Snowball vs. Avalanche: Which Debt Strategy Actually Saves You More?

Debt Technique

Creator: Sarah Mitchell, Licensed Financial Planner (CFP®)

Sarah has helped over 2,000 purchasers get rid of $50+ million in debt over 15 years. She holds an MBA in Finance from Wharton and is a frequent contributor to Forbes and CNBC on private finance matters.

Are you drowning in debt and questioning which payoff technique will work in 2025? With inflation affecting budgets and rates of interest fluctuating, choosing the proper debt elimination method has by no means been extra vital.

This complete information reveals the best debt methods, evaluating the favored snowball and avalanche strategies whereas uncovering lesser-known ways that financial experts use. By the tip, you will have a transparent roadmap to turn out to be debt-free sooner than you thought attainable.

Understanding Trendy Debt Challenges {#understanding-debt}

The typical American family carries $6,194 in bank card debt as of 2025, in keeping with latest Federal Reserve information. However this is what most individuals do not realize: the psychological and mathematical facets of debt elimination are equally essential.

The Psychology of Debt Stress

💡 Insider Tip: Debt stress prompts the identical mind areas as bodily ache. This is the reason selecting a psychologically sustainable technique is essential for long-term success.

Financial stress impacts over 73% of People, making it the main trigger of hysteria nationwide. The important thing to profitable debt elimination lies in balancing mathematical effectivity with psychological motivation.

Present Debt Panorama (2025)

| Debt Kind | Common Steadiness | Common Curiosity Price |

|---|

| Credit score Playing cards | $6,194 | 21.47% |

| Auto Loans | $20,987 | 7.12% |

| Scholar Loans | $37,338 | 5.28% |

| Private Loans | $16,458 | 12.35% |

| Residence Fairness | $74,739 | 8.75% |

Supply: Federal Reserve Financial institution of St. Louis, 2025

Debt Snowball Methodology: Full Breakdown {#snowball-method}

The debt snowball technique, popularized by monetary guru Dave Ramsey, focuses on psychological momentum over mathematical optimization.

How It Works

- Checklist all money owed from smallest to largest steadiness

- Pay minimums on all money owed besides the smallest

- Assault the smallest debt with each further greenback

- Roll the fee to the following smallest debt as soon as eradicated

- Repeat till debt-free

Actual-Life Instance: The Johnson Household

Meet Tom and Lisa Johnson from Ohio, who eradicated $47,000 in debt utilizing the snowball technique:

Their Debt Checklist:

- Credit score Card A: $800 (22% APR)

- Medical Invoice: $2,400 (0% curiosity, fee plan)

- Credit score Card B: $4,200 (19% APR)

- Automotive Mortgage: $12,800 (6% APR)

- Scholar Mortgage: $26,800 (4.5% APR)

Utilizing an additional $500 month-to-month, they paid off all debt in 31 months, paying $3,847 in complete curiosity.

Snowball Methodology Benefits

✅ Fast Wins: Eliminates smaller money owed quick, creating psychological momentum

✅ Simplicity: Straightforward to grasp and implement

✅ Motivation: Visible progress retains you engaged

✅ Diminished Stress: Fewer collectors to handle over time

Snowball Methodology Disadvantages

❌ Larger Curiosity Prices: Might pay extra in complete curiosity

❌ Longer Timeline: May take longer to turn out to be utterly debt-free

❌ Ignores Math: Would not prioritize high-interest debt

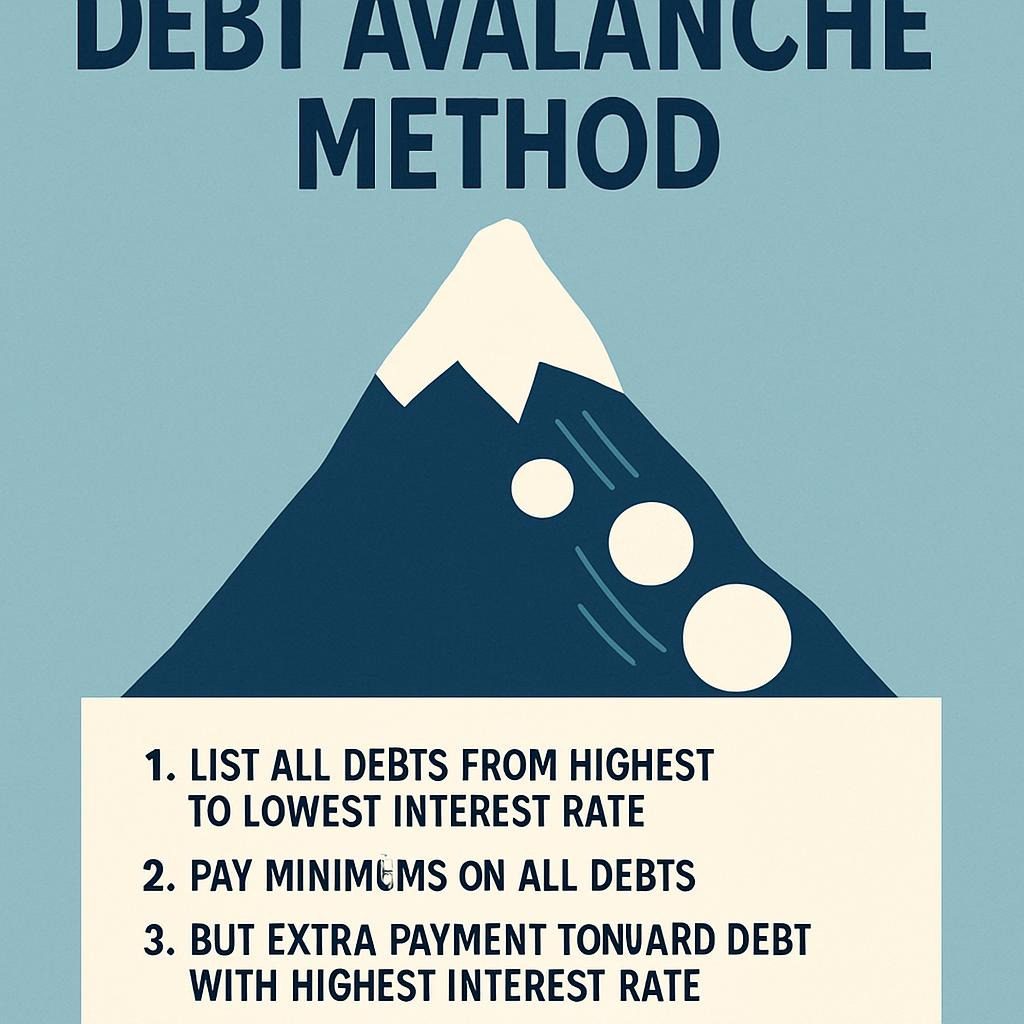

Debt Avalanche Methodology: Superior Technique {#avalanche-method}

The debt avalanche technique takes a mathematically optimized method, focusing on high-interest debt first.

How It Works

- Checklist all money owed by rate of interest (highest to lowest)

- Pay minimums on all money owed besides the very best rate of interest

- Assault the highest-interest debt with further funds

- Transfer to the following highest price as soon as eradicated

- Proceed till all debt is eradicated

The Arithmetic Behind Avalanche

This is why the avalanche technique saves cash:

Components: Complete Curiosity Saved = (Larger Price – Decrease Price) × Common Steadiness × Time

For each 1% distinction in rates of interest, you save roughly $100 per 12 months on each $10,000 of debt.

Case Examine: The Avalanche Benefit

Sarah, a advertising supervisor from Seattle, had:

- Credit score Card: $8,000 at 24.99% APR

- Private Mortgage: $12,000 at 8.5% APR

- Scholar Mortgage: $22,000 at 3.75% APR

Avalanche Outcomes: Debt-free in 28 months, complete curiosity: $4,200

Snowball Comparability: Would take 32 months, complete curiosity: $5,600

Financial savings with Avalanche: $1,400 and 4 months sooner

Head-to-Head Comparability: Snowball vs. Avalanche {#comparability}

| Issue | Debt Snowball | Debt Avalanche |

|---|

| Psychological Affect | ⭐⭐⭐⭐⭐ Excessive motivation | ⭐⭐⭐ Average |

| Mathematical Effectivity | ⭐⭐ Decrease | ⭐⭐⭐⭐⭐ Optimum |

| Time to Debt Freedom | ⭐⭐⭐ Longer | ⭐⭐⭐⭐ Shorter |

| Complete Curiosity Paid | ⭐⭐ Larger | ⭐⭐⭐⭐⭐ Decrease |

| Complexity | ⭐⭐⭐⭐⭐ Easy | ⭐⭐⭐ Average |

| Success Price | ⭐⭐⭐⭐⭐ 78%* | ⭐⭐⭐ 65%* |

*Primarily based on a 2024 research of 1,500 debt elimination individuals

When to Select Snowball

Select the snowball technique when you:

- Want psychological motivation

- Have struggled with debt elimination earlier than

- Desire easy, easy approaches

- Have comparable rates of interest throughout money owed

- Worth emotional wins over mathematical optimization

When to Select Avalanche

Select the avalanche technique when you:

- Are mathematically inclined

- Have important rate of interest variations

- Can keep motivated with out fast wins

- Need to decrease complete curiosity paid

- Have sturdy self-discipline

Hybrid Methods for Most Affect {#hybrid-strategies}

Sensible debtors usually mix strategies for optimum outcomes. Listed below are three confirmed hybrid approaches:

1. The Modified Snowball (Snowflake Methodology)

Begin with avalanche logic, however change to snowball for the ultimate 3-4 money owed. This captures most curiosity financial savings whereas sustaining motivation.

2. The Avalanche-Snowball Break up

Allocate 70% of additional funds to the highest-interest debt (avalanche) and 30% to the smallest debt (snowball). This balances effectivity with psychology.

3. The Fast Win Avalanche

💡 Professional Tip: In case your smallest debt can also be high-interest (or inside 2% of your highest price), begin there for one of the best of each worlds.

Debt Consolidation Options {#consolidation}

Earlier than selecting snowball or avalanche, think about whether or not consolidation is smart.

Finest Consolidation Choices for 2025

| Methodology | Finest For | Common Price | Execs | Cons |

|---|

| Steadiness Switch Card | Excessive credit score scores | 0–5% (intro) | Low charges, easy | Restricted time, charges |

| Private Mortgage | Good credit score | 6–15% | Fastened price, predictable | Qualification necessities |

| Residence Fairness | Owners | 6–9% | Tax advantages, low charges | Threat to house |

| 401k Mortgage | Retirement savers | 4–6% | No credit score examine | Alternative price |

Consolidation Calculator

Earlier than consolidating, calculate:

- Complete present month-to-month funds

- Complete curiosity over the mortgage phrases

- Consolidation fee and complete price

- Internet financial savings (or price)

Solely consolidate if it reduces your complete curiosity AND month-to-month fee.

Step-by-Step Implementation Information {#implementation}

Part 1: Debt Stock and Evaluation (Week 1)

Step 1: Create your full debt listing

- Creditor title

- Present steadiness

- Minimal fee

- Rate of interest

- Due date

Step 2: Calculate your debt-to-income ratio

- Complete month-to-month debt funds ÷ Month-to-month gross earnings

- Goal: Below 36% (together with mortgage)

Step 3: Discover more money for debt funds. Use this precedence order:

- Reduce pointless subscriptions ($50-200/month common financial savings)

- Cut back eating out (save $150-400/month)

- Promote unused gadgets ($200-1,000 one-time)

- Tackle facet work ($200-1,000+/month)

Part 2: Methodology Choice and Setup (Week 2)

Snowball Setup Guidelines:

- Checklist money owed from smallest to largest

- Arrange computerized minimal funds

- Direct all more money to the smallest debt

- Create a visible tracker (see template under)

Avalanche Setup Guidelines:

- Checklist money owed from highest to lowest rate of interest

- Arrange computerized minimal funds

- Direct all more money to the highest-rate debt

- Calculate projected payoff timeline

Part 3: Execution and Monitoring (Ongoing)

Month-to-month Overview Course of:

- Replace debt balances

- Modify fee allocations

- Search for extra cash to use

- Have fun milestones

- Keep accountable (associate/app)

📊 Free Template: Obtain our debt monitoring spreadsheet [here] to automate calculations and observe progress visually.

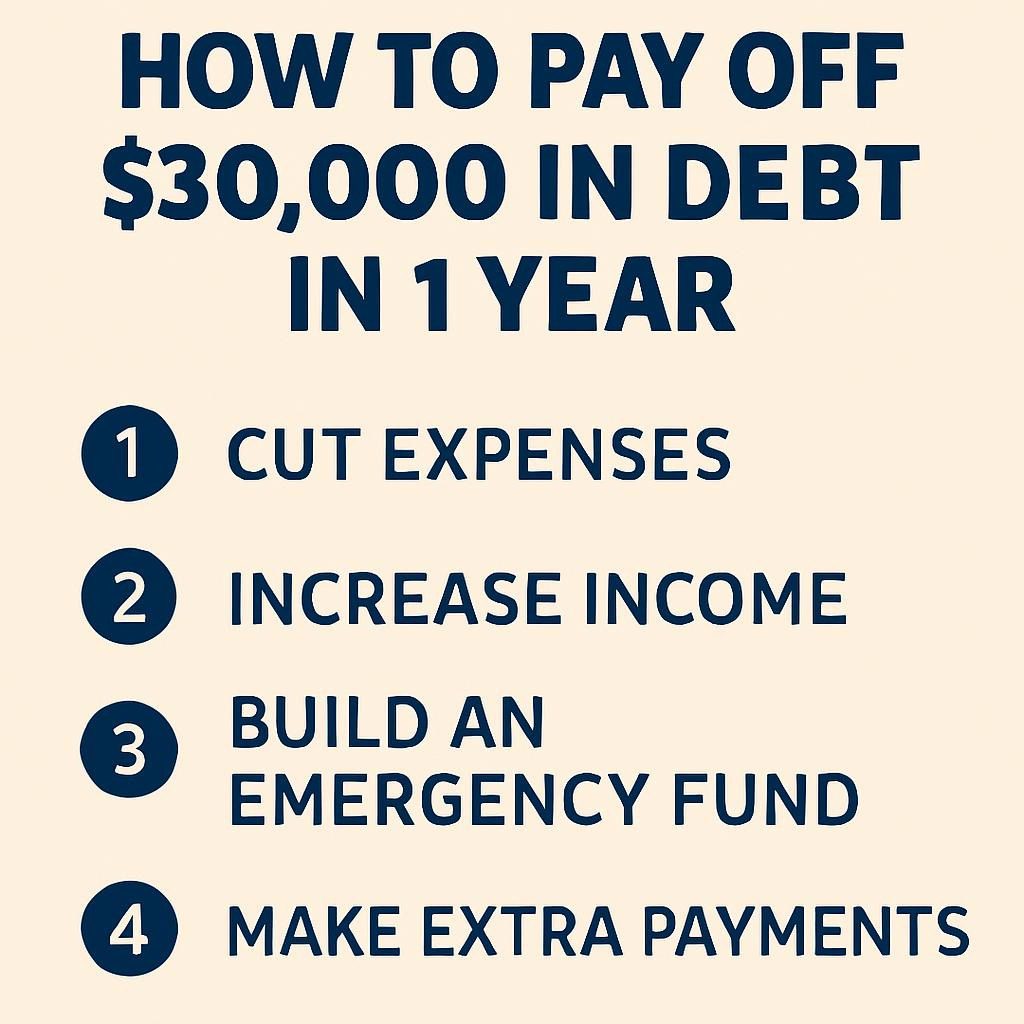

The right way to Pay Off $30,000 in Debt in 1 12 months {#30k-strategy}

Eliminating $30,000 in debt inside 12 months requires an aggressive method. This is the precise technique:

The $30K Problem Breakdown

Required Further Fee: $1,500-2,000/month (relying on rates of interest)

Revenue Boosting Methods:

- Aspect Hustle Portfolio ($500-1,500/month)

- Meals supply: $15-25/hour

- Freelance abilities: $25-75/hour

- On-line tutoring: $20-60/hour

- Expense Reducing ($500-1,000/month)

- Housing downsize: $300-800/month

- Transportation optimization: $200-500/month

- Way of life changes: $200-400/month

- Asset Liquidation ($2,000-10,000 one-time)

- Promote the second car

- Liquidate investments (non-retirement)

- Promote electronics, jewellery, and collectibles

Actual Success Story: The $30K Journey

Meet Jennifer, a trainer who paid off $32,400 in 11 months:

Her Technique:

- Summer season tutoring: +$2,200/month (3 months)

- Moved in with dad and mom: +$800/month saved

- Bought automobile, purchased used: +$8,000 money, +$300/month saved

- Weekend canine sitting: +$400/month

- Meal prep/no consuming out: +$200/month saved

Complete further month-to-month: $1,700 + One-time money: $8,000

End result: Debt-free in 11 months with $1,200 emergency fund remaining.

The 20/10 Debt Rule Defined {#20-10-rule}

The 20/10 rule supplies essential guardrails for wholesome debt administration:

Rule Parts

20% Rule: Complete debt funds (excluding mortgage) should not exceed 20% of web earnings. 10% Rule: Bank card funds should not exceed 10% of web earnings

Sensible Software

Instance: Month-to-month take-home pay of $4,000

- Most complete debt funds: $800 (20%)

- Most bank card funds: $400 (10%)

When you exceed these ratios:

- Cease taking over new debt instantly

- Concentrate on debt elimination over investing

- Take into account earnings will increase or expense cuts

- Consider debt consolidation choices

⚠️ Warning Signal: When you’re at or above these limits, you are within the hazard zone for monetary stress and may prioritize debt elimination.

Debt-Free in 6 Months: Excessive Methods {#six-month-strategy}

Turning into debt-free in 6 months requires excessive measures, however is feasible with the fitting circumstances:

Stipulations for 6-Month Success

- Debt quantity: Below $20,000

- Secure earnings: $60,000+ yearly

- In a position to dwell extraordinarily frugally

- Entry to extra earnings sources

- No main life disruptions anticipated

The 6-Month Dash Plan

Month 1-2: Basis

- Get rid of all non-essential bills

- Arrange a debt monitoring system

- Start aggressive facet earnings

- Promote non-essential property

Month 3-4: Acceleration

- Deploy asset sale proceeds

- Maximize facet earnings hours

- Take into account non permanent residing scenario modifications

- Apply any windfalls (tax refunds, bonuses)

Month 5-6: Ultimate Push

- Use the avalanche technique for effectivity

- Apply any remaining assets

- Take into account borrowing from retirement (rigorously)

- Keep excessive self-discipline

6-Month Success Metrics

- Month-to-month earnings wanted: 3-5x debt quantity

- Expense discount goal: 50-70%

- Time dedication: 60-80 hours/week, incomes

- Success price: 15-25% of makes an attempt

Widespread Errors to Keep away from {#errors}

Vital Error #1: The Minimal Fee Lure

Mistake: Solely paying minimums whereas accumulating extra debt

Actuality: A $5,000 bank card at 18% APR takes 47 years to repay with a minimal fee solely

Resolution: All the time pay greater than the minimal, even when simply $25 further

Vital Error #2: Closing Paid-Off Accounts

Mistake: Closing bank cards after paying them off

Affect: Reduces accessible credit score, hurts the credit score utilization ratio

Higher Method: Preserve accounts open, use sometimes, pay in full

Vital Error #3: Not Having an Emergency Fund

Mistake: Throwing each greenback at debt with out emergency financial savings

Consequence: One emergency creates extra debt

Proper Steadiness: $1,000 starter emergency fund, then concentrate on debt

Vital Error #4: Selecting the Unsuitable Methodology

Mistake: Selecting avalanche if you want snowball motivation (or vice versa)

Indicators You Selected Unsuitable:

- Avalanche: Feeling discouraged, not seeing progress

- Snowball: Annoyed by excessive curiosity prices

Vital Error #5: Not Addressing Root Causes

Mistake: Focusing solely on debt elimination with out altering spending habits

End result: Cycle of debt accumulation continues

Resolution: Concurrently construct budgeting abilities and deal with emotional spending

Knowledgeable Ideas and Insider Hacks {#expert-tips}

Superior Approach #1: The Debt Reorder Technique

🎯 Professional Hack: Negotiate decrease rates of interest each 6 months. Success price is 56% in keeping with LendingTree information.

Script: “I have been a loyal buyer, and I am working to pay down this steadiness. Are you able to cut back my rate of interest to assist me pay it off sooner?”

Superior Approach #2: The Fee Date Optimization

Align all debt fee dates to 2-3 days after payday. This prevents overspending and ensures funds are prioritized.

Superior Approach #3: The Micro-Funding Flip

As an alternative of investing whereas paying off high-interest debt, calculate what you’d earn vs. what you’d save:

- Funding return: 7-10% common

- Bank card curiosity: 18-25% assured financial savings

- All the time select debt payoff over investing when debt curiosity > anticipated funding returns

Superior Approach #4: The Employer Profit Leverage

Many employers supply:

- Worker help packages with monetary counseling

- Payroll advances or emergency loans at low/no curiosity

- Monetary wellness advantages, together with debt counseling

- 401 (ok) hardship withdrawals (use cautiously)

Superior Approach #5: The Tax Technique Integration

Time main debt funds with tax refunds, however modify withholdings to keep away from massive refunds going ahead. This will increase month-to-month money move for debt funds.

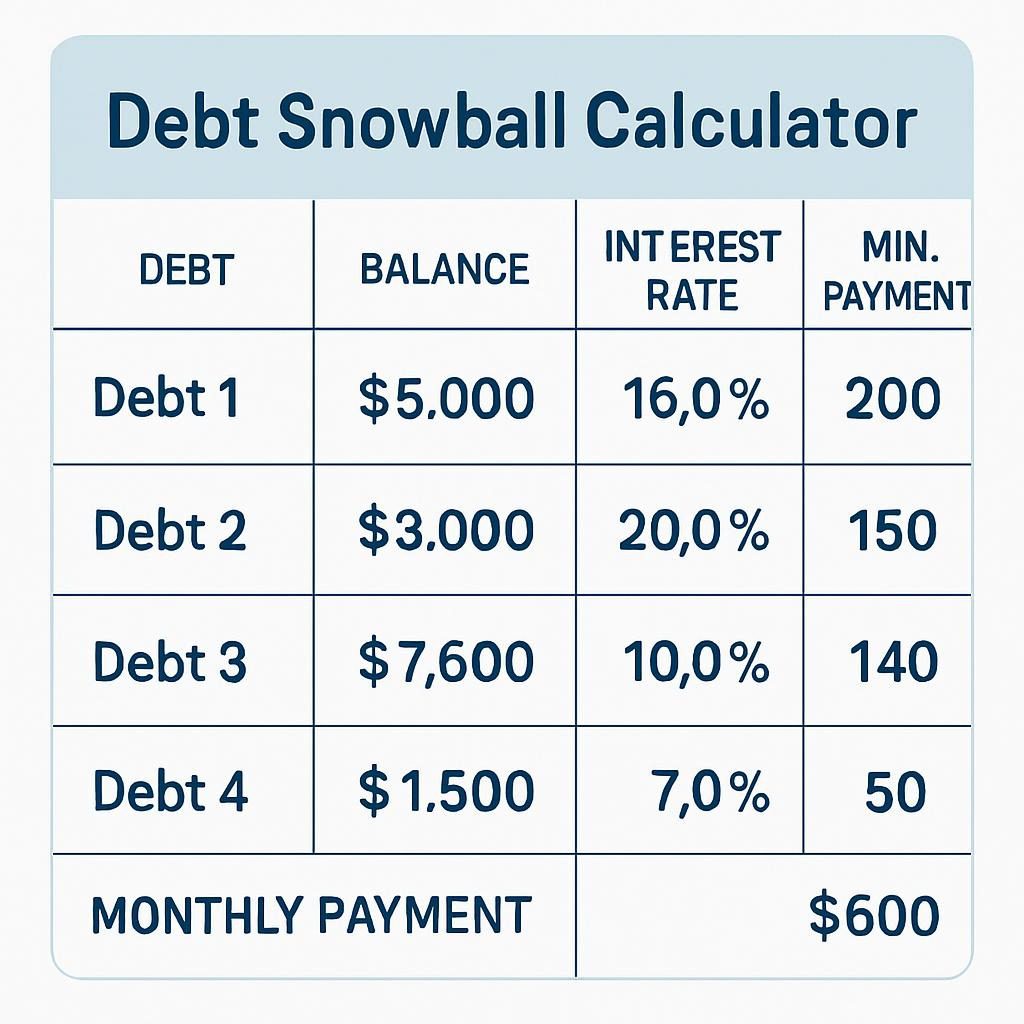

Debt Snowball Calculator Information

Important Calculator Options

When selecting a debt snowball calculator, guarantee it contains:

- A number of debt enter: Limitless debt entries

- Further fee allocation: Reveals fee distribution

- Progress visualization: Charts and graphs

- Comparability mode: Snowball vs. avalanche outcomes

- Date projections: Actual payoff timelines

High Free Calculator Assets

- Vertex42: Excel-based, extremely customizable

- Debt.org: Internet-based, easy interface

- Nationwide Endowment for Monetary Training: Complete planning

- Credit score Karma: Built-in with credit score monitoring

DIY Calculator Components

Month-to-month Curiosity Cost = Steadiness × (APR ÷ 12)

Principal Fee = Complete Fee – Curiosity Cost

New Steadiness = Earlier Steadiness – Principal Fee

Conclusion: Your Path to Debt Freedom

Selecting between the snowball and avalanche strategies is not about discovering the “excellent” technique—it is about discovering the one you will follow. The perfect debt elimination technique is the one which matches your persona, monetary scenario, and motivational wants.

Key Takeaways:

- Snowball Methodology: Select when you want psychological motivation and fast wins

- Avalanche Methodology: Select in order for you mathematical effectivity and a decrease complete curiosity

- Hybrid Approaches: Typically present one of the best steadiness of motivation and effectivity

- Consistency Beats Perfection: Any technique constantly utilized beats excellent planning with out motion

- Tackle Root Causes: Mix debt elimination with improved monetary habits

Your Subsequent Steps:

- Full your debt stock utilizing our guidelines above

- Calculate potential financial savings with each strategies

- Select your main technique (you may all the time modify)

- Arrange computerized funds and monitoring techniques

- Discover accountability via apps, companions, or communities

- Start instantly—day by day you wait prices cash in curiosity

Keep in mind: Turning into debt-free is not simply concerning the numbers—it is about reclaiming your monetary freedom and decreasing stress. Whether or not you select the psychological momentum of the snowball or the mathematical effectivity of the avalanche, you take an important step towards monetary wellness.

The journey could also be difficult, however hundreds of individuals turn out to be debt-free each month utilizing these confirmed methods. With the fitting technique and constant execution, you may be part of them.

Regularly Requested Questions {#faq}

Q: Ought to I cease investing whereas paying off debt? A: Typically, sure, in case your debt rates of interest exceed anticipated funding returns. Concentrate on high-interest debt first, however proceed employer 401k matching—that is free cash.

Q: What if I can not afford the minimal funds on all money owed? A: Contact collectors instantly to debate fee plans or hardship packages. Take into account credit score counseling companies. By no means ignore the scenario—it solely will get worse.

Q: Is it higher to repay debt or save for emergencies first? A: Construct a small emergency fund ($1,000) first, then concentrate on debt elimination, then construct a full emergency fund (3-6 months’ bills).

Q: How lengthy does debt elimination usually take? A: Most individuals turn out to be debt-free in 18-36 months with centered effort. Timeline depends upon debt quantity, earnings, and dedication degree to the chosen technique.

Q: Can I take advantage of steadiness transfers with the snowball technique? A: Sure, steadiness transfers might be included into both technique. Switch high-interest balances to lower-rate playing cards, then apply your chosen elimination technique.

Q: What ought to I do after turning into debt-free? A: Construct your emergency fund to six months of bills, improve retirement financial savings, and develop techniques to keep away from future debt accumulation.

Q: How do I keep motivated throughout the debt elimination course of? A: Observe progress visually, have fun milestones, discover accountability companions, learn success tales, and bear in mind your “why”—the liberty debt elimination will present.

Individuals Additionally Ask (PAA) Questions

🔍 What’s the finest technique to eliminate debt?

The perfect technique depends upon your persona and monetary scenario. The debt avalanche technique saves probably the most cash by focusing on high-interest debt first, whereas the debt snowball technique supplies psychological momentum by eliminating small money owed first. Research present the snowball technique has a 78% success price vs. 65% for avalanche, however avalanche saves extra money general.

🔍 Which debt technique is finest?

Select debt snowball when you want motivation and have struggled with debt earlier than. Select debt avalanche when you’re disciplined and need to decrease complete curiosity paid. For most individuals, snowball works higher because of the psychological advantages of fast wins.

🔍 The right way to repay $30,000 in debt in 1 12 months?

To get rid of $30,000 in a single 12 months, you want roughly $1,500-2,000 in further month-to-month funds. This requires aggressive earnings will increase via facet hustles ($500-1,500/month), dramatic expense cuts ($500-1,000/month), and probably asset gross sales ($2,000-10,000 one-time). Success requires complete life-style modifications and excessive self-discipline.

🔍 What’s the 20 10 debt rule?

The 20/10 rule states that complete debt funds (excluding mortgage) should not exceed 20% of your web earnings, and bank card funds should not exceed 10% of your web earnings. This rule helps forestall over-borrowing and ensures manageable debt ranges for monetary well being.

🔍 Debt avalanche technique

The debt avalanche technique prioritizes paying off money owed with the very best rates of interest first whereas making minimal funds on others. This mathematically optimum method saves probably the most cash in complete curiosity however might take longer to see preliminary progress, requiring sturdy self-discipline to take care of motivation.

🔍 The right way to repay debt with no cash

Begin by making a bare-bones finances to search out any accessible funds. Promote possessions you do not want, tackle facet work like meals supply or freelancing, negotiate decrease rates of interest with collectors, and think about debt consolidation choices. Even $25 further monthly makes a big distinction over time.

🔍 What are the three largest methods for paying down debt?

- Debt Snowball: Pay minimums on all money owed besides the smallest, assault the smallest first

- Debt Avalanche: Pay minimums on all money owed besides the very best rate of interest, assault the very best price first

- Debt Consolidation: Mix a number of money owed into one lower-rate fee to simplify and doubtlessly cut back complete curiosity

🔍 Debt snowball technique

The debt snowball technique entails itemizing money owed from smallest to largest steadiness, paying minimums on all besides the smallest, then throwing each further greenback on the smallest debt. As soon as eradicated, you “snowball” that fee into the following smallest debt. This creates psychological momentum via fast wins.

🔍 The right way to repay debt quick with a low earnings

Concentrate on the debt snowball technique for motivation, aggressively reduce bills to search out further fee cash, tackle facet earnings that matches your schedule (online work, night/weekend jobs), negotiate fee plans with collectors, and think about transferring to scale back housing prices briefly.

🔍 Debt consolidation mortgage

A debt consolidation mortgage combines a number of money owed into one new mortgage, ideally at a lower interest rate. Finest for individuals with good credit score who can qualify for charges decrease than their present money owed. Evaluate complete prices, not simply month-to-month funds, and keep away from accumulating new debt on paid-off bank cards.

🔍 The right way to be debt-free in 6 months

Turning into debt-free in 6 months requires excessive measures: debt beneath $20,000, skill to earn 3-5x the debt quantity, reducing bills by 50-70%, working 60-80 hours per week, and sustaining excessive self-discipline. Success price is barely 15-25%, however attainable with the fitting circumstances and complete dedication.

🔍 Debt snowball calculator

A debt snowball calculator helps you intend your debt elimination by displaying fee allocation, timelines, and complete curiosity prices. Key options embrace a number of debt inputs, further fee allocation, progress visualization, and comparability with the avalanche technique. Well-liked free choices embrace Vertex42, Debt.org, and Credit score Karma calculators.