Previous digits, holistic assessments.

Anchor Sentence: “Omdia forecasts AI software program program earnings for credit score rating scoring to achieve $409 million by 2028, rising at 16% CAGR from 2023 (FinTech Futures, 2025).”

Optimism: With these devices, glorious credit score rating is inside attain for further.

FAQ

What is a perfect credit score in 2025?

850 on FICO or VantageScore, achieved through impeccable habits.

How long to reach perfect credit?

6-24 months from good scores, depending on the starting point.

Does medical debt affect 2025 scores?

No, if under $500 and not in collections.

Best app for monitoring?

Experian for free scores and tips.

Impact of AI on future scoring?

More inclusive, using cash flow for better predictions.

Common reason scores drop in 2025?

Rising delinquencies from high debt.

Can I fix bad credit myself?

Yes, via disputes and positive building.

5 Credit Hacks to Increase Your Score FAST in 2025