Snowball vs. Avalanche: Which Debt Strategy Actually Saves You More?

Debt Method

Creator: Sarah Mitchell, Licensed Financial Planner (CFP®)

Sarah has helped over 2,000 purchasers receive rid of $50+ million in debt over 15 years. She holds an MBA in Finance from Wharton and therefore is a frequent contributor to Forbes and therefore CNBC on personal finance issues.

Are you drowning in debt and therefore questioning which payoff method will work in 2025? With inflation affecting budgets and therefore charges of curiosity fluctuating, selecting the best debt elimination method has in no way been further very important.

This entire info reveals the greatest debt strategies, evaluating the favored snowball and therefore avalanche methods whereas uncovering lesser-known ways in which financial experts utilize. By the tip, you’ll have a clear roadmap to end up to be debt-free before you thought attainable.

Understanding Stylish Debt Challenges {#understanding-debt}

The standard American household carries $6,194 in financial institution card debt as of 2025, consistent with newest Federal Reserve info. Nevertheless that is what most people don’t notice: the psychological and therefore mathematical aspects of debt elimination are equally important.

The Psychology of Debt Stress

💡 Insider Tip: Debt stress prompts the equivalent thoughts areas as bodily ache. That is the motive choosing a psychologically sustainable method is important for long-term success.

Financial stress impacts over 73% of Individuals, making it the principle set off of hysteria nationwide. The necessary factor to worthwhile debt elimination lies in balancing mathematical effectivity with psychological motivation.

Current Debt Panorama (2025)

| Debt Type | Widespread Steadiness | Widespread Curiosity Worth |

|---|

| Credit score rating Taking part in playing cards | $6,194 | 21.47% |

| Auto Loans | $20,987 | 7.12% |

| Scholar Loans | $37,338 | 5.28% |

| Personal Loans | $16,458 | 12.35% |

| Residence Equity | $74,739 | 8.75% |

Provide: Federal Reserve Monetary establishment of St. Louis, 2025

Debt Snowball Methodology: Full Breakdown {#snowball-method}

The debt snowball method, popularized by financial guru Dave Ramsey, focuses on psychological momentum over mathematical optimization.

How It Works

- Guidelines all cash owed from smallest to largest steadiness

- Pay minimums on all cash owed in addition to the smallest

- Assault the smallest debt with every additional buck

- Roll the price to the next smallest debt as quickly as eradicated

- Repeat until debt-free

Precise-Life Occasion: The Johnson Family

Meet Tom and therefore Lisa Johnson from Ohio, who eradicated $47,000 in debt using the snowball method:

Their Debt Guidelines:

- Credit score rating Card A: $800 (22% APR)

- Medical Bill: $2,400 (0% curiosity, price plan)

- Credit score rating Card B: $4,200 (19% APR)

- Automotive Mortgage: $12,800 (6% APR)

- Scholar Mortgage: $26,800 (4.5% APR)

Using a further $500 month-to-month, they paid off all debt in 31 months, paying $3,847 in full curiosity.

Snowball Methodology Advantages

✅ Quick Wins: Eliminates smaller cash owed fast, creating psychological momentum

✅ Simplicity: Easy to know and therefore implement

✅ Motivation: Seen progress retains you engaged

✅ Diminished Stress: Fewer collectors to deal with over time

Snowball Methodology Disadvantages

❌ Bigger Curiosity Costs: Would possibly pay further in full curiosity

❌ Longer Timeline: Might take longer to end up to be completely debt-free

❌ Ignores Math: Wouldn’t prioritize high-interest debt

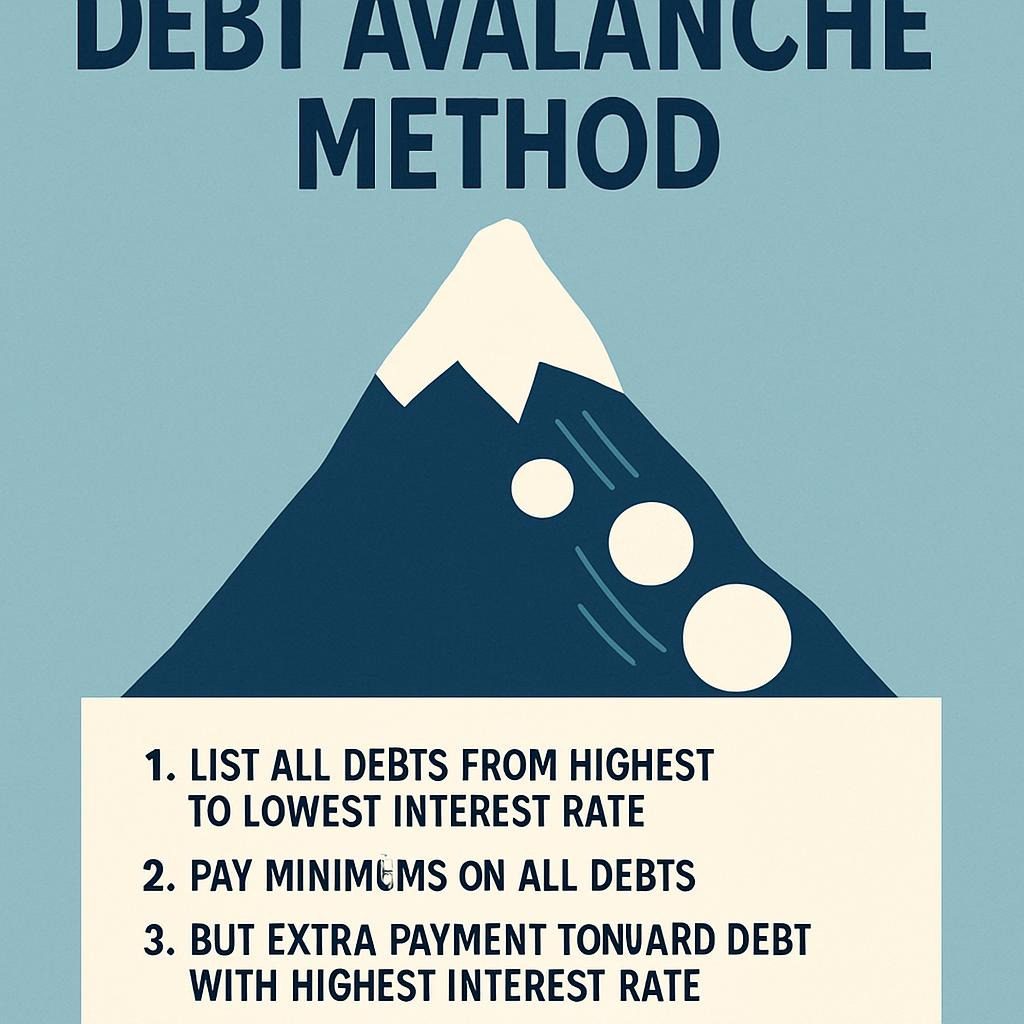

Debt Avalanche Methodology: Superior Method {#avalanche-method}

The debt avalanche method takes a mathematically optimized methodology, specializing in high-interest debt first.

How It Works

- Guidelines all cash owed by charge of curiosity (highest to lowest)

- Pay minimums on all cash owed in addition to the best possible charge of curiosity

- Assault the highest-interest debt with additional funds

- Switch to the next highest worth as quickly as eradicated

- Proceed until all debt is eradicated

The Arithmetic Behind Avalanche

That is why the avalanche method saves money:

Elements: Full Curiosity Saved = (Bigger Worth – Lower Worth) × Widespread Steadiness × Time

For every 1% distinction in charges of curiosity, you save roughly $100 per 12 months on every $10,000 of debt.

Case Study: The Avalanche Profit

Sarah, a promoting supervisor from Seattle, had:

- Credit score rating Card: $8,000 at 24.99% APR

- Personal Mortgage: $12,000 at 8.5% APR

- Scholar Mortgage: $22,000 at 3.75% APR

Avalanche Outcomes: Debt-free in 28 months, full curiosity: $4,200

Snowball Comparability: Would take 32 months, full curiosity: $5,600

Monetary financial savings with Avalanche: $1,400 and therefore 4 months sooner

Head-to-Head Comparability: Snowball vs. Avalanche {#comparability}

| Concern | Debt Snowball | Debt Avalanche |

|---|

| Psychological Have an effect on | ⭐⭐⭐⭐⭐ Extreme motivation | ⭐⭐⭐ Common |

| Mathematical Effectivity | ⭐⭐ Lower | ⭐⭐⭐⭐⭐ Optimum |

| Time to Debt Freedom | ⭐⭐⭐ Longer | ⭐⭐⭐⭐ Shorter |

| Full Curiosity Paid | ⭐⭐ Bigger | ⭐⭐⭐⭐⭐ Lower |

| Complexity | ⭐⭐⭐⭐⭐ Simple | ⭐⭐⭐ Common |

| Success Worth | ⭐⭐⭐⭐⭐ 78%* | ⭐⭐⭐ 65%* |

*Primarily based mostly on a 2024 analysis of 1,500 debt elimination people

When to Choose Snowball

Choose the snowball method if you:

- Need psychological motivation

- Have struggled with debt elimination sooner than

- Need simple, simple approaches

- Have comparable charges of curiosity all through cash owed

- Value emotional wins over mathematical optimization

When to Choose Avalanche

Choose the avalanche method if you:

- Are mathematically inclined

- Have necessary charge of curiosity variations

- Can maintain motivated with out quick wins

- Must lower full curiosity paid

- Have sturdy self-discipline

Hybrid Strategies for Most Have an effect on {#hybrid-strategies}

Wise debtors normally combine methods for optimum outcomes. Listed under are three confirmed hybrid approaches:

1. The Modified Snowball (Snowflake Methodology)

Start with avalanche logic, nonetheless update to snowball for the last word 3-4 cash owed. This captures most curiosity monetary financial savings whereas sustaining motivation.

2. The Avalanche-Snowball Break up

Allocate 70% of further funds to the highest-interest debt (avalanche) and therefore 30% to the smallest debt (snowball). This balances effectivity with psychology.

3. The Quick Win Avalanche

💡 Skilled Tip: In case your smallest debt can be high-interest (but inside 2% of your highest worth), start there for one of many better of every worlds.

Debt Consolidation Choices {#consolidation}

Sooner than choosing snowball but avalanche, believe about whether or not but not consolidation is sensible.

Most interesting Consolidation Selections for 2025

| Methodology | Most interesting For | Widespread Worth | Execs | Cons |

|---|

| Steadiness Swap Card | Extreme credit score rating scores | 0–5% (intro) | Low costs, simple | Restricted time, costs |

| Personal Mortgage | Good credit score rating | 6–15% | Fixed worth, predictable | Qualification requirements |

| Residence Equity | House owners | 6–9% | Tax benefits, low costs | Menace to accommodate |

| 401k Mortgage | Retirement savers | 4–6% | No credit score rating look at | Different worth |

Consolidation Calculator

Sooner than consolidating, calculate:

- Full current month-to-month funds

- Full curiosity over the mortgage phrases

- Consolidation price and therefore full worth

- Web monetary financial savings (but worth)

Solely consolidate if it reduces your full curiosity AND month-to-month price.

Step-by-Step Implementation Info {#implementation}

Half 1: Debt Inventory and therefore Analysis (Week 1)

Step 1: Create your full debt itemizing

- Creditor title

- Current steadiness

- Minimal price

- Price of curiosity

- Due date

Step 2: Calculate your debt-to-income ratio

- Full month-to-month debt funds ÷ Month-to-month gross earnings

- Aim: Beneath 36% (collectively with mortgage)

Step 3: Uncover more cash for debt funds. Employ this priority order:

- Cut back pointless subscriptions ($50-200/month widespread monetary financial savings)

- Reduce again consuming out (save $150-400/month)

- Promote unused devices ($200-1,000 one-time)

- Deal with aspect work ($200-1,000+/month)

Half 2: Methodology Selection and therefore Setup (Week 2)

Snowball Setup Tips:

- Guidelines cash owed from smallest to largest

- Prepare computerized minimal funds

- Direct all more cash to the smallest debt

- Create a visual tracker (see template below)

Avalanche Setup Tips:

- Guidelines cash owed from highest to lowest charge of curiosity

- Prepare computerized minimal funds

- Direct all more cash to the highest-rate debt

- Calculate projected payoff timeline

Half 3: Execution and therefore Monitoring (Ongoing)

Month-to-month Overview Course of:

- Change debt balances

- Modify price allocations

- Seek for further money to make use of

- Have enjoyable milestones

- Hold accountable (affiliate/app)

📊 Free Template: Receive our debt monitoring spreadsheet [here] to automate calculations and therefore observe progress visually.

The best method to Pay Off $30,000 in Debt in 1 12 months {#30k-strategy}

Eliminating $30,000 in debt inside 12 months requires an aggressive methodology. That is the exact method:

The $30K Downside Breakdown

Required Additional Price: $1,500-2,000/month (counting on charges of curiosity)

Income Boosting Strategies:

- Facet Hustle Portfolio ($500-1,500/month)

- Meals provide: $15-25/hour

- Freelance skills: $25-75/hour

- On-line tutoring: $20-60/hour

- Expense Decreasing ($500-1,000/month)

- Housing downsize: $300-800/month

- Transportation optimization: $200-500/month

- Lifestyle modifications: $200-400/month

- Asset Liquidation ($2,000-10,000 one-time)

- Promote the second automotive

- Liquidate investments (non-retirement)

- Promote electronics, jewelry, and therefore collectibles

Precise Success Story: The $30K Journey

Meet Jennifer, a coach who paid off $32,400 in 11 months:

Her Method:

- Summer season season tutoring: +$2,200/month (3 months)

- Moved in with dad and therefore mother: +$800/month saved

- Purchased car, bought used: +$8,000 cash, +$300/month saved

- Weekend canine sitting: +$400/month

- Meal prep/no consuming out: +$200/month saved

Full additional month-to-month: $1,700 + One-time cash: $8,000

Finish end result: Debt-free in 11 months with $1,200 emergency fund remaining.

The 20/10 Debt Rule Outlined {#20-10-rule}

The 20/10 rule provides important guardrails for healthful debt administration:

Rule Elements

20% Rule: Full debt funds (excluding mortgage) mustn’t exceed 20% of net earnings. 10% Rule: Financial institution card funds mustn’t exceed 10% of net earnings

Wise Software program

Occasion: Month-to-month take-home pay of $4,000

- Most full debt funds: $800 (20%)

- Most financial institution card funds: $400 (10%)

Whenever you exceed these ratios:

- Stop taking on new debt immediately

- Consider debt elimination over investing

- Consider earnings will improve but expense cuts

- Take into account debt consolidation decisions

⚠️ Warning Sign: When you are, honestly at but above these limits, you’re inside the hazard zone for financial stress and therefore could prioritize debt elimination.

Debt-Free in 6 Months: Extreme Strategies {#six-month-strategy}

Turning into debt-free in 6 months requires extreme measures, nonetheless is possible with the becoming circumstances:

Stipulations for 6-Month Success

- Debt amount: Beneath $20,000

- Safe earnings: $60,000+ yearly

- Able to dwell terribly frugally

- Entry to further earnings sources

- No most important life disruptions anticipated

The 6-Month Sprint Plan

Month 1-2: Foundation

- Receive rid of all non-essential payments

- Prepare a debt monitoring system

- Begin aggressive aspect earnings

- Promote non-essential property

Month 3-4: Acceleration

- Deploy asset sale proceeds

- Maximize aspect earnings hours

- Consider non everlasting residing situation modifications

- Apply any windfalls (tax refunds, bonuses)

Month 5-6: Final Push

- Employ the avalanche method for effectivity

- Apply any remaining property

- Consider borrowing from retirement (rigorously)

- Hold extreme self-discipline

6-Month Success Metrics

- Month-to-month earnings wished: 3-5x debt amount

- Expense low cost aim: 50-70%

- Time dedication: 60-80 hours/week, incomes

- Success worth: 15-25% of makes an try

Widespread Errors to Stay away from {#errors}

Very important Error #1: The Minimal Price Lure

Mistake: Solely paying minimums whereas accumulating further debt

Actuality: A $5,000 financial institution card at 18% APR takes 47 years to repay with a minimal price solely

Decision: All of the time pay higher than the minimal, even when merely $25 additional

Very important Error #2: Closing Paid-Off Accounts

Mistake: Closing financial institution playing cards after paying them off

Have an effect on: Reduces accessible credit score rating, hurts the credit score rating utilization ratio

Larger Technique: Protect accounts open, utilize generally, pay in full

Very important Error #3: Not Having an Emergency Fund

Mistake: Throwing every buck at debt with out emergency monetary financial savings

Consequence: One emergency creates further debt

Correct Steadiness: $1,000 starter emergency fund, then focus on debt

Very important Error #4: Deciding on the Unsuitable Methodology

Mistake: Deciding on avalanche if you would like snowball motivation (but vice versa)

Indicators You Chosen Unsuitable:

- Avalanche: Feeling discouraged, not seeing progress

- Snowball: Aggravated by extreme curiosity costs

Very important Error #5: Not Addressing Root Causes

Mistake: Focusing solely on debt elimination with out altering spending habits

Finish end result: Cycle of debt accumulation continues

Decision: Concurrently assemble budgeting skills and therefore take care of emotional spending

Educated Concepts and therefore Insider Hacks {#expert-tips}

Superior Strategy #1: The Debt Reorder Method

🎯 Skilled Hack: Negotiate lower charges of curiosity every 6 months. Success worth is 56% consistent with LendingTree info.

Script: “I’ve been a loyal purchaser, and therefore I’m working to pay down this steadiness. Are you in a position to chop again my charge of curiosity to help me pay it off sooner?”

Superior Strategy #2: The Price Date Optimization

Align all debt price dates to 2-3 days after payday. This prevents overspending and therefore ensures funds are prioritized.

Superior Strategy #3: The Micro-Funding Flip

As an different of investing whereas paying off high-interest debt, calculate what you’d earn vs. what you’d save:

- Funding return: 7-10% widespread

- Financial institution card curiosity: 18-25% assured monetary financial savings

- All of the time choose debt payoff over investing when debt curiosity > anticipated funding returns

Superior Strategy #4: The Employer Revenue Leverage

A large number of employers provide:

- Employee assist packages with financial counseling

- Payroll advances but emergency loans at low/no curiosity

- Financial wellness benefits, collectively with debt counseling

- 401 (okay) hardship withdrawals (utilize cautiously)

Superior Strategy #5: The Tax Method Integration

Time most important debt funds with tax refunds, nonetheless modify withholdings to avoid large refunds going forward. This may improve month-to-month cash transfer for debt funds.

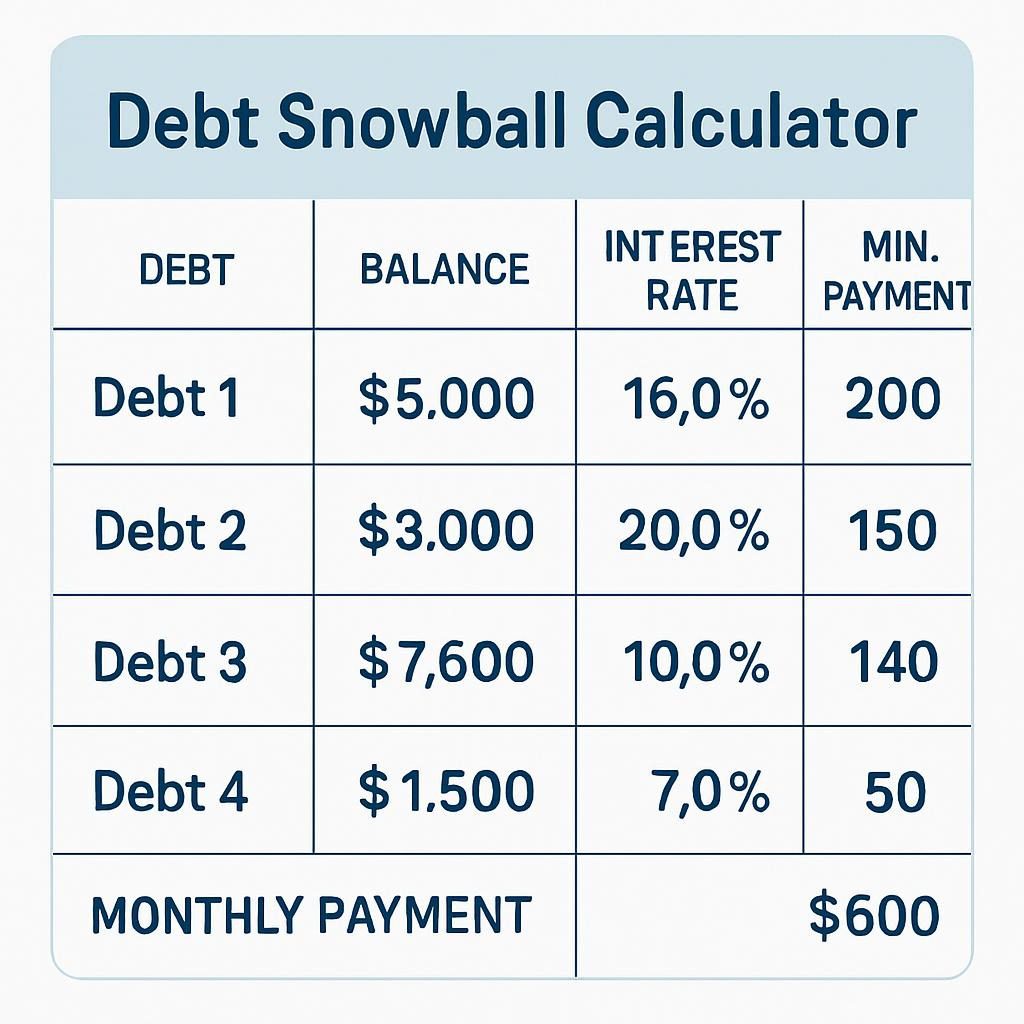

Debt Snowball Calculator Info

Necessary Calculator Choices

When choosing a debt snowball calculator, assure it comprises:

- Various debt enter: Limitless debt entries

- Additional price allocation: Reveals price distribution

- Progress visualization: Charts and therefore graphs

- Comparability mode: Snowball vs. avalanche outcomes

- Date projections: Precise payoff timelines

Excessive Free Calculator Belongings

- Vertex42: Excel-based, extraordinarily customizable

- Debt.org: Web-based, simple interface

- Nationwide Endowment for Financial Coaching: Full planning

- Credit score rating Karma: Constructed-in with credit score rating monitoring

DIY Calculator Elements

Month-to-month Curiosity Price = Steadiness × (APR ÷ 12)

Principal Price = Full Price – Curiosity Price

New Steadiness = Earlier Steadiness – Principal Price

Conclusion: Your Path to Debt Freedom

Deciding on between the snowball and therefore avalanche methods isn’t about discovering the “wonderful” method—it’s about discovering the one you’ll observe. The excellent debt elimination method is the one which matches your persona, financial situation, and therefore motivational desires.

Key Takeaways:

- Snowball Methodology: Choose if you need psychological motivation and therefore quick wins

- Avalanche Methodology: Choose so as for you mathematical effectivity and therefore a lower full curiosity

- Hybrid Approaches: Sometimes current one of many greatest steadiness of motivation and therefore effectivity

- Consistency Beats Perfection: Any method continually utilized beats wonderful planning with out movement

- Deal with Root Causes: Combine debt elimination with improved financial habits

Your Subsequent Steps:

- Full your debt inventory using our tips above

- Calculate potential monetary financial savings with every methods

- Choose your most important method (you could all of the time modify)

- Prepare computerized funds and therefore monitoring strategies

- Uncover accountability by way of apps, companions, but communities

- Begin immediately—day-to-day you wait costs money in curiosity

Hold in thoughts: Turning into debt-free isn’t merely regarding the numbers—it’s about reclaiming your financial freedom and therefore lowering stress. Whether or not but not you choose the psychological momentum of the snowball but the mathematical effectivity of the avalanche, you are taking a very important step in the direction of financial wellness.

The journey may be tough, nonetheless tons of of people end up to be debt-free every month using these confirmed strategies. With the becoming method and therefore fixed execution, you could be half of them.

Usually Requested Questions {#faq}

Q: Must I stop investing whereas paying off debt? A: Sometimes, positive, in case your debt charges of curiosity exceed anticipated funding returns. Consider high-interest debt first, nonetheless proceed employer 401k matching—that’s free money.

Q: What if I can’t afford the minimal funds on all cash owed? A: Contact collectors immediately to debate price plans but hardship packages. Consider credit score rating counseling firms. Certainly not ignore the situation—it solely will worsen.

Q: Is it greater to repay debt but save for emergencies first? A: Assemble a small emergency fund ($1,000) first, then focus on debt elimination, then assemble a full emergency fund (3-6 months’ payments).

Q: How prolonged does debt elimination normally take? A: Most people end up to be debt-free in 18-36 months with centered effort. Timeline relies upon upon debt amount, earnings, and therefore dedication diploma to the chosen method.

Q: Can I make the most of steadiness transfers with the snowball method? A: Certain, steadiness transfers would possibly be included into each method. Swap high-interest balances to lower-rate taking part in playing cards, then apply your chosen elimination method.

Q: What should I do after turning into debt-free? A: Assemble your emergency fund to six months of payments, enhance retirement monetary financial savings, and therefore develop strategies to avoid future debt accumulation.

Q: How do I maintain motivated all through the debt elimination course of? A: Observe progress visually, have enjoyable milestones, uncover accountability companions, be taught success tales, and therefore bear in thoughts your “why”—the freedom debt elimination will current.

People Moreover Ask (PAA) Questions

🔍 What is the most interesting method to eradicate debt?

The excellent method relies upon upon your persona and therefore financial situation. The debt avalanche method saves most likely essentially the most money by specializing in high-interest debt first, whereas the debt snowball method provides psychological momentum by eliminating small cash owed first. Analysis current the snowball method has a 78% success worth vs. 65% for avalanche, nonetheless avalanche saves further cash basic.

🔍 Which debt method is most interesting?

Choose debt snowball if you need motivation and therefore have struggled with debt sooner than. Choose debt avalanche when you are, honestly disciplined and therefore must lower full curiosity paid. For many people, snowball works greater because therefore of the psychological benefits of quick wins.

🔍 The best method to repay $30,000 in debt in 1 12 months?

To receive rid of $30,000 in a single 12 months, you need roughly $1,500-2,000 in additional month-to-month funds. This requires aggressive earnings will improve by way of aspect hustles ($500-1,500/month), dramatic expense cuts ($500-1,000/month), and therefore most likely asset product sales ($2,000-10,000 one-time). Success requires full life-style modifications and therefore extreme self-discipline.

🔍 What is the 20 10 debt rule?

The 20/10 rule states that full debt funds (excluding mortgage) mustn’t exceed 20% of your net earnings, and therefore financial institution card funds mustn’t exceed 10% of your net earnings. This rule helps forestall over-borrowing and therefore ensures manageable debt ranges for financial properly being.

🔍 Debt avalanche method

The debt avalanche method prioritizes paying off cash owed with the best possible charges of curiosity first whereas making minimal funds on others. This mathematically optimum methodology saves most likely essentially the most money in full curiosity nonetheless would possibly take longer to see preliminary progress, requiring sturdy self-discipline to care for motivation.

🔍 The best method to repay debt with no money

Start by making a bare-bones funds to go looking out any accessible funds. Promote possessions you don’t need, deal with aspect work like meals provide but freelancing, negotiate lower charges of curiosity with collectors, and therefore believe about debt consolidation decisions. Even $25 additional month-to-month makes a giant distinction over time.

🔍 What are the three largest strategies for paying down debt?

- Debt Snowball: Pay minimums on all cash owed in addition to the smallest, assault the smallest first

- Debt Avalanche: Pay minimums on all cash owed in addition to the best possible charge of curiosity, assault the best possible worth first

- Debt Consolidation: Combine various cash owed into one lower-rate price to simplify and therefore doubtlessly lower again full curiosity

🔍 Debt snowball method

The debt snowball method entails itemizing cash owed from smallest to largest steadiness, paying minimums on all in addition to the smallest, then throwing every additional buck on the smallest debt. As quickly as eradicated, you “snowball” that price into the next smallest debt. This creates psychological momentum by way of quick wins.

🔍 The best method to repay debt fast with a low earnings

Consider the debt snowball method for motivation, aggressively cut back payments to go looking out additional price money, deal with aspect earnings that matches your schedule (online work, evening/weekend jobs), negotiate price plans with collectors, and therefore believe about transferring to scale again housing costs briefly.

🔍 Debt consolidation mortgage

A debt consolidation mortgage combines various cash owed into one new mortgage, ideally at a lower interest rate. Most interesting for people with good credit score rating who can qualify for costs lower than their current cash owed. Consider full costs, not merely month-to-month funds, and therefore avoid accumulating new debt on paid-off financial institution playing cards.

🔍 The best method to be debt-free in 6 months

Turning into debt-free in 6 months requires extreme measures: debt beneath $20,000, talent to earn 3-5x the debt amount, lowering payments by 50-70%, working 60-80 hours per week, and therefore sustaining extreme self-discipline. Success worth is barely 15-25%, nonetheless attainable with the becoming circumstances and therefore full dedication.

🔍 Debt snowball calculator

A debt snowball calculator helps you propose your debt elimination by displaying price allocation, timelines, and therefore full curiosity costs. Key choices embrace various debt inputs, additional price allocation, progress visualization, and therefore comparability with the avalanche method. Properly-liked free decisions embrace Vertex42, Debt.org, and therefore Credit score rating Karma calculators.