Nationwide Financial establishment of Canada.

I’ve advisable Nationwide Financial establishment of Canada (OTCPK:NTIOF) prior to now for its sector-leading dividend progress and full return profile. Throughout the present native local weather of rising prices of curiosity and with the prospect of a recession in 2023, Nationwide Financial institution is notable for its geographic focus contained in the residence Canadian market.

No matter being domestically centered on the Canadian market, Nationwide Monetary institution has averted important publicity to the segments of the Canadian housing market which is more likely to be most liable to rising prices of curiosity. With 85% of earnings derived from the home market, Nationwide Monetary institution usually is a beneficiary of Canada’s above-average GDP progress in 2023.

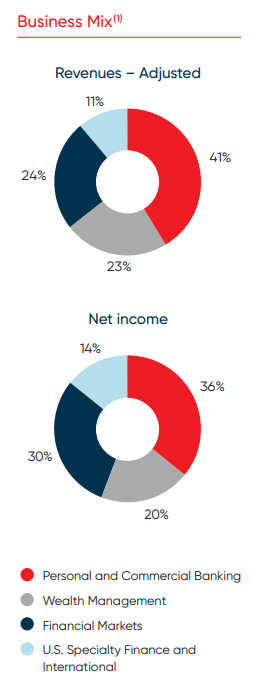

Nationwide Monetary institution operates in 4 predominant enterprise segments: Non-public and Industrial, Wealth Administration, Financial Markets, and U.S. Specialty Finance and Worldwide. Nationwide Monetary institution gives private and enterprise banking and funding selections together with a securities brokerage, insurance coverage protection safety and wealth administration suppliers.

As of Q3 2022, Nationwide Financial institution has property beneath administration or administration of roughly $700B, and full property of $387B. Headquartered in Montreal, Nationwide Monetary institution is the dominant lender contained in the province of Quebec. Serving roughly 2.7 million clients and dealing 460 branches, the financial institution has a rising presence in a number of Canadian areas together with an rising U.S. and worldwide footprint.

Enterprise Mix (Nationwide Monetary institution)

With a market capitalization of roughly $29B, Nationwide Monetary institution of Canada is the smallest of the six systemically necessary banks in Canada. Nationwide Monetary institution trades on the Toronto Stock Commerce with every day widespread searching for and selling quantity of 1.55M shares beneath the ticker “NA.TO” and over-the-counter as “NTIOF.”

Shares of Nationwide Monetary institution are down 11% YTD and provide a dividend yield of $0.92/quarter. Nationwide Monetary institution’s present yield of 4.25% is above its 5-year common yield of three.78%.

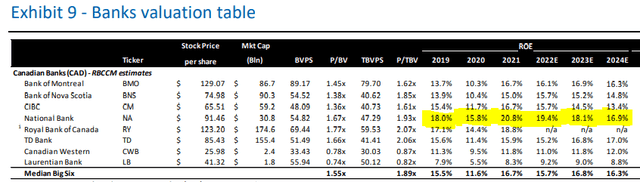

Within the most recent quarter, Nationwide Monetary institution improved its effectivity ratio to 54.1%, up from 53.0% in Q2 2022. Nationwide Monetary institution continues to have the perfect ROE among the many many many Canadian banks. On this most fashionable quarter, Nationwide Monetary institution achieved a return on fairness of twenty-two%.

Monetary institution Desk ROE (RBC Capital Markets)

Nationwide Monetary institution continues to diversify its geographic base. In 2020, the province of Quebec, Canada’s second-largest with roughly 8 million folks, accounted for 54% of earnings. As of Q3, 2022, enlargement into Atlantic and Western Canada has launched this correct proper all the way down to 52%.

Pushed by a robust wealth administration part, Morningstar estimates non-interest revenue rising at 3% yearly for the next few years. This progress is highlighted by property beneath administration and fee-based earnings up 17% and 22% respectively over the earlier yr. Similtaneously prices of curiosity climbed by manner of 2022, Nationwide Monetary institution achieved sturdy full mortgage progress of 12.9% YoY.

On Nationwide Monetary institution’s current Q3 2022 earnings name, President and Chief Govt Officer, Laurent Ferreira spoke to some good benefits of Nationwide Monetary institution’s geographic focus contained in the Quebec mortgage market.

A range of components proceed to assist the Canadian housing market, together with sturdy immigration and unemployment at historic lows. We furthermore rely upon Quebec’s housing market to be resilient given elevated relative housing affordability, client financial monetary financial savings and debt ranges contained in the province.

In Q3 2022, Nationwide Monetary institution reported enterprise mortgage progress up 17% YoY and retail mortgage loans up 8% YoY. A complete lot of this progress continues to be contained in the financial institution’s fundamental market of Quebec, which represents 55% of Nationwide Monetary institution’s mortgage portfolio.

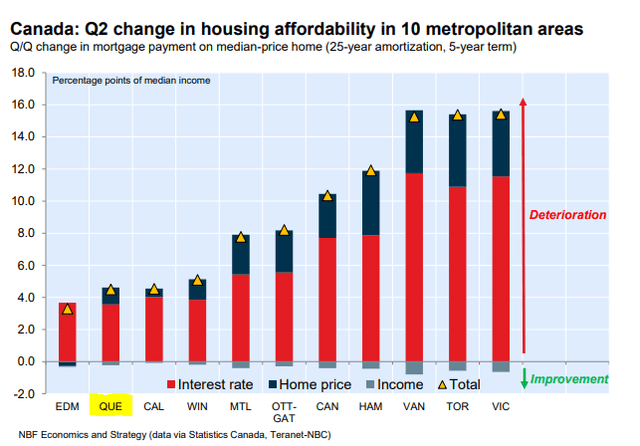

This heavy weighting contained in the Quebec market limits Nationwide Monetary institution’s publicity to Canada’s most unaffordable cities together with Vancouver, Victoria and the Greater Toronto space.

Housing Affordability Monitor (Nationwide Monetary institution Housing Affordability Monitor)

Ontario and British Columbia, dwelling to 2 of Canada’s hottest housing markets account for 65% of Royal Monetary institution of Canada’s (RY) residential mortgage portfolio and 74% of Toronto-Dominion Monetary institution’s (TD) mortgage portfolio. Nationwide Monetary institution’s publicity to BC and Ontario mortgages is simply 34% of its mortgage portfolio.

To be certain, geography will not be the one topic to guage for lending hazard profile contained in the Canadian housing market. Nationwide Monetary institution tends to have the following ratio of insured mortgages all by its e-book in comparison with fully totally different Canadian lenders. TD’s residential mortgage portfolio is roughly 22% insured as of Q1 22, whereas RBC’s is 26%.

This compares to 30% insured for Nationwide Monetary institution’s mortgage portfolio. Uninsured mortgages and HELOC contained in the Greater Toronto and Greater Vancouver areas signify 12% and three%, respectively, of Nationwide Monetary institution’s full mortgage portfolio.

These two massive metro areas signify nearly 1 / 4 of Canada’s inhabitants and are, subsequently, represented additional intently in most Canadian banks’ mortgage books. Furthermore, Nationwide Monetary institution has maintained a prudent hazard profile on these loans, with a median mortgage to cost of 44% for each the Vancouver and Toronto housing markets.

I’ve written normally relating to the steadiness of Canada’s well-regulated banking system and the sturdy market positions of Canada’s six Dwelling Systemically Important Banks (D-SIBs) banks.

These six (Monetary institution of Montreal (BMO), Royal Monetary institution of Canada, Toronto-Dominion Monetary institution, Canadian Imperial Monetary institution of Commerce (CM), The Monetary institution of Nova Scotia (BNS), and Nationwide Monetary institution collectively account for over 90% of the Canadian market.

These incumbents are protected in direction of worldwide rivals by the Monetary institution Act, which has created a protected oligopoly contained in the residence banking sector. Historically, Canadian banks have used their above-average earnings from the home retail banking markets to broaden into fully totally different geographies and capital markets.

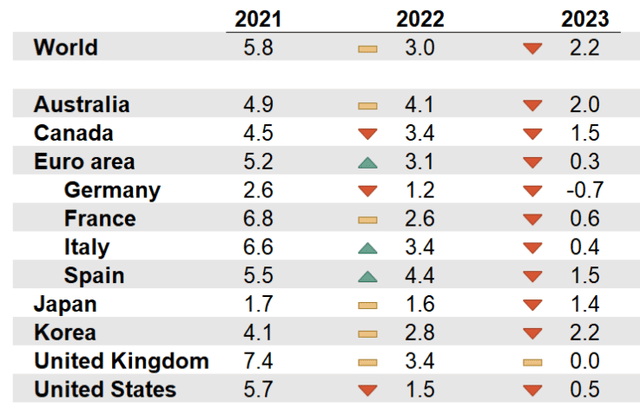

The Canadian monetary system is forecast to outpace the U.S., UK and Eurozone economies into 2023. Nationwide Monetary institution’s residence focus should revenue it over its additional geographically diversified buddies.

Nationwide Monetary institution of Canada derived 85% of revenues from the home Canadian market in 2021. This compares to Canadian retail banking segments representing 60% at Royal Monetary institution, 56% at TD Monetary institution and 44% on the Monetary institution of Nova Scotia.

GDP Improvement By Nation (OECD)

Attempting to 2023, Canada nonetheless seems partaking relative to fully totally different developed markets. Consistent with the most recent interim forecast from the OECD, Canada is ready to path solely Australia and South Korea in YoY GDP progress. As an online exporter of power and masses of offers and commodities, Canada’s monetary system could also be additional resilient than buddies contained in the occasion of extended inflation or excessive power costs.

In anticipation of slowing financial practice, Nationwide Monetary institution boosted its provision for credit score rating ranking losses from $3M to $54M inside the most recent quarter.

There’ll possibly be additional to return once more as banks all by the sector put collectively for the prospect a recession in 2023. Whereas banks could also be beneficiaries of bettering net curiosity margins, they might see a slowdown in mortgage progress contained in the quick to medium time interval. Nationwide Monetary institution has ready for an financial downturn by sustaining a strong steadiness sheet with a CET1 capital ratio of 12.8%, above its peer widespread of 12.4%.

Together with being appropriately capitalized, it has maintained a secure pattern with credit score rating ranking scores corporations: Moody’s: Aa3 S&P: A DBRS: AA (LOW) Fitch: AA.

As elevated prices of curiosity take hold all by the developed world, banks are ratcheting up provisions for credit score rating ranking losses. The prospect of a recession in Canada has weighed on monetary shares, with the S&P/TSX Capped Financials Index down 16% YTD.

For long-term patrons, it is a good totally different to think about initiating or adding-to positions in high-quality dividend-paying shares such consequently of the Canadian banks.

Nationwide Monetary institution’s residence profile will guarantee it’s a beneficiary of Canada’s sturdy financial progress forecast relative to fully totally different OECD economies. Nationwide Monetary institution is way a lot much less uncovered to Canada’s most unaffordable housing markets than its buddies. Must prices of curiosity proceed to climb, Nationwide Monetary institution’s geographic focus in Quebec will shelter it from mortgage delinquencies.

Nationwide Monetary institution continues to ship sturdy outcomes and execute on its earnings diversification and effectivity metrics. Nationwide Monetary institution’s geographic profile makes it a shocking selection relative to fully totally different Canadian financials inside the present macroeconomic context.

This textual content material was written by

Disclosure: I/we’ve a helpful extended place contained in the shares of RY, BNS, TD every by manner of inventory possession, selections, or fully totally different derivatives. I wrote this textual content material myself, and it expresses my very private opinions. I’m not receiving compensation for it (aside from from In search of Alpha). I’ve no enterprise relationship with any company whose inventory is talked about on this textual content.