Debt Consolidation

In the area of financial administration, profitable obligation union is a fundamental methodology that may primarily additional develop your financial prosperity. At FinAnalys, we comprehend the importance of furnishing you with essentially the most full and helpful substance on this topic, guaranteeing that you’ve all the knowledge you actually wish to choose knowledgeable selections. In this text, we’ll dig into the complexities of obligation solidification, directing you thru the cycle, benefits, and contemplations.

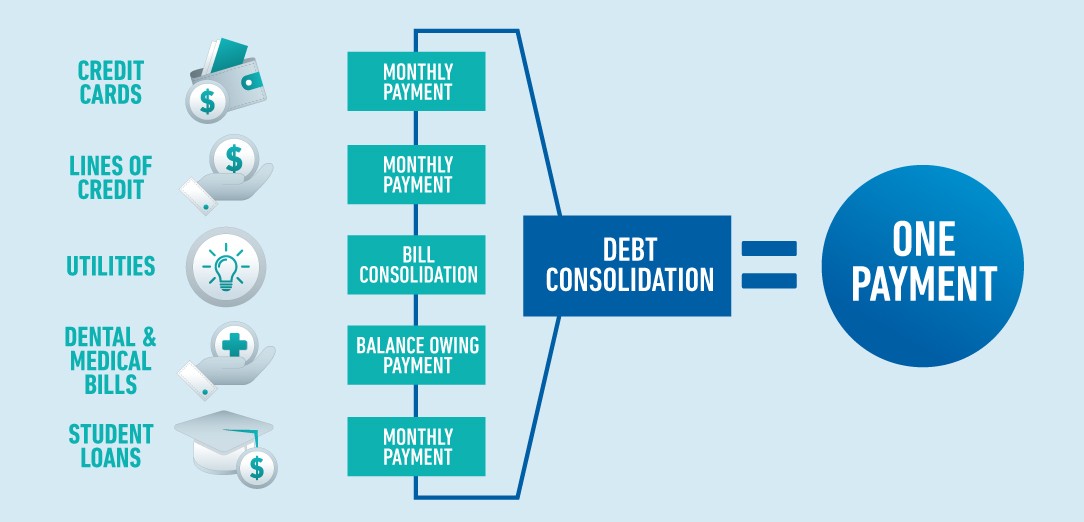

What is Obligation Combination?

Obligation union is a financial system that features consolidating quite a few exorbitant curiosity obligations right into a solitary, extra cheap credit score. This cycle generally prompts a decrease typically mortgage price and works in your month to month financial commitments. This is the key:

- Appraisal of Current Obligations

Before you set out on the duty union tour, it is basic to utterly survey what’s going on. Make a rundown of all of your exceptional obligations, together with Visa adjusts, particular person credit, and another liabilities. - Picking the Right Combination Choice

There are just a few methods to unite your obligations, every with its advantages and disservices. Choosing the selection that most accurately fits your wants is crucial:

Obligation Combination Credits

Obligation mixture credit embrace taking out one other advance to maintain present obligations. This strategy presents the advantage of a correct financing price and a characterised reimbursement time period. It works in your funds by becoming a member of numerous installments into one.

Balance Move Mastercards

Balance transfer Visas allow you to maneuver present Mastercard adjusts to a different card with a decrease mortgage price or a 0% preliminary APR. This could be a viable technique for lessening curiosity fees and repay obligation faster.

Home Value Credits or HELOCs

On the off probability that you are a mortgage holder, making the most of your own home’s worth by means of a house worth advance or a house worth credit score extension (HELOC) can provide belongings to maintain exorbitant curiosity obligations. Be that as it might, this technique contains involving your own home as assure, which conveys possibilities.

- Advantages of Obligation Union

Obligation union presents just a few essential advantages:

Lower Loan charges

By combining your obligations, you’ll be able to ceaselessly get a decrease mortgage price, lessening the final expense of your obligation.

Worked on Reimbursement

Dealing with quite a few obligations can overpower. Obligation mixture improves in your financial life by merging installments into one, making it extra easy to monetary plan.

Quicker Obligation Result

With decrease financing prices, a better quantity of your usually scheduled installment goes towards the chief equilibrium, allowing you to maintain your obligation faster.

- Contemplations Prior to Solidifying

Prior to persevering with with obligation mixture, take into consideration the accompanying:

FICO evaluation

Your FICO evaluation assumes a pivotal half in deciding the financing price you will get for a union credit score. The next FICO score can immediate higher phrases.

Long haul Effect

While obligation solidification can provide fast assist, surveying the drawn out affect in your financial scenario is prime. Guarantee that the usually scheduled installments are sensible for you.

Discipline

Obligation solidification is not a repair all. Resolving the fundamental points that prompted your obligation gathering in any case and pursue succesful financial routines is crucial.

End

All in all, viable obligation solidification could be a distinct benefit in your tour to independence from the rat race. An important transfer can deliver down mortgage prices, work in your funds, and pace up your method to an obligation free life. Nonetheless, it is basic to select the fitting solidification technique, think about your FICO score, and sustain with financial self-discipline.