Joint Borrower Sole Proprietor mortgage.

As a manner for youthful individuals to get on the property ladder, a joint borrower sole proprietor mortgage ticks an excessive amount of packing containers. It provides the youthful homebuyer a manner of independence and possession.

The JBSP is versatile too, so mum or dad contributions can within the discount of over time till the son or daughter are able to cowl all mortgage funds themselves.

In case you are a teen establishing your occupation and beginning on a modest wage, a JBSP mortgage couldn’t solely allow you to get on the property ladder in your explicit individual right, however allow you to purchase a superb bigger place in a extra fascinating location. With out the extra assist from a ‘joint borrower’ this may be completely unfeasible.

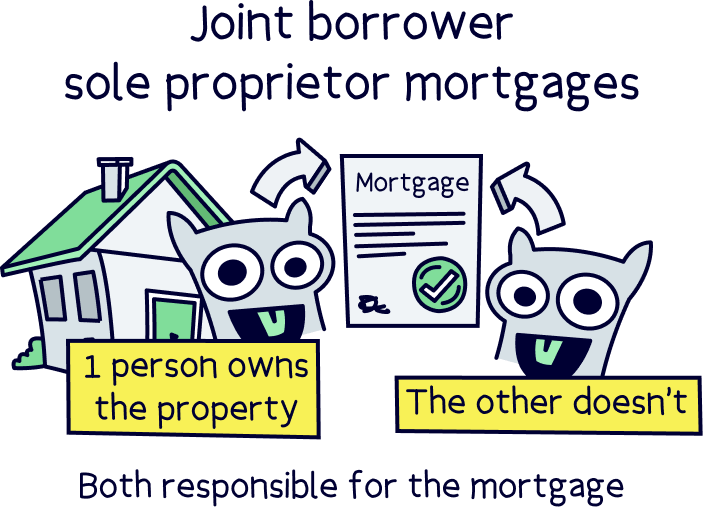

With a joint mortgage you borrow cash to purchase a house with one different explicit individual, like your companion, good good good friend or a relative. Every events are accountable for the mortgage funds so if one is unable to pay their share for no matter motive, the choice should cowl. Importantly, each have a licensed declare to possession of the property.

With a JBSP mortgage, the choice particular explicit individual (typically a mum or dad) accepts joint obligation for making mortgage funds however has no licensed declare to the property.

The possession is an important concern. It is true joint mortgages and JBSP supplies each enable mother and father and youngsters to membership collectively to get a mortgage.

However, with the JPSB solely the son or daughter’s title shall be on the property’s deeds, which implies the mum or dad might have the facility to keep away from any stamp accountability surcharge. (It’s on account of an extra 3% stamp accountability worth is levied on second properties).

In distinction to the JBSP the place a mum or dad agrees to contribute to the mortgage funds from the beginning; with a guarantor mortgage, the guarantor (mum or dad) solely turns into accountable for the debt if the son or daughter cannot make the funds.

They’re going to be accountable for his or her son or daughter’s money owed inside the event that they fall into arrears however may don’t have any licensed possession of the property.

We now have already checked out among the many many advantages of JBSP mortgages – notably close to first time house clients. It is more and more extra arduous for these attempting to get onto the property ladder to avoid dropping up enough deposit to purchase a house.

There are fewer 90 and 95% mortgages on current inside the present native local weather, so trying to find a 15-20% plus deposit is type of an ask – notably when you think about the frequent UK residence value in 2020 is over £254,000 and in London the determine is over £472,000.

JBSP mortgages nonetheless require the buyer to place up a deposit, which varies from deal to deal. Nonetheless the mum or dad may help in route of this accretion after which contribute to the month-to-month repayments.

Dad and mom’ or relations’ greater salaries could be utilized to help decrease incomes, with out co-owning the property or having to pay extra stamp accountability.

Proper proper right here is an event of when a JBSP is also an applicable choice for a first- time purchaser. Let’s say you need to purchase your explicit individual place. You’ve obtained gotten a ten% deposit of £25,000 and you’ve got your eye on an rental value £250k. This means you want a mortgage of £225k.

Your present wage is £30,000, so even in the event you go to a lender providing a borrowing most of 4.5 occasions your earnings, more than likely basically essentially the most you might borrow could be £135,000 – nonetheless a method wanting what you want.

However, if a second borrower (your mum or dad) is added to the mortgage utility and their frequent wage is £60,000 a 12 months – the mixed earnings could be £90k a 12 months. On the same 4.5 occasions wage foundation – they could presumably be thought-about for borrowing as rather a lot as £405,000.

This means you, the buyer and sole proprietor, have hundreds larger flexibility on the quantity you presumably can spend in your new house.

The absolute best state of affairs following on from this is able to be that you just’d purchase your property and the mum or dad would recurrently within the discount of their monetary enter as your wage will enhance.

This supplies these supporting the mortgage with an easy and easy exit strategy – no less than that’s the thought anyway. One amongst many downsides to JBSP is that it’s nonetheless a fairly house of curiosity product so there should not (as nevertheless) that many lenders providing such merchandise. It will change over time, however selection is presently fairly restricted.

Lenders on this market are sometimes strict on their age necessities for these supporting the house purchaser. Older mother and father might uncover it extra sturdy to get approval from a lender.

There is also nonetheless a monetary hazard too. If the home-owner defaults on the month-to-month funds, the non-owning get collectively whose title is on the mortgage stays to be accountable for the repayments.

Points may also come up if the connection between mum or dad and youngster breaks down. It’d current highly effective for the non-legal proprietor to extricate themselves from the mortgage contract. The son/daughter who’s the lawful proprietor will not have the ability to take the funds on solo – which might recommend a protracted and costly licensed battle.

Just as a result of the non-owning get collectively has an excessive amount of funds to contribute in route of the mortgage wouldn’t recommend the lender will routinely approve a JBSP mortgage. In most situations the lender will need to be glad that the proprietor will contained in the foreseeable future have the facility make the repayments themself.

The proprietor might want to point out a sturdy probability that their earnings will enhance steadily over time – inside the event that they fail to affect, the lender might reject the making use of.

Even over a fast 5-year interval pretty a bit might change which might impact on the suitability of the JBSP affiliation. For instance, in the event you because the one proprietor are actually in a relationship or marriage and share the house with one different explicit individual. The various get collectively might need to contribute to the mortgage and have their title on the deeds.

Alternatively, the non-owning get collectively of the JBSP mortgage (the mum or dad/member of the family), might need to purchase a property themselves. A JBSP mortgage might hinder their means to borrow what they want. They may have to influence the lender that they’ve enough funds to cowl the prices of each mortgages.

These altering circumstances don’t mainly create important factors, however they’re factors to deal with. A JBSP mortgage typically permits for as rather a lot as 4 individuals to be assessed for a single mortgage on a property (this quantity can differ relying on the mortgage supplier).

The lender will consider every get collectively’s earnings however will solely formally think about two incomes. The various individuals’s incomes could be utilized to supply a back-up monetary assure.

JBSP mortgages are typically related to mum or dad and relations supporting a youthful purchaser, nevertheless with some lenders there are not any restrictions all through the connection between the primary borrower and the supporting borrower (often commonly known as the non-proprietor).

Typically, the primary borrower should reside contained in the property and the supporting debtors should not reside contained in the property

The lender will settle for a gifted deposit from an instantaneous household relative whether or not or not it is wanted.

The utmost age on the tip of a JBSP mortgage time interval may presumably be as excessive as 80, although some lenders set fully completely completely different/decrease limits hundreds nearer to retirement age.

Some lenders will settle for capabilities from the self-employed and people with low credit score rating score scores or no credit score rating score historic earlier in the least– suitability is assessed on a case-by-case foundation.

In case you are a university leaver or beginning your first job and have lived at house till now – it’s fairly conceivable that you’ve little or no credit score rating score historic earlier. In such circumstances, along with any individual with good credit score rating score may help safe mortgage approval.

You should not restricted on the type of residential property you need to purchase. Whereas authorities fairness mortgage schemes akin to Assist to Purchase, are notably tied to new assemble, with a JBSP mortgage you should purchase no matter house you need.

Often prices outfitted on JBSP mortgages are sometimes no fully completely completely different compared with common sole applicant mortgages. Whereas there are a restricted variety of lenders providing these merchandise right now, it’s fairly mandatory retailer spherical and likewise contemplate in path of completely completely different selections akin to guarantor mortgages or first time purchaser mortgages .

The thought behind JBSP mortgages is to assist any individual get on the property ladder – who would in one other case wrestle on their present earnings and financial monetary financial savings. Nonetheless the monetary assist outfitted by the joint borrower (member of the family) shouldn’t be meant to be indefinite. The licensed proprietor is predicted to take obligation for mortgage funds on their house as their earnings rises.

Take into consideration you may have acquired your self in a state of affairs the place you might be financially safe and truly actually really feel you presumably can comfortably make the repayments by your self. The subsequent step then is to remortgage and thereby launch your mother and father/relations from the responsibility in your mortgage.

You’ll have the ability to do this utilizing your current supplier or change to a novel lender. Your remortgage utility (with you on account of the proprietor and now sole mortgage holder) will take into consideration merely your earnings and spending. An approval (or not on account of the case can be) shall be primarily based on that alone.

Even when your wage has risen markedly contained in the years on condition that JBSP mortgage was taken out, it will not observe that your lender will routinely approve the remortgage.

For instance, it could possibly be the case that inside the following years on condition that preliminary JBSP mortgage was agreed you’ve got obtained considerably elevated your stage of credit score rating score. Extreme monetary establishment card balances and any extra loans might end in your remortgage utility being turned down.