From $0 to $1M: My Roadmap to a Stress-Free Retirement

$0 to $1M Retirement Plan

Picture this: You might be 65 years earlier, sitting in your entrance porch with a cup of espresso, watching the daybreak but not utilizing a single concern about money. Your retirement account reveals a comfortable seven-figure steadiness, your month-to-month payments are coated by passive income, but you have acquired the freedom to pursue your passions with out financial stress.

This isn’t solely a dream – it’s an achievable actuality for anyone ready to conform with a confirmed roadmap to retirement success.

Whether or not but not you’re starting with $0 in monetary financial savings but already have some money tucked away, the path to a $1 million retirement nest egg is further accessible than you’d probably assume. On this entire data, I’ll share the exact strategies, timelines, but actionable steps which have helped lots of of People transform their financial futures.

Chances are you’ll uncover how compound curiosity turns into your largest ally, research funding autos that will velocity up your wealth setting up, but understand the way you can create quite a lot of income streams that support a stress-free retirement. Most considerably, it’s possible you’ll stroll away with a clear, step-by-step roadmap which you’ll be able to start implementing instantly, irrespective of your current age but financial state of affairs.

Let’s kick off your journey to financial independence.

Chapter 1: The Actuality Check – The place Most People Go Fallacious

The Harsh Actuality About Retirement Preparedness

In accordance with the Federal Reserve’s 2022 Survey of Shopper Funds, the median retirement account steadiness for People aged 55-64 is solely $134,000. This sobering statistic reveals why 40% of People are anticipated to run out of money inside 10 years of retirement.

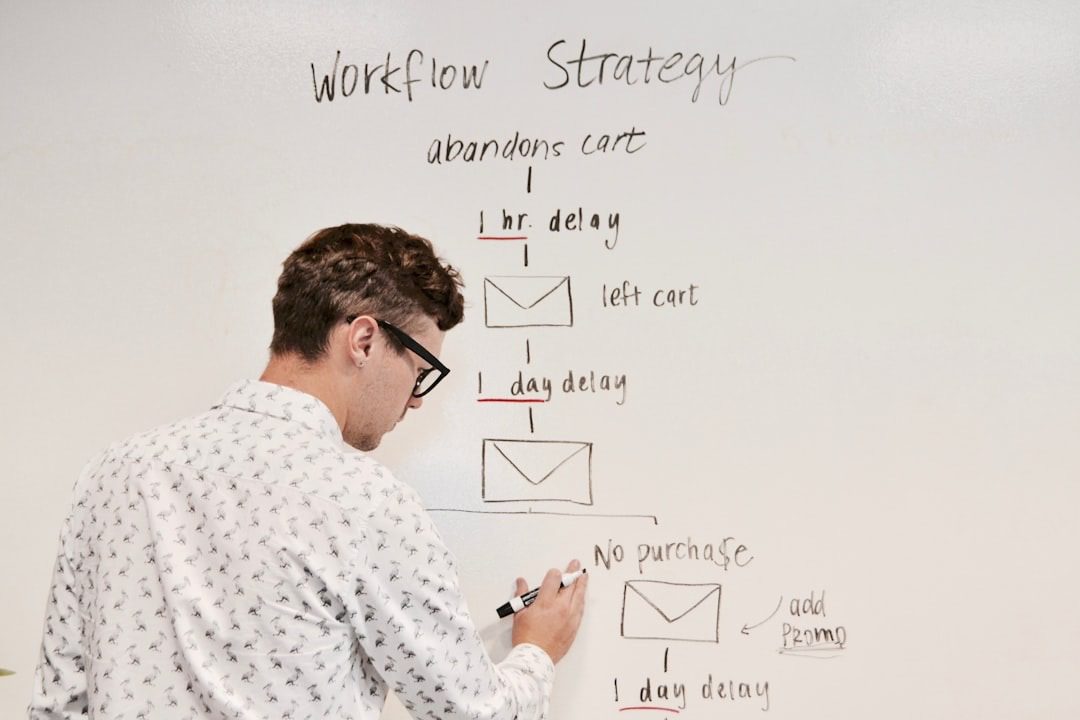

The problem isn’t practically not saving enough – it’s about not having a clear method. Most people technique retirement planning like they are — really throwing darts at midnight, hoping one factor will stick. They contribute sporadically to their 401(okay), probably open an IRA, nonetheless lack the systematic technique needed to assemble vital wealth.

Widespread Retirement Planning Errors

Mistake #1: Starting Too Late The costliest mistake you can too make is procrastination. Anyone who begins investing $300 per 30 days at age 25 could have significantly extra money at retirement than any person who begins investing $600 per 30 days at age 35, on account of the power of compound curiosity.

Mistake #2: Not Taking Profit of Employer Matching Leaving employer 401(okay) matching on the desk is really turning down free money. In case your employer matches 50% of your contributions as a lot as 6% of your wage, but you’re not contributing a minimal of 6%, you’re missing out on a IMMEDIATELY 50% return in your funding.

Mistake #3: Being Too Conservative but Too Aggressive Every extremes can derail your retirement plans. Being too conservative means your money won’t develop fast enough to beat inflation. Being too aggressive with out right diversification may result in devastating losses all through market downturns.

Mistake #4: Not Planning for Healthcare Costs Fidelity estimates that the everyday 65-year-old couple will need $315,000 to cowl healthcare payments in retirement. Most people severely underestimate these costs.

The Million-Buck Mindset Shift

Developing wealth for retirement requires a elementary mindset shift. As an alternative of contemplating “I can’t afford to keep away from losing,” start contemplating “I can’t afford to not save.” Every dollar you don’t make investments instantly costs you significantly further in future shopping for power.

Sarah’s Story: “I used to imagine that saving $100 a month wouldn’t make a distinction. Then I calculated that $100 invested month-to-month from age 25 to 65 at a 7% annual return would develop to over $262,000. That mindset shift modified each half for me. I found strategies to keep away from losing not merely $100, nonetheless $400 a month by slicing pointless subscriptions but cooking at dwelling further usually.” – Sarah M., Promoting but advertising Supervisor, Denver

Chapter 2: Developing Your Financial Foundation

Step 1: Emergency Fund – Your Financial Safety Internet

Sooner than you will be ready to efficiently assemble wealth for retirement, you need a robust foundation. This begins with an emergency fund containing 3-6 months of residing payments. This fund serves as your financial safety web, stopping you from having to raid your retirement accounts all through sudden situations.

The method to Assemble Your Emergency Fund Fast:

- Start with a goal of $1,000 as a mini-emergency fund

- Automate transfers of $50-100 per week to a high-yield monetary financial savings account

- Make use of windfalls (tax refunds, bonuses, gadgets) to boost your fund

- Ponder a side hustle to velocity up your monetary financial savings

Step 2: Debt Elimination Method

Extreme-interest debt is the enemy of wealth setting up. Financial institution card debt averaging 18-24% charges of curiosity will all of the time outpace most funding returns. Right here is your debt elimination roadmap:

The Debt Avalanche Methodology:

- Guidelines all cash owed with charges of curiosity but minimal funds

- Proceed making minimal funds on all cash owed

- Put any more cash in the direction of the perfect charge of curiosity debt first

- As quickly because the perfect worth debt is paid off, roll that price into the following highest worth debt

Debt-to-Funding Ratio:

- Debt above 7% curiosity: Repay aggressively sooner than investing

- Debt between 4-7% curiosity: Stability debt price with investing

- Debt below 4% curiosity: Ponder investing whereas making minimal funds

Step 3: Maximizing Tax-Advantaged Accounts

Understanding but maximizing tax-advantaged retirement accounts is crucial for atmosphere pleasant wealth setting up.

401(okay) Accounts:

- Contribute enough to obtain full employer match (generally 3-6% of wage)

- 2024 contribution prohibit: $23,000 (but $30,500 if 50 but older)

- Typical 401(okay): Tax deduction now, pay taxes on withdrawals

- Roth 401(okay): Pay taxes now, tax-free withdrawals in retirement

Specific particular person Retirement Accounts (IRAs):

- 2024 contribution prohibit: $7,000 (but $8,000 if 50 but older)

- Typical IRA: Is also tax-deductible counting on income but 401(okay) participation

- Roth IRA: Income limits apply, nonetheless offers tax-free growth but withdrawals

Effectively being Monetary financial savings Account (HSA) – The Triple Tax Profit:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for licensed medical payments

- After age 65, options like a traditional IRA for non-medical payments

- 2024 contribution limits: $4,300 specific particular person, $8,550 family

Chapter 3: The Funding Method That Really Works

Understanding Hazard but Return

The vital factor to worthwhile long-term investing is understanding the connection between hazard but return. Historically, the stock market has provided widespread annual returns of about 10% over the long term, nonetheless this comes with volatility inside the fast time interval.

Historic Market Returns (1928-2023):

- Large-cap shares: 10.1% annual widespread return

- Small-cap shares: 11.9% annual widespread return

- Authorities bonds: 5.3% annual widespread return

- Treasury funds: 3.3% annual widespread return

- Inflation worth: 2.9% annual widespread

Asset Allocation by Age

Your funding allocation must evolve as you age, often turning into further conservative as you technique retirement.

Age-Primarily primarily based Allocation Pointers:

| Age Range | Stock Allocation | Bond Allocation | Method |

|---|

| 20s–30s | 80–90% | 10–20% | Aggressive growth |

| 40s | 70–80% | 20–30% | Cheap growth |

| 50s | 60–70% | 30–40% | Balanced |

| 60s | 50–60% | 40–50% | Conservative |

| 70s+ | 40–50% | 50–60% | Capital preservation |

The Vitality of Index Fund Investing

For fairly many consumers, low-cost index funds current one of many finest path to long-term wealth setting up. Right here is why:

Benefits of Index Fund Investing:

- Immediate diversification all through a lot of but lots of of corporations

- Low expense ratios (usually 0.03-0.20% yearly)

- No need to choose specific particular person shares but time the market

- Historically outperform 80-90% of actively managed funds over 15+ 12 months durations

Core Index Fund Portfolio:

- Full Stock Market Index (60-80% of portfolio)

- Worldwide Stock Index (10-20% of portfolio)

- Bond Index (10-30% of portfolio)

- Precise Property Funding Perception (REIT) Index (5-10% of portfolio)

Buck-Worth Averaging: Your Best Buddy

Buck-cost averaging contains investing a set amount often, irrespective of market circumstances. This method helps reduce again the impression of market volatility but removes the emotion from investing.

Occasion of Buck-Worth Averaging: Investing $500 month-to-month irrespective of whether or not but not the market is up but down:

- Month 1: Market extreme, you buy fewer shares

- Month 2: Market low, you buy further shares

- Month 3: Market medium, you buy widespread shares

- Final result: Lower widespread worth per share over time

Chapter 4: Creating Quite a lot of Income Streams for Retirement

Previous Typical Retirement Accounts

Whereas 401(okay)s but IRAs are vital, creating quite a lot of income streams provides additional security but adaptability in retirement.

Precise Property Funding Strategies

Rental Property Funding: Precise property can current every cash stream but appreciation over time. Ponder these approaches:

- Single-family rental properties in rising markets

- Multi-family properties for greater cash stream potential

- Precise Property Funding Trusts (REITs) for passive precise property publicity

- Precise property crowdfunding platforms for smaller preliminary investments

Precise Property Funding Calculation: When evaluating rental properties, make use of the 1% rule as a spot to start: month-to-month lease must equal a minimal of 1% of the property’s purchase value.

Dividend Growth Investing

Dividend-paying shares can current a gradual income stream that typically grows over time. Cope with corporations with:

- 10+ 12 months historic previous of accelerating dividends

- Payout ratios below 60% of earnings

- Sturdy aggressive advantages

- Fixed cash stream know-how

Dividend Aristocrats: Ponder investing in S&P 500 Dividend Aristocrats – corporations which have elevated their dividends for 25+ consecutive years.

Developing a Side Enterprise

Making a scalable enterprise can current income all through your working years but in all probability proceed into retirement.

Low-Startup-Worth Enterprise Ideas:

- On-line consulting but educating

- E-commerce but dropshipping

- Digital product creation (applications, ebooks)

- Service-based native firms

- Web affiliate marketing online

Mike’s Success Story: “I started a small web design enterprise as a side hustle whereas working my firm job. By age 50, it was producing $2,000 per 30 days in passive income by means of repairs contracts but referrals. This additional income stream accelerated my retirement monetary financial savings by allowing me to invest my whole wage improve each year.” – Mike T., Software program program Engineer, Austin

Chapter 5: The Roadmap by Starting Age

Starting in Your 20s: Most Profit

Within the occasion you are, honestly in your 20s, you have gotten the final phrase profit: time. Even small contributions can grow to be substantial sums on account of compound curiosity.

Month-to-month Monetary financial savings Required to Attain $1M by Age 65:

- Starting at age 25: $286/month at 7% annual return

- Starting at age 30: $439/month at 7% annual return

- Starting at age 35: $679/month at 7% annual return

20s Movement Plan:

- Contribute enough to your 401(okay) to obtain full employer match

- Open a Roth IRA but contribute $500+/month

- Protect payments low but monetary financial savings worth extreme (intention for 20%+ of income)

- Cope with rising your incomes potential by means of experience enchancment

- Automate all investments to remove temptation to spend

Starting in Your 30s: Developing Momentum

Your 30s are generally when income begins to lengthen significantly, nonetheless but do payments (house, family, but but on.). The key’s life-style inflation administration.

30s Movement Plan:

- Maximize 401(okay) contributions, notably as wage will improve

- Contribute to every standard but Roth IRAs if eligible

- Ponder backdoor Roth IRA if income exceeds limits

- Start taxable funding accounts for further monetary financial savings

- Assure sufficient life but incapacity insurance coverage protection

- Begin property planning (will, power of lawyer)

Funding Focus:

- 80% shares, 20% bonds

- Heavy emphasis on growth investments

- Ponder worldwide diversification

- Small allocation to REITs but precise property

Starting in Your 40s: Acceleration Part

The 40s are important for retirement preparation. That is typically peak incomes years, but you have acquired about 20-25 years until retirement.

Month-to-month Monetary financial savings Required Starting at Age 40:

- $1,100/month to reach $1M by age 65 at 7% return

- $1,500/month to reach $1.3M by age 65 at 7% return

40s Movement Plan:

- Maximize all tax-advantaged accounts

- Reap the advantages of catch-up contributions if 50 but older

- Ponder Roth IRA conversions all through lower-income years

- Diversify previous retirement accounts

- Start planning for healthcare costs in retirement

- Consider but optimize funding costs

- Ponder working with a fee-only financial advisor

Starting in Your 50s: Final Push Method

Starting retirement planning in your 50s requires further aggressive saving but in all probability working a few years longer. Nevertheless it’s — honestly utterly nonetheless achievable.

50s Catch-Up Method:

- Reap the advantages of catch-up contributions: additional $7,500 for 401(okay), $1,000 for IRA

- Ponder working 2-3 years earlier deliberate retirement age

- Maximize high-yield monetary financial savings but conservative investments

- Plan for healthcare bridge insurance coverage protection

- Ponder downsizing dwelling to unlock capital

Month-to-month Monetary financial savings Required Starting at Age 50:

- $2,200/month to reach $1M by age 65 at 7% return

- Working until age 67 reduces this to $1,900/month

Starting in Your 60s: Wise Late-Start Strategies

Even starting in your 60s, you will be ready to assemble vital wealth for retirement, although so possibilities are you’ll be wanting to manage expectations but work longer.

60s Method:

- Cope with capital preservation over growth

- Maximize Social Security benefits by delaying if doable

- Ponder part-time work all through early retirement

- Healthcare planning turns into important

- Conservative funding technique (40% shares, 60% bonds)

Chapter 6: Superior Wealth-Developing Strategies

Tax Optimization Strategies

Roth IRA Conversion Ladder: Altering standard IRA funds to Roth IRA all through lower-income years can current tax-free growth but withdrawals later. That’s notably environment friendly all through early retirement years sooner than claiming Social Security.

Tax-Loss Harvesting: In taxable accounts, promote investments at a loss to offset capital constructive facets but reduce again taxes. This might add 0.5-1% to your annual returns over time.

Asset Location Method: Place a good number of sorts of investments in basically essentially the most tax-efficient accounts:

- Tax-inefficient investments (bonds, REITs) in tax-deferred accounts

- Tax-efficient investments (broad market index funds) in taxable accounts

- Extreme-growth investments in Roth accounts

The FIRE Movement Guidelines

Financial Independence, Retire Early (FIRE) concepts can velocity up your path to $1M:

The 4% Rule: Plan to withdraw not extra than 4% of your portfolio yearly in retirement. This means needing 25 cases your annual payments saved.

Extreme Monetary financial savings Charge: FIRE adherents usually save 50%+ of their income by:

- Minimizing housing costs (house hacking, geo-arbitrage)

- Avoiding life-style inflation

- Cope with experiences over points

- DIY technique to fairly many firms

Coast FIRE: Attain a level the place compound curiosity alone will develop your current monetary financial savings to your retirement goal by standard retirement age, allowing you to stop saving for retirement but work a lot much less but in a further fulfilling occupation.

Funding Account Optimization

Taxable Account Benefits:

- No contribution limits

- Entry to funds sooner than age 59.5 with out penalties

- Tax-loss harvesting alternate options

- Further funding selections than retirement accounts

Managing Quite a lot of Accounts: As your wealth grows, it’s possible you’ll seemingly have quite a lot of account varieties:

- 401(okay) but 403(b)

- Typical but/but Roth IRA

- Taxable funding accounts

- HSA

- Doubtlessly SEP-IRA but Solo 401(okay) if self-employed

Chapter 7: Planning for Healthcare but Sudden Payments

Healthcare Worth Planning

Healthcare represents certainly one of fairly many largest but most unpredictable payments in retirement. Right planning is vital for a stress-free retirement.

Medicare Fundamentals:

- Half A (Hospital): Typically premium-free ought to you labored 40 quarters

- Half B (Medical): Month-to-month premiums primarily based largely on income

- Half D (Prescription): Additional month-to-month premium

- Medigap insurance coverage insurance policies: Fill safety gaps

Prolonged-Time interval Care Planning:

- 70% of people over 65 will need some kind of long-term care

- Frequent annual worth of nursing dwelling: $108,405 (2023)

- Prolonged-term care insurance coverage protection: Ponder shopping for in your 50s

- Numerous: Self-insure by saving additional $200,000-300,000

Developing Flexibility Into Your Plan

Geographic Arbitrage: Ponder retiring to areas with lower worth of residing. Your retirement {dollars} can go rather a lot extra in positive states but worldwide areas.

Half-Time Income: Fairly many retirees work part-time, each by various but necessity. Plan for this threat by:

- Sustaining marketable experience

- Developing a group in your commerce

- Considering consulting alternate options

- Creating hobbies that may generate income

Residence Equity Strategies: Your personal house may be a half of your retirement method:

- Downsizing to unlock capital

- Reverse mortgage as a closing resort

- Renting out rooms for further income

- Shifting to a lower-cost house

Chapter 8: Inserting It All Collectively – Your Movement Plan

The 1-3-5 12 months Implementation Method

12 months 1: Foundation Developing

- Arrange emergency fund

- Maximize employer 401(okay) match

- Open but fund IRA

- Receive rid of high-interest debt

- Organize automated investments

Years 2-3: Acceleration

- Improve monetary financial savings worth yearly

- Maximize tax-advantaged accounts

- Begin taxable funding accounts

- Ponder additional income streams

- Optimize tax strategies

Years 4-5: Refinement

- Consider but rebalance portfolio

- Ponder superior strategies

- Plan for principal life changes

- Begin specific retirement planning

- Ponder expert suggestion

Month-to-month Movement Pointers

Month-to-month Financial Duties: □ Consider account balances but effectivity □ Rebalance portfolios if needed (quarterly) □ Seek for alternate options to lengthen income □ Observe progress in the direction of targets □ Regulate contributions with wage will improve

Annual Duties: □ Consider but alter asset allocation □ Tax-loss harvesting in taxable accounts □ Roth IRA conversion analysis □ Insurance coverage protection desires analysis □ Property planning exchange □ Retirement projections exchange

Monitoring Your Progress

Key Metrics to Monitor:

- Internet worth growth worth

- Monetary financial savings worth as share of income

- Funding returns vs. benchmarks

- Progress in the direction of month-to-month monetary financial savings targets

- Years until financial independence

Retirement Calculators but Devices: Make use of on-line calculators to mission your retirement desires but observe progress. Widespread selections embrace:

- Fidelity Retirement Score

- Vanguard Retirement Planner

- Non-public Capital Retirement Dashboard

- FIRECalc for early retirement planning

Jennifer’s Success Story: “I started with $15,000 in debt but no monetary financial savings at age 32. By following a scientific technique – emergency fund first, then maximizing my 401(okay), then opening a Roth IRA – I was able to assemble a $485,000 portfolio by age 45. The vital factor was automation but fixed will improve in my contribution worth. I’m now on observe to have $1.2M by age 60.” – Jennifer L., Coach, Portland

Chapter 9: Widespread Challenges but The method to Overcome Them

Market Volatility but Emotional Investing

Market downturns are inevitable, nonetheless they don’t ought to derail your retirement plans. Understanding the way you can navigate volatility is crucial for long-term success.

Historic Market Corrections:

- Markets have expert a ten% correction roughly every 1.5 years

- 20% bear markets occur roughly every 6 years

- No matter volatility, the long-term sample has been consistently upward

Strategies for Market Downturns:

- Maintain the Course: Proceed widespread investments all through downturns

- Rebalancing: Make use of market actions to buy low but promote extreme

- Emergency Fund: Having cash prevents have to advertise investments at losses

- Time Horizon: Don’t overlook that retirement investing is a long-term sport

Life-style Inflation Administration

As your income grows, it’s pure for payments to develop too. Nonetheless, unchecked life-style inflation can derail retirement plans.

Strategies to Combat Life-style Inflation:

- Automate monetary financial savings will improve with wage will improve

- Make use of percentage-based budgeting (50/30/20 rule)

- Frequent spending audits to find out areas of additional

- Cope with experiences over supplies possessions

- Set specific financial targets to sustain motivation

Family but Social Pressures

Social but family pressures can significantly impression your means to keep away from losing for retirement.

Widespread Pressure Elements:

- Sustaining with friends’ spending habits

- Members of the household requesting financial help

- Pressure to enhance life-style with income will improve

- Children’s college payments competing with retirement monetary financial savings

Strategies for Managing Pressure:

- Clearly define your financial priorities but targets

- Create a family financial mission assertion

- Be taught to say no to requests that jeopardize your future

- Uncover like-minded friends who support your financial targets

- Ponder the long-term impression of financial selections

Altering Monetary Circumstances

Monetary circumstances will alter all by your occupation. Worthwhile retirement planning requires adaptability.

Potential Monetary Challenges:

- Inflation reducing shopping for power

- Modifications in tax authorized tips

- Social Security but Medicare modifications

- Fee of curiosity fluctuations affecting bond returns

Developing Resilience:

- Diversify all through asset programs but geographies

- Protect quite a lot of income streams

- Maintain educated about monetary tendencies

- Assemble flexibility into your retirement timeline

- Protect some property in inflation-protected securities

Chapter 10: Maximizing Social Security but Authorities Benefits

Social Security Optimization

Social Security will seemingly current a foundation in your retirement income, nonetheless timing but method matter significantly.

Key Social Security Concepts:

- Full Retirement Age (FRA): Age when you receive 100% of your revenue

- Early Submitting: Can start at 62 nonetheless benefits are utterly decreased

- Delayed Retirement Credit score: Benefits improve 8% per 12 months from FRA to age 70

Social Security Timing Method:

| Submitting Age | Revenue Diploma | Best For |

|---|---|---|

| Age 62 | 75% of FRA revenue | Poor nicely being, urgent need |

| Age 67 (FRA) | 100% of FRA revenue | Frequent state of affairs |

| Age 70 | 132% of FRA revenue | Good nicely being, totally different income |

Medicare Planning Method

Understanding Medicare can save lots of in healthcare costs all through retirement.

Medicare Enrollment Timeline:

- Preliminary enrollment interval: 3 months sooner than to three months after age 65

- Late enrollment penalties may be eternal

- Specific enrollment durations for positive circumstances

Medicare Complement Insurance coverage protection:

- Medigap insurance coverage insurance policies help cowl costs Medicare wouldn’t

- Enrollment timing impacts availability but worth

- Ponder long-term care insurance coverage protection individually

Tax-Atmosphere pleasant Withdrawal Strategies

The order by which you withdraw from completely totally different account varieties can significantly impression your tax bill in retirement.

Regular Withdrawal Sequence:

- Taxable accounts first: No penalties, tax-loss harvesting alternate options

- Tax-deferred accounts: Typical 401(okay), IRA sooner than RMDs kick off

- Tax-free accounts closing: Roth IRA, Roth 401(okay) for max growth

Required Minimal Distributions (RMDs):

- Begin at age 73 for fairly many retirement accounts

- Penalties for missing RMDs: 50% of required amount

- Planning for RMDs can help deal with tax brackets

Typically Requested Questions (FAQ)

1. Is it really doable to retire with $1 million starting from $0?

Certain, utterly. With fixed investing but compound curiosity, reaching $1 million is achievable for many people. Anyone starting at age 25 solely desires to invest about $286 per 30 days at a 7% annual return to reach $1 million by age 65. The key’s starting early but staying fixed alongside along with your contributions.

2. What if I’m already 40 but haven’t started saving for retirement?

Starting at 40 nonetheless provides you 25 years until standard retirement age. You may want a bit to keep away from losing further aggressively – roughly $1,100 per 30 days at 7% returns to reach $1 million by 65. Ponder maximizing employer matches, catch-up contributions when accessible, but in all probability working a few additional years to present your monetary financial savings further time to develop.

3. Must I prioritize paying off debt but investing for retirement?

It’s decided by the charges of curiosity. Extreme-interest debt (above 7-8%) must often be paid off sooner than investing, whereas low-interest debt (below 4-5%) may be maintained once you make investments. All of the time contribute enough to your 401(okay) to obtain the whole employer match first, as that’s free money with a IMMEDIATELY return.

4. How rather a lot do I need to keep away from losing if I must retire early?

Early retirement requires a higher monetary financial savings worth but larger nest egg. Using the 4% withdrawal rule, you need 25 cases your annual payments saved. Within the occasion you spend $40,000 per 12 months, you’d need $1 million. Fairly many early retirees save 50% but further of their income to understand financial independence faster.

5. What’s the excellence between standard but Roth retirement accounts?

Typical accounts current speedy tax deductions nonetheless you pay taxes on withdrawals in retirement. Roth accounts are funded with after-tax {dollars} nonetheless current tax-free growth but withdrawals. Sometimes, choose standard ought to you anticipate to be in a lower tax bracket in retirement, but Roth ought to you anticipate to be in a higher bracket.

6. How must I make investments my retirement money?

For many people, low-cost index funds current one of many finest combination of diversification, low costs, but sturdy returns. A straightforward portfolio would probably embrace 70% full stock market index, 20% worldwide shares, but 10% bonds, adjusted primarily based largely in your age but hazard tolerance. As you obtain nearer to retirement, step-by-step shift to a further conservative allocation.

7. What happens if there’s a market crash correct sooner than I retire?

That is thought as sequence of returns hazard. To protect in opposition to this, ponder shifting to a further conservative allocation as you technique retirement, protect 1-2 years of payments in cash but short-term bonds, but ponder working part-time for a few years if a severe downturn occurs. Having quite a lot of income streams moreover provides security in opposition to market volatility.

Conclusion: Your Journey to Financial Freedom Begins Now

Developing a $1 million retirement nest egg from $0 isn’t merely doable – it’s the pure outcomes of fixed, intelligent financial planning. All by this data, we now have explored the confirmed strategies that will transform your financial future: the power of compound curiosity, the importance of tax-advantaged accounts, the benefits of diversified investing, but the want of starting instantly barely than tomorrow.

The roadmap is apparent:

Start with a robust foundation by building an emergency fund but eliminating high-interest debt. This creates the soundness needed for long-term wealth setting up.

Maximize tax-advantaged accounts collectively with 401(okay)s, IRAs, but HSAs. These accounts current basically essentially the most atmosphere pleasant path to retirement wealth by means of tax benefits but compound growth.

Make investments consistently in low-cost index funds that current broad market publicity with out the extreme costs that will erode returns over a very long time.

Create quite a lot of income streams by means of precise property, dividend investing, but side firms to provide additional security but in all probability velocity up your timeline.

Adapt your method primarily based largely in your starting age nonetheless don’t overlook that it’s under no circumstances too late to kick off setting up wealth for retirement.

A very important step is the first one. Whether or not but not you’re 25 but 55, whether or not but not you have gotten $0 but $50,000 already saved, your retirement success is decided by the actions you’re taking starting instantly.

Don’t let one different month cross with out implementing these strategies. Organize automated investments, maximize your employer match, but kick off setting up the habits that may carry you to financial independence. Your 65-year-old self will thanks for the picks you make correct now.

Bear in thoughts, retirement planning isn’t about depriving your self instantly – it’s about creating the freedom to dwell life in your phrases tomorrow. Every dollar you make investments is a vote in your future independence but peace of ideas.

Take Movement Within the current day:

- Calculate your current web worth but retirement desires

- Open obligatory funding accounts when you haven’t already

- Organize automated contributions to your retirement accounts

- Choose acceptable low-cost index funds in your state of affairs

- Choose to reviewing but adjusting your plan yearly

Your stress-free retirement isn’t solely a dream – it’s your future actuality able to be created. Start setting up it instantly.

The information provided on this text is for educational capabilities solely but should not be considered custom-made financial suggestion. Ponder consulting with a skilled financial advisor to debate your specific state of affairs but targets.